Consumer staples behemoth Clorox (NYSE: CLX) has confronted no scarcity of points over the previous few years. With ballooning inflation and a cyberattack hampering Clorox’s operations (among many other companies), the corporate’s inventory nonetheless languishes 33% beneath its all-time highs from 2020.

Nonetheless, regardless of dealing with these challenges, Clorox nonetheless grew gross sales by 17% over the previous 5 years. This progress highlights the nondiscretionary nature of its merchandise — they are going to be bought whatever the difficult macroeconomic atmosphere.

The place to take a position $1,000 proper now? Our analyst staff simply revealed what they consider are the 10 finest shares to purchase proper now. See the 10 stocks »

This gross sales stability, paired with Clorox’s ongoing turnaround but depressed share worth, makes it a steady-Eddie inventory price a protracted look at this time. With the corporate (and its 3% dividend yield) nicely on its technique to changing into a Dividend King, I consider this magnificent inventory presents the potential for a lifetime of passive revenue.

Clorox’s array of niche-leading manufacturers

The central funding thesis for proudly owning Clorox inventory is that it’s house to over a dozen market-leading manufacturers. In reality, roughly 80% of its gross sales come from manufacturers that maintain a No. 1 or No. 2 market share of their product class. Here’s a take a look at the corporate’s most distinguished manufacturers in every of its enterprise segments:

- Well being and wellness: Clorox, Pine-Sol, Scentiva, Formulation 409, and Liquid-Plumr.

- Family: Glad, Kingsford, Recent Step, and Scoop Away.

- Way of life: Burt’s Bees, Brita, and Hidden Valley.

This dominant positioning throughout a number of shopper staples classes has helped Clorox roughly match the S&P 500’s whole returns for the reason that flip of the century. These returns come regardless of a cyberattack in 2023 that triggered the corporate to halt manufacturing at a lot of its manufacturing services and despatched its inventory down over 30%.

Whereas this assault disrupted Clorox’s product distribution and interrupted its five-year, $500 million enterprise useful resource platform changeover and transition to the cloud, the corporate is sort of again to “regular” one 12 months later. CEO Linda Rendle spoke so far on the firm’s lastearnings name explaining:

We entered fiscal 2025 ready of operational energy, having absolutely restored provide, distribution, and the overwhelming majority of market share from the August 2023 cyberattack. This quarter, we drove additional progress as we absolutely restored general market share, grew share in most of our classes, and delivered outcomes above our expectations, whereas persevering with to make progress in opposition to our technique for long-term worth creation.

Greatest but for traders, the corporate’s gross revenue margin improved for the eighth straight quarter, highlighting its operational turnaround seen following the cyberattack and inflation that beset the enterprise.

CLX Gross Profit and Free Cash Flow Margin information by YCharts

Whereas its 9% free cash flow (FCF) margins have but to get better to their historic norm, Clorox’s money return on invested capital (ROIC) stays excessive at 23%. This lofty ROIC signifies that the corporate does an impressive job of producing outsized money flows from its debt and fairness — a trait that has confirmed to supply traders market-beating potential.

47 years of dividend fee will increase and an inexpensive valuation

Powered by this regular money technology — even amid one of the vital attempting instances in Clorox’s historical past — the corporate can simply fund its 3% dividend yield, with room for future fee will increase. Presently, Clorox’s dividend funds solely use 89% of its FCF regardless of the very fact these money flows are but to return to pre-pandemic ranges.

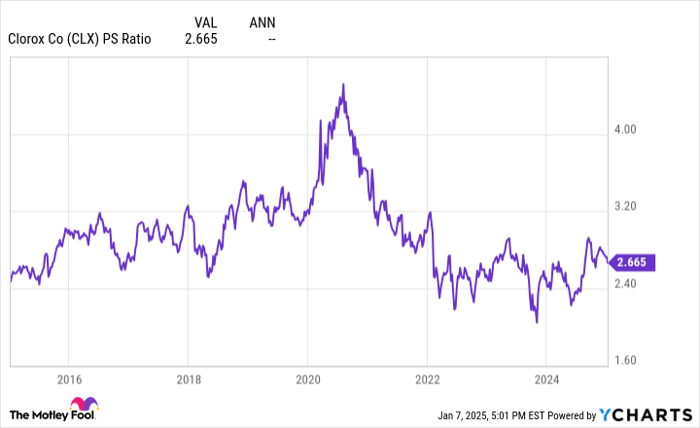

After growing its dividend funds yearly for 47 straight years, Clorox is just three years away from changing into a Dividend King. Dividend Kings are a who’s who of probably the most profitable dividend progress shares of all time and in style amongst traders searching for dependable passive revenue progress. Regardless of being set to affix this elite firm, Clorox inventory solely trades at 2.7 instances gross sales at this time.

CLX PS Ratio information by YCharts

If it may return to its 13% FCF margins of yesteryear, the inventory could be out there at an inexpensive 20 times FCF. This valuation compares favorably to the S&P 500’s average mark of round 30.

With administration guiding for long-term gross sales progress of 4% yearly and barely greater bottom-line progress as its operations normalize, Clorox’s discounted valuation and high-yield dividend seem like a secure haven in an in any other case costly market.

Do you have to make investments $1,000 in Clorox proper now?

Before you purchase inventory in Clorox, take into account this:

The Motley Idiot Inventory Advisor analyst staff simply recognized what they consider are the 10 best stocks for traders to purchase now… and Clorox wasn’t one in all them. The ten shares that made the reduce may produce monster returns within the coming years.

Contemplate when Nvidia made this record on April 15, 2005… for those who invested $1,000 on the time of our advice, you’d have $858,668!*

Inventory Advisor offers traders with an easy-to-follow blueprint for fulfillment, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of January 6, 2025

Josh Kohn-Lindquist has no place in any of the shares talked about. The Motley Idiot has no place in any of the shares talked about. The Motley Idiot has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.