The S&P 500 is coming off back-to-back annual features of greater than 25% in 2023 and 2024 (together with dividends), one thing it has solely finished one different time in its historical past courting again to 1957. In different phrases, the bull market is roaring.

The S&P 500 is weighted by market capitalization, so the most important corporations within the index have a larger affect over its efficiency than the smallest. A number of its current energy is coming from its greatest constituents — particularly these within the expertise sector, which function on the forefront of traits like synthetic intelligence (AI).

The place to take a position $1,000 proper now? Our analyst group simply revealed what they consider are the 10 greatest shares to purchase proper now. See the 10 stocks »

The Vanguard Development ETF (NYSEMKT: VUG) is an exchange-traded fund (ETF) that completely invests in these massive and megacap shares. It has outperformed the S&P 500 because it was established in 2004, and I believe that development will proceed.

Here is why traders with a spare $430 (cash they do not want for speedy bills) ought to think about using it to purchase one share of this ETF in 2025 and holding it for the long term.

Tech shares dominate this Vanguard ETF

The Vanguard Development ETF holds 182 shares from 12 completely different sectors. Because it primarily invests in America’s largest corporations, it is no shock the expertise sector accounts for a whopping 56.8% of the entire worth of its portfolio.

Apple, Nvidia, and Microsoft are the one three corporations on the earth with market capitalizations of $3 trillion or extra, and every of them is within the tech sector. These three names alone make up a mixed 32.7% of the Vanguard ETF:

|

Inventory |

Vanguard ETF Portfolio Weighting |

|---|---|

|

1. Apple |

11.52% |

|

2. Nvidia |

10.68% |

|

3. Microsoft |

10.54% |

Knowledge supply: Vanguard. Portfolio weightings are correct as of Nov. 30, 2024, and are topic to vary.

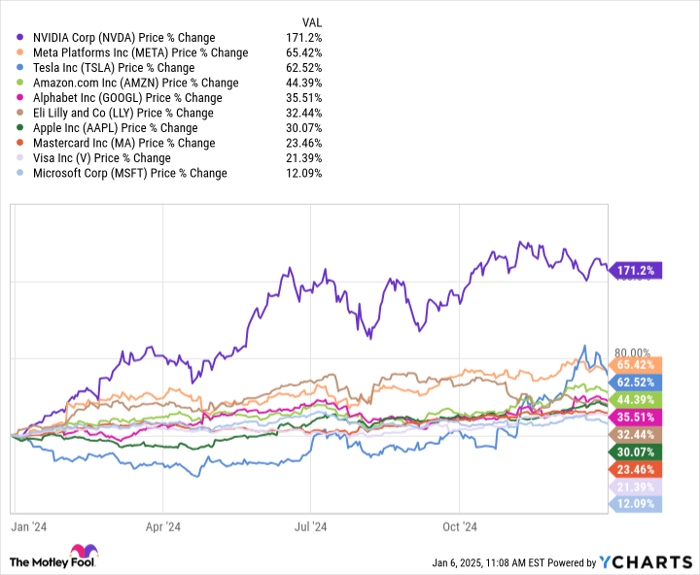

The highest 10 holdings within the Vanguard ETF — lots of that are thought of leaders in various segments of the AI boom — delivered a mean return of 49.8% in 2024. Subsequently, it is no shock the ETF was up 32.6% total final yr, crushing the S&P 500 by a fair wider margin than it usually does (extra on that later):

Nvidia is a very powerful firm within the AI space proper now, as a result of its graphics processors (GPUs) for the information middle are the most effective on the earth for creating the expertise. Demand far exceeds provide for its new Blackwell AI chips, which is a key motive I believe its inventory will soar again during 2025.

Apple and Microsoft are additionally essential items of the puzzle. With greater than 2.2 billion energetic gadgets worldwide, Apple may turn out to be the most important distributor of AI to customers through its Apple Intelligence software program, which is now energetic within the newest iPhones, iPads, and Mac computer systems. Microsoft’s Azure cloud platform, then again, is a go-to vacation spot for enterprise and builders looking for the instruments they should construct AI software program, together with computing capability and ready-made large language models (LLMs).

Amazon’s cloud division can be becoming a leader in AI infrastructure and services. Then there may be Meta Platforms, the developer of the world’s hottest open-source LLM known as Llama, which has been downloaded greater than 600 million occasions.

This spectacular portfolio of shares comes at a really low value. The Vanguard ETF has an expense ratio of simply 0.04%, which is the proportion of the fund deducted annually to cowl administration prices. Vanguard says the common expense ratio of comparable funds within the business is considerably increased at 0.95%, which might detract from traders’ returns in the long term.

Picture supply: Getty Photographs.

Beating the S&P 500 once more in 2025 (and past)

The Vanguard ETF has delivered a compound annual return of 11.7% because it was established in 2004, beating the common annual acquire of 10.4% within the S&P 500.

Its return accelerated to 18.3% per yr over the past 5 years, as America’s tech giants grew extra dominant than ever. That compares to a mean yearly return of 15.2% within the S&P over the identical interval.

In different phrases, the Vanguard ETF appears to be extending its efficiency hole in comparison with the S&P over time. Can that development proceed? It’d rely on the success of AI.

Nvidia CEO Jensen Huang believes tech giants will spend as much as $1 trillion over the following 4 years on upgrading their infrastructure to satisfy demand from AI builders. That may profit his firm, along with others like Broadcom and Advanced Micro Devices, that are additionally within the Vanguard ETF.

World consulting agency PwC thinks AI will add $15.7 trillion to the worldwide economic system total by 2030, which would require a contribution from not solely {hardware} corporations, but additionally cloud and software program corporations like Microsoft, Amazon, and Meta.

Alternatively, all the corporations I simply talked about may lose worth if AI fails to stay as much as expectations, which might seemingly set off a interval of poor efficiency within the Vanguard ETF given their huge weightings. Buyers can mitigate that threat by proudly owning the ETF as a part of a diversified portfolio of other funds or particular person shares, and I believe that is the way in which to go.

Must you make investments $1,000 in Vanguard Index Funds – Vanguard Development ETF proper now?

Before you purchase inventory in Vanguard Index Funds – Vanguard Development ETF, think about this:

The Motley Idiot Inventory Advisor analyst group simply recognized what they consider are the 10 best stocks for traders to purchase now… and Vanguard Index Funds – Vanguard Development ETF wasn’t considered one of them. The ten shares that made the minimize may produce monster returns within the coming years.

Take into account when Nvidia made this checklist on April 15, 2005… should you invested $1,000 on the time of our suggestion, you’d have $858,852!*

Inventory Advisor supplies traders with an easy-to-follow blueprint for fulfillment, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of January 6, 2025

John Mackey, former CEO of Complete Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Randi Zuckerberg, a former director of market growth and spokeswoman for Fb and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Idiot’s board of administrators. Suzanne Frey, an government at Alphabet, is a member of The Motley Idiot’s board of administrators. Anthony Di Pizio has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Superior Micro Units, Alphabet, Amazon, Apple, Mastercard, Meta Platforms, Microsoft, Nvidia, Tesla, Vanguard Index Funds-Vanguard Development ETF, and Visa. The Motley Idiot recommends Broadcom and recommends the next choices: lengthy January 2025 $370 calls on Mastercard, lengthy January 2026 $395 calls on Microsoft, brief January 2025 $380 calls on Mastercard, and brief January 2026 $405 calls on Microsoft. The Motley Idiot has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.