Solely six American firms have a valuation of at the least $1 trillion:

- Microsoft, valued at $2.9 trillion.

- Apple, valued at $2.6 trillion.

- Nvidia, valued at $2.1 trillion.

- Alphabet, valued at $2 trillion.

- Amazon (NASDAQ: AMZN), valued at $1.9 trillion.

- Meta Platforms, valued at $1.1 trillion.

And as this record exhibits, simply 4 firms have crossed the $2 trillion threshold. However Amazon is now knocking on the door of that unique membership. Actually, it gained admission in April for a quick interval earlier than its inventory worth pulled again.

Amazon was based in 1994 as an e-commerce firm, but it surely has since developed to construct a gargantuan presence in different tech segments together with cloud computing, streaming, digital promoting, and now synthetic intelligence (AI).

Amazon simply launched its monetary outcomes for the primary quarter of 2024 (ended March 31), and so they had been sturdy throughout the board. Nevertheless, AI is perhaps the expertise that lifts this firm’s valuation to $2 trillion (and past) on a sustained foundation.

Amazon is weaving AI into its most vital companies

E-commerce is Amazon’s largest income, and the Amazon Net Companies (AWS) cloud platform is liable for the overwhelming majority of the corporate’s working revenue (revenue). Subsequently, Amazon wants each segments firing on all cylinders, and it is at present utilizing AI to drive their success.

In his Q1 convention name with traders, CEO Andy Jassy mentioned that greater than 100,000 sellers have used at the least one among Amazon’s generative AI instruments to enhance product listings and attain extra prospects. One in every of its latest instruments permits sellers to routinely create detailed and fascinating product pages by merely feeding Amazon’s AI engine a hyperlink to their web site. Different AI instruments assist sellers craft content material for his or her ads to extend clicks and enhance conversions.

On the cloud aspect, Amazon continued to make progress on its mission to dominate the three core layers of AI. Infrastructure is the underside layer, and Jassy mentioned demand remained excessive for AWS’s new Trainium 2 chips, which had been designed in-house, due to their favorable worth and efficiency relative to competing {hardware}. They complement AWS’s broad collection of information heart cases powered by Nvidia’s industry-leading graphics chips (GPUs).

The center layer is residence to Amazon Bedrock, which is a service for companies that do not need to construct and practice their very own AI large language models (LLMs). In Bedrock, they’ll entry a portfolio of ready-made LLMs to speed up the event of customer-facing AI purposes. These LLMs embody a number of the {industry}’s strongest, like Anthropic’s Claude 3 and Meta Platforms’ Llama 3.

Lastly, full AI purposes sit on the prime layer. AWS developed a robust AI digital assistant referred to as Q, which turned extensively obtainable to prospects within the first quarter. It is totally customizable and may be skilled to boost productiveness inside nearly any enterprise utilizing inside information. It is able to writing, testing, and debugging pc code, which Amazon says can save months of handbook work. Plus, it might quickly analyze mountains of information to identify developments and potential alternatives throughout a corporation.

Picture supply: Amazon.

Amazon delivered sturdy income progress, and hovering income

Final 12 months, Amazon break up its U.S. success community into eight separate areas. This enables success facilities to carry elevated ranges of stock for merchandise which might be widespread in their very own geographic space, and it additionally means these items journey shorter distances to succeed in prospects. The top result’s sooner supply instances; in March, Amazon mentioned 60% of orders from its Prime members arrived on the identical day or the subsequent day throughout 60 of the biggest U.S. metro areas.

Amazon’s principle is that rushing up supply instances will give prospects the arrogance to purchase from its web site extra ceaselessly, and Jassy factors to the rising on a regular basis necessities section as proof the technique is working. Plus, progress in Amazon’s on-line gross sales revenue total seems to be accelerating. It elevated by 7% to $54.7 billion throughout Q1, which was a lot sooner than the three% progress fee it delivered within the year-ago interval.

AWS cloud income got here in at $25 billion, representing year-over-year progress of 17%, which was additionally an acceleration, each sequentially and in comparison with the year-ago interval. AWS is at present the world’s prime cloud supplier by income, and traders have longed for sooner progress after a sluggish 2023 when companies trimmed their spending resulting from excessive rates of interest. That interval of value optimization seems to be over, in accordance with Jassy, and he says momentum is choosing up — thanks particularly to AI demand.

Lastly, Amazon’s digital promoting income jumped 24% to $11.8 billion, making it the fastest-growing section in your complete group. Amazon.com receives 2.2 billion visits each month, making it the perfect place for retailers to promote their merchandise. Amazon additionally launched adverts to the Prime Video streaming service this 12 months, and whereas it is nonetheless early days, this may very well be a profitable alternative as extra of the $147.9 billion tv advert market shifts to streaming.

Throughout all segments, Amazon’s complete income got here in at $143.3 billion throughout Q1, which was a 13% year-over-year leap. The larger story was on the underside line; the corporate’s net income (revenue) soared 228% to $10.4 billion as administration fastidiously managed prices throughout all divisions.

Amazon is a stone’s throw away from the $2 trillion membership

With a market cap of $1.9 trillion, Amazon inventory solely has to realize one other 5.3% to hitch the $2 trillion membership. Membership is perhaps a mere formality at this level contemplating the corporate’s progress, however there is a large cause Amazon might stay there for the lengthy haul.

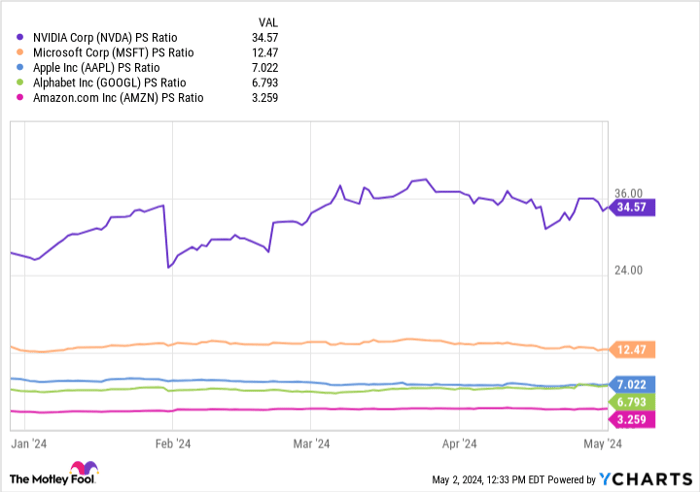

Amazon generates extra income than each firm within the $2 trillion membership. Greater than $574 billion flowed by way of its doorways in 2023, in comparison with $394 billion for Apple, which led Nvidia, Microsoft, and Alphabet. Nevertheless, Amazon inventory is cheaper than all of them on the premise of its price to sales (P/S) ratio (which divides an organization’s market capitalization by its income):

PS Ratio information by YCharts

Amazon is traditionally the least worthwhile firm amongst its big-tech friends, primarily as a result of its e-commerce enterprise runs on razor skinny margins. Nevertheless, the corporate’s web revenue has surged by triple-digit percentages within the final three quarters, which, for my part, ought to entice traders to pay the next valuation a number of for Amazon’s income over time. Its P/S ratio has slowly climbed over the previous 12 months, which is proof that is already taking place.

Subsequently, not solely will Amazon inventory doubtless rise sooner or later based mostly on the sturdy progress throughout its enterprise, however there may also be a case of a number of growth in its P/S ratio — particularly contemplating how far it is lagging behind Alphabet, which is next-to-last within the above chart.

Must you make investments $1,000 in Amazon proper now?

Before you purchase inventory in Amazon, contemplate this:

The Motley Idiot Inventory Advisor analyst crew simply recognized what they consider are the 10 best stocks for traders to purchase now… and Amazon wasn’t one among them. The ten shares that made the lower might produce monster returns within the coming years.

Take into account when Nvidia made this record on April 15, 2005… for those who invested $1,000 on the time of our suggestion, you’d have $544,015!*

Inventory Advisor offers traders with an easy-to-follow blueprint for fulfillment, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of Could 6, 2024

Randi Zuckerberg, a former director of market improvement and spokeswoman for Fb and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Idiot’s board of administrators. Suzanne Frey, an govt at Alphabet, is a member of The Motley Idiot’s board of administrators. John Mackey, former CEO of Entire Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Anthony Di Pizio has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Alphabet, Amazon, Apple, Meta Platforms, Microsoft, and Nvidia. The Motley Idiot recommends the next choices: lengthy January 2026 $395 calls on Microsoft and quick January 2026 $405 calls on Microsoft. The Motley Idiot has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially mirror these of Nasdaq, Inc.