Earnings season is slowly winding down, with only a small chunk of S&P 500 firms but to disclose their quarterly outcomes. The interval has remained constructive, with the expansion development anticipated to proceed within the coming intervals.

Keep up-to-date with all quarterly releases: See Zacks Earnings Calendar.

And all through the interval, a number of standard firms, together with Superior Micro Units AMD and Tesla TSLA – loved a profitability increase, seeing their margins enhance on a year-over-year foundation. Let’s take a better have a look at the releases.

AMD Forecasts Document Annual Gross sales

Regarding headline figures within the launch, AMD posted a 1.1% beat relative to the Zacks Consensus EPS estimate and reported gross sales 1.5% forward of expectations, reflecting progress charges of 31% and 17%, respectively.

Margin growth aided the leads to an enormous method, with a gross margin of 54% nicely above the 47% mark within the year-ago interval. Margin growth has been current for a number of intervals, as proven beneath.

Under is a chart illustrating the corporate’s margins on a trailing twelve-month foundation.

Picture Supply: Zacks Funding Analysis

Notably, the corporate is now on observe to ship file annual income for 2024 because of important progress amongst its Knowledge Middle and Consumer segments. Actually, Knowledge Middle income of $3.5 billion mirrored a quarterly file, up an astonishing 122% on a year-over-year stack.

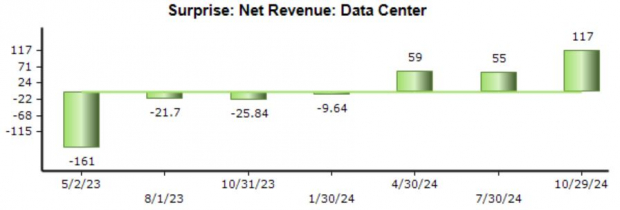

AMD’s information heart outcomes have usually exceeded our consensus expectations in latest quarters, as we will see beneath.

Picture Supply: Zacks Funding Analysis

Tesla’s Margins Recuperate

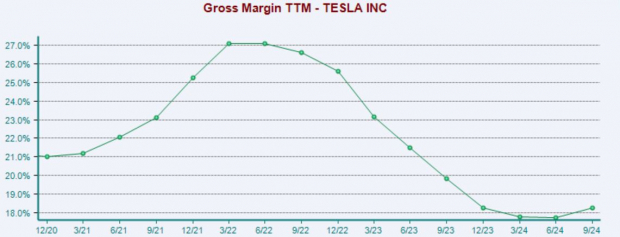

Whereas the corporate’s EV numbers are necessary, the true spotlight of the Tesla launch was margin growth, with the corporate’s gross margin increasing properly to 19.8% vs. a 17.9% print in the identical interval final 12 months. As proven beneath, margins have lastly begun recovering.

Please be aware that the chart’s values are calculated on a trailing twelve-month foundation.

Picture Supply: Zacks Funding Analysis

Whereas margins stay nicely beneath highs set in 2022, the latest uptick is undoubtedly encouraging, additional underpinned by the truth that Tesla reported its lowest-ever stage of price of products bought (COGS) per car all through the interval.

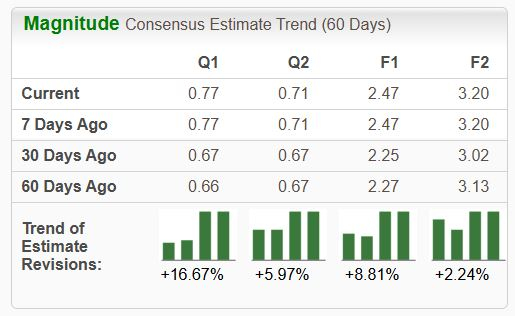

The favorable commentary surrounding profitability and outcomes vaulted the inventory into the highly-coveted Zacks Rank #1 (Sturdy Purchase), with analysts revising their EPS expectations throughout the board following the discharge.

Picture Supply: Zacks Funding Analysis

Backside Line

Margin growth is a bullish sign, permitting an organization to get pleasure from increased earnings. Firms typically see margin growth by means of profitable cost-cutting measures or from a positive financial working atmosphere, simply as we’ve seen within the circumstances above with Superior Micro Units AMD and Tesla TSLA.

Should-See: Photo voltaic Shares Poised to Skyrocket

The photo voltaic business stands to bounce again as tech firms and the financial system transition away from fossil fuels to energy the AI increase.

Trillions of {dollars} shall be invested in clear power over the approaching years – and analysts predict photo voltaic will account for 80% of the renewable power growth. This creates an outsized alternative to revenue within the near-term and for years to return. However it’s a must to choose the precise shares to get into.

Discover Zacks’ hottest solar stock recommendation FREE.

Advanced Micro Devices, Inc. (AMD) : Free Stock Analysis Report

Tesla, Inc. (TSLA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.