We proceed to wade by means of the 2024 This autumn cycle, which has been optimistic to this point. Subsequent week’s reporting docket is notably stacked, with main AI gamers Vertiv VRT and Tremendous Micro Laptop SMCI anticipated to report.

How do expectations stack up heading into their releases? Let’s take a better look.

Vertiv

Vertiv supplies companies for knowledge facilities, communication networks, and business and industrial services with a portfolio of energy, cooling, and IT infrastructure options and companies.

Earnings and gross sales expectations for the interval to be reported haven’t budged a lot, with VRT forecasted to see 50% EPS progress on 15% increased gross sales. The corporate’s progress trajectory has been underpinned by red-hot demand for its companies amid the AI infrastructure buildout.

Beneath is a chart illustrating the corporate’s gross sales on a quarterly foundation.

Picture Supply: Zacks Funding Analysis

Tremendous Micro Laptop

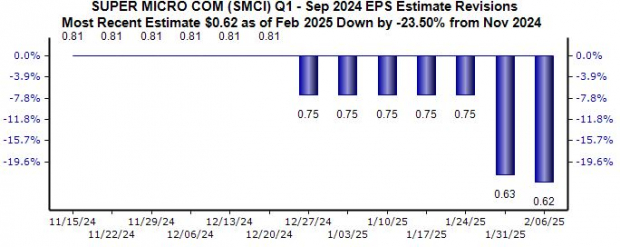

Tremendous Micro Laptop is a complete IT resolution Supplier for AI, Cloud, Storage, and 5G/Edge companies, totally explaining the thrill across the inventory. EPS expectations for the upcoming launch have nosedived over current months, with the present $0.62 per share consensus estimate suggesting 10% progress.

Picture Supply: Zacks Funding Analysis

Income revisions have been taken decrease as properly, with forecasted gross sales of $5.8 billion down 5% over the identical timeframe and suggesting 60% year-over-year progress. Like VRT, the corporate has seen important prime line enlargement over current durations.

Picture Supply: Zacks Funding Analysis

Backside Line

We proceed to wade by means of the 2024 This autumn earnings cycle, which continues to be optimistic. And subsequent week, two massive AI favorites – Tremendous Micro Laptop SMCI and Vertiv VRT – are on the reporting docket.

Steerage can be key for each shares’ reactions post-earnings.

Free In the present day: Taking advantage of The Future’s Brightest Power Supply

The demand for electrical energy is rising exponentially. On the identical time, we’re working to scale back our dependence on fossil fuels like oil and pure fuel. Nuclear power is a perfect substitute.

Leaders from the US and 21 different nations not too long ago dedicated to TRIPLING the world’s nuclear power capacities. This aggressive transition might imply great earnings for nuclear-related shares – and buyers who get in on the motion early sufficient.

Our pressing report, Atomic Alternative: Nuclear Power’s Comeback, explores the important thing gamers and applied sciences driving this chance, together with 3 standout shares poised to learn essentially the most.

Download Atomic Opportunity: Nuclear Energy’s Comeback free today.

Super Micro Computer, Inc. (SMCI) : Free Stock Analysis Report

Vertiv Holdings Co. (VRT) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially mirror these of Nasdaq, Inc.