The Customer Staples as well as Optional markets presently flaunt a few of the premier Zacks Industries with much of these supplies looking positioned to publish solid quarterly revenues.

Allow’s have a look at 2 supplies out of these corresponding markets that financiers might intend to think about getting prior to their fourth-quarter revenues records.

International Pc Gaming Technologies ( IGT)

Beginning with the Customer Discretionary market, International Pc gaming Technologies supply looks appealing prior to its Q4 record on Tuesday, February 28.

With the Pc gaming Sector presently in the leading 27% of over 250 Zacks Industries revenues price quote alterations have actually a little increased for IGT supply throughout the quarter for its existing monetary 2022 as well as FY23.

IGT presently sporting activities a Zacks Ranking # 1 (Solid Buy) as well as must gain from a thriving organization setting as a developer, programmer, supplier, as well as online marketer of casino-style pc gaming devices, systems modern technology, as well as video game web content.

Picture Resource: Zacks Financial Investment Study

Q4 Sneak Peek & & Expectation

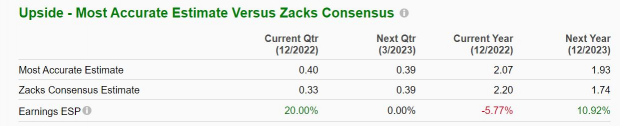

IGT’s Q4 revenues are predicted at $0.33 per share, up an excellent 266% from Q4 2021 EPS of $0.09 a share. Also much better, the Zacks Expected Shock Forecast (ESP) shows IGT might considerably defeat fundamental assumptions with one of the most Precise Quote having Q4 EPS at $0.40. On the leading line, fourth-quarter sales are anticipated to be $1.04 billion, down approximately -1% from the previous year quarter.

Picture Resource: Zacks Financial Investment Study

Completing 2022, IGT’s revenues are currently anticipated to climb up 609% to $2.20 a share contrasted to EPS of $0.31 in 2021. Financial 2023 revenues are predicted to go down -20% to $1.74 per share after an excellent year. Sales are anticipated to be up 2% for FY22 as well as a little dip -1% in FY23 to $4.15 billion.

Takeaway

With shares of IGT up 15% year to day, the remarkable rally might proceed if the business can get to quarterly expectorations as well as use favorable assistance. Additional sustaining even more benefit is IGT’s appraisal at $26 a share as well as 14.9 X onward revenues which is well listed below the sector standard of 20.3 X as well as the S&P 500’s 18.2 X.

Beast Drink ( MNST)

Out of the Customer Staples market, Beast Drink supply is interesting prior to its fourth-quarter record on February 28. Beast supply gets on the cusp of getting to greater highs with its Beverage-Soft Drinks Sector presently in the leading 14% of all Zacks markets.

The online marketer as well as representative of power beverages as well as different drinks is showing off a Zacks Ranking # 2 (Buy) entering into its quarterly launch with revenues price quotes a little greater for monetary 2023 as the business concludes FY22.

Picture Resource: Zacks Financial Investment Study

Q4 Sneak Peek & & Expectation

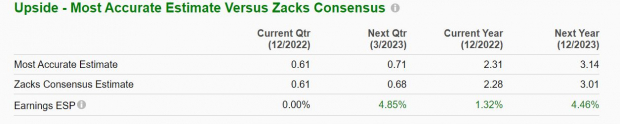

The Zacks Agreement for Monsters Q4 revenues is $0.61 per share, up 1% year over year. The Zacks Expected Shock Forecast shows Beast must reach its quarterly revenues assumptions with one of the most Precise Quote likewise at $0.61 a share. Sales for the quarter are anticipated to be up 11% YoY at $1.59 billion.

Picture Resource: Zacks Financial Investment Study

Generally, Beast revenues are currently anticipated to dip -11% to $2.28 a share for FY22 contrasted to EPS of $2.57 in 2021. Nonetheless, Financial 2023 revenues are anticipated to rebound as well as jump 32% to $3.01 per share. Sales are currently predicted to leap 15% for FY22 as well as increase an additional 11% in FY23 to $7.09 billion.

Picture Resource: Zacks Financial Investment Study

Takeaway

The leading as well as profits development of Beast Drink is extremely eye-catching, specifically when taking into consideration MNST’s solid efficiency over the last years up +508% to squash the criteria’s +161% as well as the Beverage-Soft Drinks Markets’ +48%.

And also, trading at $102 per share as well as 34X onward revenues, Beast supply professions well listed below its decade-long high of 51X as well as on the same level with the average of 34X.

Profits

Financiers will definitely intend to watch on International Pc gaming Technologies as well as Beast Drink supply entering into their Q4 revenues records. With both firms being recipients of solid organization markets there might definitely be a lot of benefit for these consumer-centric supplies.

Is THIS the Ultimate New Clean Power Resource? (4 Ways to Revenue)

The globe is progressively concentrated on removing nonrenewable fuel sources as well as increase use sustainable, tidy power resources. Hydrogen gas cells, powered by the most bountiful material in deep space, might offer an endless quantity of ultra-clean power for numerous markets.

Our immediate unique record exposes 4 hydrogen supplies keyed for huge gains – plus our various other leading tidy power supplies.

International Game Technology (IGT) : Free Stock Analysis Report

Monster Beverage Corporation (MNST) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The sights as well as viewpoints revealed here are the sights as well as viewpoints of the writer as well as do not always show those of Nasdaq, Inc.