Corporations had been trialing with synthetic intelligence (AI) in 2023, adopted the know-how in 2024, and are actually gearing up for disruptive adjustments of their AI operations.

President Trump additionally rolled out a big AI infrastructure funding of $500 billion, a shot within the arm for the main tech gamers. The market measurement for AI worldwide, in the meantime, is estimated to succeed in $243.7 billion this 12 months from $184.1 billion final 12 months, per statista.com.

Banking on such positives, the long run seems brighter for AI shares. Two standouts within the S&P 500 final 12 months had been NVIDIA Company NVDA and Palantir Applied sciences Inc. PLTR, poised for sturdy efficiency once more this 12 months, making them attractive buys. Let’s see why –

The Bullish Case for NVDA Inventory

NVIDIA’s dominance within the graphic processing models (GPU) market has given the AI behemoth a aggressive benefit. NVIDIA accounts for greater than two-thirds of the GPU market, which is projected to develop to $101.54 billion this 12 months from $75.77 billion final 12 months, based on Priority Analysis.

The rising acceptability of NVIDIA’s chips additionally stands in good stead for the corporate. The demand for NVIDIA’s next-generation Blackwell chips is surging, whereas the demand for Hopper chips stays regular, confirmed CEO Jensen Huang.

NVIDIA’s older and newer chips proceed to realize prospects’ confidence as a result of their superior high quality in comparison with opponents Intel Company INTC and Superior Micro Gadgets, Inc. AMD. The Blackwell chip, specifically, can run AI inference at a 30 instances quicker tempo in comparison with the older chips and has seen a big rise in shipments within the present quarter. The Blackwell chips are additionally 25 instances extra power environment friendly, which does decrease prices.

As a result of rising demand for Blackwell chips, it’s anticipated that NVIDIA will proceed to witness a wholesome improve in quarterly income regardless of appreciable features final 12 months. Subsequently, NVDA’s earnings per share (EPS) are projected to extend by 46.3% from final 12 months. The Zacks Consensus Estimate is $2.94.

Picture Supply: Zacks Funding Analysis

The Bullish Case for PLTR Inventory

Within the AI platform software program market, Palantir has the second-biggest share behind Microsoft Company MSFT. With spending on AI platforms set to extend considerably by 2028, Palantir is well-poised for sturdy development.

Palantir has additionally seen its authorities and business buyer base improve final 12 months as a result of immense demand for its AI platform, referred to as Synthetic Intelligence Platform (AIP). This AI platform can automate duties by integrating AI brokers that people can’t do.

The demand for AIP elevated Palantir’s revenues from each the federal government and business sectors within the final reported quarter. On the similar time, Palantir’s net-dollar retention charge improved within the final reported quarter.

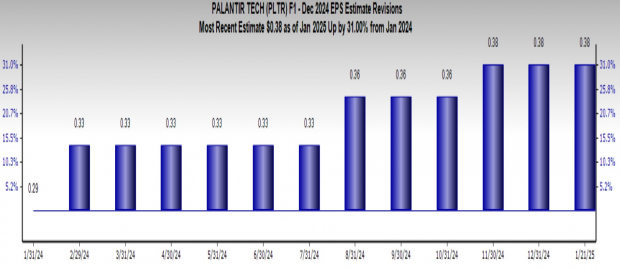

Above all, Palantir might have related properly with its authorities purchasers however has extra potential to increase its attain amongst business purchasers in the US, indicating room for additional development. Consequently, the $0.38 Zacks Consensus Estimate for PLTR’s EPS is up 31% from a 12 months in the past.

Picture Supply: Zacks Funding Analysis

NVIDIA & Palantir Are Should-Purchase Shares for 2025

To conclude, NVIDIA’s GPU market dominance and excessive demand for AI chips will assist its shares preserve scaling upward this 12 months. Equally, the rising business buyer base and stable demand for AIP present Palantir’s shares huge room for development within the present 12 months.

Thus, astute traders ought to guess on each shares to maximise their development potential. Each NVIDIA and Palantir have a Zacks Rank #2 (Purchase). You possibly can see the complete list of today’s Zacks #1 (Strong Buy) Rank stocks here.

Zacks’ Analysis Chief Names “Inventory Most Prone to Double”

Our group of specialists has simply launched the 5 shares with the best chance of gaining +100% or extra within the coming months. Of these 5, Director of Analysis Sheraz Mian highlights the one inventory set to climb highest.

This prime decide is among the many most revolutionary monetary corporations. With a fast-growing buyer base (already 50+ million) and a various set of innovative options, this inventory is poised for giant features. In fact, all our elite picks aren’t winners however this one may far surpass earlier Zacks’ Shares Set to Double like Nano-X Imaging which shot up +129.6% in little greater than 9 months.

Free: See Our Top Stock And 4 Runners Up

Intel Corporation (INTC) : Free Stock Analysis Report

Advanced Micro Devices, Inc. (AMD) : Free Stock Analysis Report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Palantir Technologies Inc. (PLTR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially mirror these of Nasdaq, Inc.