Following its third-quarter earnings report, a slew of Wall Road analysts not too long ago raised their worth targets on Lowe’s Firms (NYSE: LOW). Truist’s Scot Ciccarelli raised his goal to $310 whereas sustaining a purchase score on the inventory.

A inventory for a lower-interest-rate surroundings

Wall Road has warmed to the house enchancment sector this 12 months, hoping to revenue from a falling-interest-rate surroundings. As such, Ciccarelli and others see Lowe’s as a beneficiary of an bettering outlook for dwelling spending pushed by decrease mortgage charges and a pick-up in dwelling gross sales. The latter drives gross sales, as householders usually spend on enhancements to organize for a sale or after buying a property.

US Existing Home Sales information by YCharts.

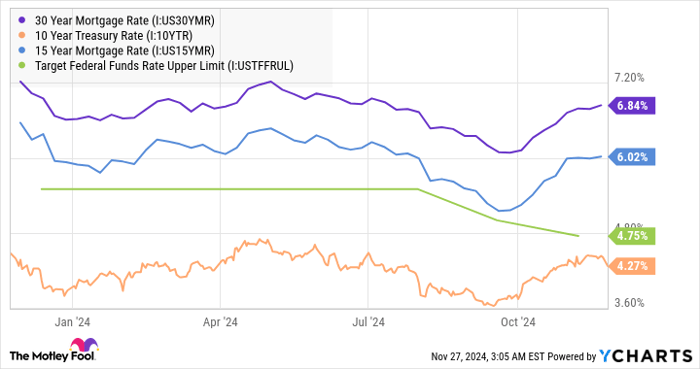

It is a compelling case, however there’s motive for some warning. Whereas the Federal Reserve has lower rates of interest, market and mortgage charges have moved in the wrong way.

30-Year Mortgage Rate information by YCharts.

Historical past means that the cycle will finally flip, and market charges will come down, nevertheless it would possibly take longer than is implied in dwelling enchancment retailer valuations.

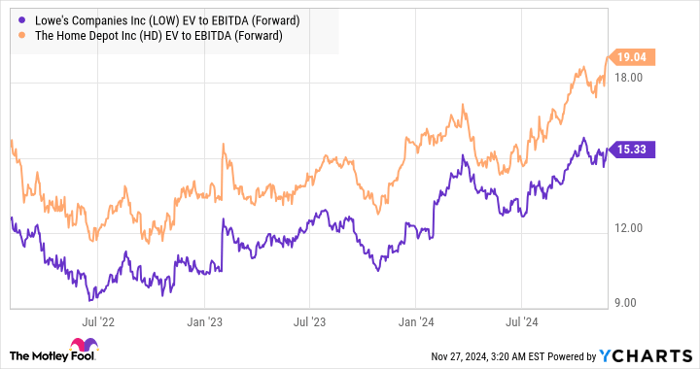

LOW EV to EBITDA (Forward) information by YCharts. EV = enterprise worth. EBITDA = earnings earlier than curiosity, taxes, depreciation, and amortization.

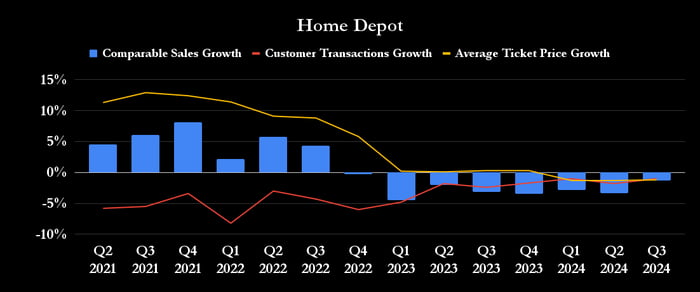

Furthermore, there’s nonetheless strain on larger-ticket discretionary merchandise gross sales, and on buyer transactions and gross sales. In case you have a look at the pattern in House Depot‘s buyer transactions, common ticket worth, and comparable gross sales development, you’ll be able to see that these stay in unfavorable territory. Equally, Lowe’s expects its comparable gross sales to say no by 3% to three.5% in 2024.

Knowledge supply: House Depot displays. Chart by creator.

Whereas Lowe’s and House Depot are apparent methods to play the theme, their valuations counsel little upside potential to stability the chance. Consequently, better-value choices would possibly make sense, like pool products company Pentair, dwelling home equipment firm Whirlpool, or roofing, insulation, and doorways firm Owens Corning.

Don’t miss this second probability at a probably profitable alternative

Ever really feel such as you missed the boat in shopping for essentially the most profitable shares? Then you definately’ll need to hear this.

On uncommon events, our skilled workforce of analysts points a “Double Down” stock advice for corporations that they assume are about to pop. In case you’re nervous you’ve already missed your probability to take a position, now’s one of the best time to purchase earlier than it’s too late. And the numbers communicate for themselves:

- Nvidia: in the event you invested $1,000 once we doubled down in 2009, you’d have $350,915!*

- Apple: in the event you invested $1,000 once we doubled down in 2008, you’d have $44,492!*

- Netflix: in the event you invested $1,000 once we doubled down in 2004, you’d have $473,142!*

Proper now, we’re issuing “Double Down” alerts for 3 unbelievable corporations, and there might not be one other probability like this anytime quickly.

*Inventory Advisor returns as of November 25, 2024

Lee Samaha has no place in any of the shares talked about. The Motley Idiot has positions in and recommends House Depot. The Motley Idiot recommends Lowe’s Firms, Owens Corning, and Whirlpool. The Motley Idiot has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially mirror these of Nasdaq, Inc.