In fact, buyers hate to see giant pullbacks available in the market even when corrections may be wholesome for the long run. Amid the decision for the market to right itself, among the strongest-performing shares can cool after which proceed their prolonged rallies.

Given the robust efficiency of the Zacks Enterprise Providers sector over the past 12 months this may very well be the case for Distribution Options Group DSGR and TriNet TNET which have been two of the highest performers.

Efficiency Overview

Distribution Options Group’s value-added distribution options lengthen to services and products for upkeep and restore operations, authentic gear producers, and the economic applied sciences markets. Notably, DSGR has pulled again 11% from a 52-week excessive of $36.61 seen earlier within the month.

As for TriNet, it additionally has an in depth attain providing a complete suite of human payroll options to the banking and monetary providers markets together with expertise, non-profits, enterprise capital, and promoting and advertising industries. TNET has dipped 3% after touching 52-week highs of $134.67 in early April as properly.

The selloff does look wholesome contemplating DSGR and TNET are nonetheless up +2% and +10% YTD respectively and have soared over +50% within the final 12 months to impressively outperform the broader indexes and the Zacks Enterprise Providers Market’s +19%.

Picture Supply: Zacks Funding Analysis

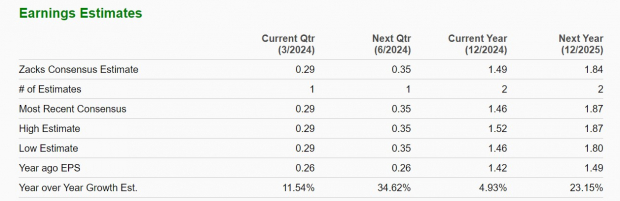

EPS Development & Revisions: Shopping for their latest dip seems to be attractive as Distribution Options Group and TriNet each examine an “A” Zacks Type Scores Grades for Development.

DSGR is anticipating 5% EPS progress this 12 months and extra compelling is that earnings estimate revisions have soared 37% over the past 60 days from estimates of $1.09 a share to $1.49 per share. Even higher, whereas fiscal 2025 EPS estimates have dipped -1% within the final month, annual earnings are nonetheless projected to climb one other 23% subsequent 12 months to $1.84 per share.

Picture Supply: Zacks Funding Analysis

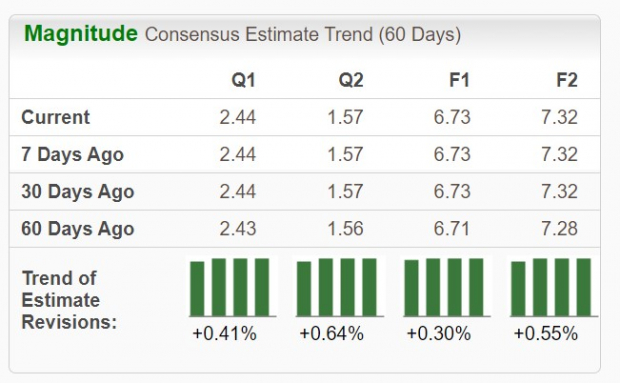

Turning to TNET, after reaching a multi-year EPS peak of $7.81 in 2023, annual earnings are anticipated to dip to $6.73 per share in FY24. Nonetheless, FY25 EPS is projected to rebound and rise 8%. Extra importantly, FY24 and FY25 EPS estimates are barely up over the past 60 days.

Picture Supply: Zacks Funding Analysis

Cheap Valuations: Extra interesting is that Distribution Options Group and TriNet each commerce at reductions to the Enterprise Providers Market’s ahead weighted P/E common of 26.4X. They commerce nearer to the S&P 500’s 21.2X with TNET properly beneath the benchmark at 19.1X and DSRG at 21.8X.

Moreover, Distribution Options Group and TriNet’s inventory commerce properly beneath their decade-long P/E highs and are nonetheless at reductions to their medians throughout this era as properly.

Picture Supply: Zacks Funding Analysis

Backside Line

There will probably be an abundance of shares to select from which may function viable buy-the-dip candidates amid latest market volatility and buyers might wish to take into account DSRG and TNET. For the time being, Distribution Options Group and TriNet’s inventory each sport a Zacks Rank #1 (Sturdy Purchase).

Zacks Names #1 Semiconductor Inventory

It is only one/9,000th the scale of NVIDIA which skyrocketed greater than +800% since we beneficial it. NVIDIA remains to be robust, however our new high chip inventory has far more room to growth.

With robust earnings progress and an increasing buyer base, it is positioned to feed the rampant demand for Synthetic Intelligence, Machine Studying, and Web of Issues. World semiconductor manufacturing is projected to blow up from $452 billion in 2021 to $803 billion by 2028.

See This Stock Now for Free >>

TriNet Group, Inc. (TNET) : Free Stock Analysis Report

Distribution Solutions Group, Inc. (DSGR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.