Today’s episode of Complete Court Money at Zacks studies where the stock exchange stands as we start the active stretch of very first quarter revenues period. The episode after that discovers 2 titans of crucial markets– Taiwan Semiconductor (TSM) as well as Union Pacific (UNP)— that are resting at beaten-down degrees heading right into revenues that may make them appealing to lasting financiers.

The following numerous weeks are most likely to verify essential for the stock exchange because a great deal is riding on company revenues expectations holding stable.

Beyond revenues, Wall surface Road shows up to like what it saw from the March CPI as well as PPI information. Rising cost of living is plainly cooling down from its summer season heights. Capitalists are valuing because the Fed is almost made with price walks as well as will certainly begin rotating to a much more dovish tone by the end of 2023.

Supplies were down via late-afternoon trading on Friday after the marketplace rose greater on Thursday. The S&P 500 as well as the Nasdaq stay well over their 50-day relocating standards as JPMorgan, Citi, as well as others unofficially started 2nd quarter revenues period.

Picture Resource: Zacks Financial Investment Study

In spite of the revival, the S&P 500 still trades 15% listed below its highs as well as not also much over its 10-year typical in regards to forward revenues. The marketplace is, nevertheless, looking a little overheated, particularly in particular pockets as well as particular supplies.

Capitalists may rather intend to look for lasting worth using fantastic, tested firms trading at really appealing degrees in regards to cost as well as worth.

It is constantly worth keeping in mind that several of the most effective times to acquire fantastic supplies is when other individuals apparently do not desire them for different temporary factors, and after that offer some when every person craves them once again.

Taiwan Semiconductor Production Business ( TSM) is readied to report its very first quarter 2023 revenues on Thursday, April 20. TSM is the globe’s biggest chip maker as well as it is increasing its impact beyond Taiwan in the United State Taiwan Semi is dealing with turning out next-gen, 3-nanometer transistors as chip companies race to enhance rates

Taiwan Semi stands to profit for years to find from the relentless technology change that’s sustained by chips. TSM, which gets hold of a Zacks Ranking # 3 (Hold) now, is trading about 40% from its highs as Wall surface Road bother with stress in between the united state as well as China. In the lasting, TSM will likely verify also important to both financial titans for either to adversely influence TSM’s important chip manufacturing.

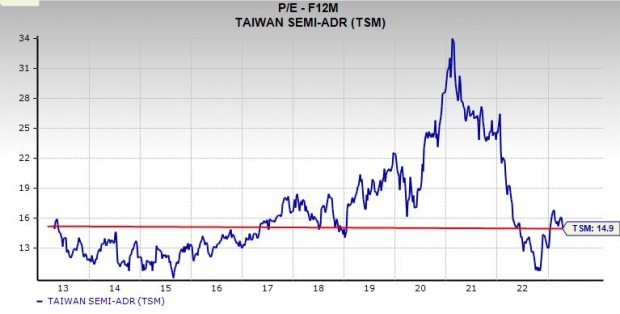

Picture Resource: Zacks Financial Investment Study

TSM’s appraisal is wonderful, with it trading at a 55% discount rate to possess highs at 14.9 X ahead 12-month revenues. Together with its appraisal as well as upside, TSM’s returns returns around 1.6% right now as well as it flaunts a solid annual report.

Union Pacific Firm ( UNP) is likewise readied to report very first quarter 2023 monetary outcomes on April 20. Union Pacific is a rail products titan that’s an instead simple lasting play right into the bigger globe of transport as well as delivery. As well as it appears extremely not likely that railway delivery heads out of design regardless of what the economic climate or power framework appears like 50 or perhaps 100 years from currently.

UNP as well as the bigger team ofrailroad drivers have actually controlled expectations for 2023 as they support for a downturn popular. Union Pacific likewise revealed in late February that its chief executive officer would certainly be tipping down amidst a press to tremble points up as well as urge UNP to increase its procedures as well as earnings.

Picture Resource: Zacks Financial Investment Study

Union Pacific has actually paid a reward for 124 years straight as well as it has actually increased its payment by 12% annualized over the previous 5 years. UNP has actually squashed the S&P 500 over the last 25 years, up 1,300% vs. 350%. UNP has actually climbed up 45% in the previous 5 years as well as presently trades about 30% listed below its all-time highs, as well as its appraisal is looking strong. As well as its blended revenues modifications task assists UNP land a Zacks Ranking # 3 (Hold) now.

Disclosure: Ben Rains very own TSM shares in his individual profile.

Union Pacific Corporation (UNP) : Free Stock Analysis Report

Taiwan Semiconductor Manufacturing Company Ltd. (TSM) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The sights as well as point of views revealed here are the sights as well as point of views of the writer as well as do not always mirror those of Nasdaq, Inc.