Since we have actually gone into the summertime, lots of travel-related firms need to see raised service from greater need as well as alleviating rising cost of living. To that factor, there are a couple of supplies standing out amongst the Zacks Transportation-Airline Sector which is presently in the leading 16% of over 250 Zacks sectors.

Allow’s have a look at 2 standout supplies in the sector that seem positioned for even more upside as we relocate via June.

Allegiant ( ALGT)

With a Zacks Ranking # 1 (Solid Buy) Allegiant Traveling Firm is well-positioned to gain from this year’s top traveling period via its low-priced traveler airline company, Allegiant Air. Although rising cost of living has actually started to alleviate lots of customers will certainly still be aiming to save money on traveling as well as seem looking for Allegiant’s solutions.

Based in Las Las Vega, Allegiant is concentrated on connecting recreation vacationers in little as well as medium-sized cities to first-rate recreation locations. Trading around $109 a share, Allegiant supply is up +62% year to day to conveniently cover the S&P 500’s +13% as well as the Transportation-Airline Markets +19%.

Photo Resource: Zacks Financial Investment Study

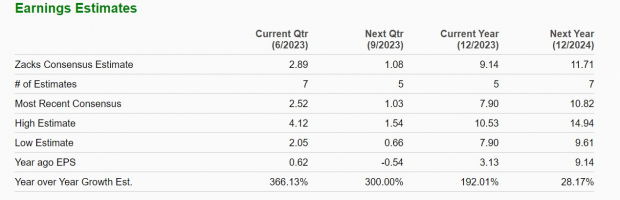

Allegiant’s outstanding YTD efficiency might proceed as incomes price quotes have actually climbed up throughout the quarter. Monetary 2023 EPS price quotes have actually currently risen 46% over the last 90 days with FY24 approximates up 18%.

Allegiant’s incomes are currently anticipated to skyrocket 192% this year to $9.14 per share contrasted to EPS of $3.13 in 2022. And also, FY24 incomes are anticipated to climb an additional 28% at $11.71 per share. On the leading line, sales are anticipated to climb 11% in FY23 as well as dive an additional 11% in FY24 to $2.85 billion.

Photo Resource: Zacks Financial Investment Study

Copa Holdings ( CERTIFIED PUBLIC ACCOUNTANT)

Likewise showing off a Zacks Ranking # 1 (Solid Buy) Copa Holdings deserves capitalists’ factor to consider as well as uses international direct exposure to Latin America’s economic climate. Based in Panama, Copa’s 2 primary subsidiaries Copa Airlines as well as Copa Columbia deal traveler as well as freight solutions.

Significantly, incomes price quotes have actually increased 25% for financial 2023 over the last 3 months with FY24 EPS approximates increasing 22%. Copa’s FY23 incomes are currently forecasted to jump 75% to $14.49 per share contrasted to EPS of $8.26 in 2022. Monetary 2024 incomes are anticipated to climb an additional 3%. Sales are anticipated to leap 15% this year as well as increase an additional 2% in FY24 to $3.50 billion.

Photo Resource: Zacks Financial Investment Study

Much more appealing, Copa supply is up 34% this year to surpass the standard as well as the Transportation-Airline Market however still trades at 7.6 X onward incomes. This is a wonderful discount rate to the sector standard of 10.5 X as well as magnificently underneath the S&P 500’s 19.9 X.

Photo Resource: Zacks Financial Investment Study

Profits

There is a likelihood Allegiant as well as Copa supply might proceed relocating greater with incomes price quotes flying over the last quarter. Currently seems a great time to purchase both supplies as we advance via the summer season as well as right into peak traveling period.

4 Oil Supplies with Large Benefits

Worldwide need for oil is via the roof covering … as well as oil manufacturers are battling to maintain. So despite the fact that oil rates are well off their current highs, you can anticipate large make money from the firms that provide the globe with “black gold.”

Zacks Financial investment Study has actually simply launched an immediate unique record to aid you count on this fad.

In Oil Market ablaze, you’ll find 4 unanticipated oil as well as gas supplies placed for large gains in the coming weeks as well as months. You do not wish to miss out on these referrals.

Download your free report now to see them.

Copa Holdings, S.A. (CPA) : Free Stock Analysis Report

Allegiant Travel Company (ALGT) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The sights as well as viewpoints shared here are the sights as well as viewpoints of the writer as well as do not always show those of Nasdaq, Inc.