Amidst current issues bordering the economic wellness of financial institutions, capitalists might be searching for supplies in the more comprehensive economic industry that might have the ability to endure the headwinds.

Below are 2 premier supplies from the Zacks Money industry that capitalists might wish to think about. These supplies are additionally Returns Aristocrats, increasing their rewards for at the very least 25 successive years.

Aflac ( AFL)

Starting is Aflac which sporting activities a Zacks Ranking # 2 (Buy). Aflac remains in the money industry however as an insurance policy service provider, it needs to have the ability to prevent much of the examination as well as unpredictability that financial institutions are dealing with.

And also, Aflac’s Insurance-Accident as well as Wellness Market is presently in the leading 4% of over 250 Zacks Industries. To that factor, revenues quotes modifications have actually remained to rise over the last 60 days. Financial 2023 revenues quotes have actually currently increased 4% throughout the quarter as well as FY24 EPS quotes are up 3%.

Photo Resource: Zacks Financial Investment Research Study

Aflac’s revenues are currently anticipated to be up 5% this year as well as dive one more 6% in FY24 at $5.96 per share. Sales are forecasted to dip -5% in FY23 however rebound as well as surge 1% in FY24 to $18.64 billion.

Returns Background: AFL has a 2.60% yearly reward return at $1.68 a share. The annualized reward development over the last 5 years is 10.76%. With a 30% payment proportion, Aflac has actually currently elevated its reward for 39 successive years.

Photo Resource: Zacks Financial Investment Research Study

Shares of AFL are down -11% year to day, however this year’s decline might be a purchasing possibility as Aflac supply is up an extremely outstanding +148% over the last 3 years to quickly cover the S&P 500 as well as match the Insurance-Accident & & Wellness Markets +147%.

Photo Resource: Zacks Financial Investment Research Study

Making Aflac supply look much more appealing currently is its price-to-earnings assessment. Shares of AFL profession at $63 per share as well as 11.5 X onward revenues which is underneath the sector standard of 12.6 X as well as the S&P 500’s 18.4 X. This is additionally listed below its years high of 13.8 X as well as stone’s throw over the average of 10.5 X.

Photo Resource: Zacks Financial Investment Research Study

Cincinnati Financial ( CINF)

One more premier Zacks Money industry supply that capitalists might wish to think about is Cincinnati Financial. As a marketing expert of home as well as casualty insurance coverage, Cincinnati Financial might additionally prevent much of the weak point related to financial institutions currently.

Cincinnati Financial additionally sporting activities a Zacks Ranking # 2 (Buy) with its Insurance-Property as well as Casualty Market in the leading 30% of all Zacks Industries.

Incomes quotes have actually significantly increased throughout the quarter. Financial 2023 revenues quotes have actually leapt 13% as well as FY24 EPS quotes have actually climbed up 19%.

Photo Resource: Zacks Financial Investment Research Study

Cincinnati Financials revenues are currently anticipated to jump 21% this year as well as dive one more 15% in FY24 at $5.90 per share. On the leading line, sales are anticipated to be up 7% in FY23 as well as surge one more 8% in FY24 to $9.34 billion.

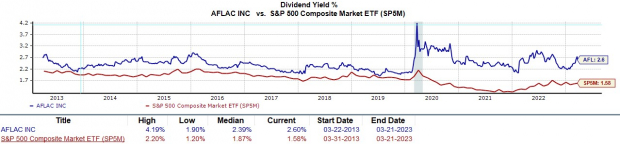

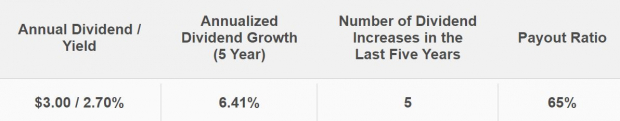

Returns Background: CINF has a 2.70% yearly reward return at $3 a share. Cincinnati Financials reward development over the last 5 years is 6.41% with a 65% payment proportion. Also much better, Cincinnati Financial has actually elevated its reward for 61 successive years categorizing it as a Returns King also (50 successive years).

Photo Resource: Zacks Financial Investment Research Study

CINF supply is up 5% YTD to a little cover the S&P 500’s +4% as well as the Insurance-Property & & Casualty Markets -2%. Over the last 3 years, CINF’s +61% has actually a little tracked the standard however approximately matched its Zacks Subindustry’s +66%.

Photo Resource: Zacks Financial Investment Research Study

With that said being claimed, Cincinnati Financial supply professions wonderfully about its past. At $107 per share, CINF professions at 21.6 X onward revenues as well as over the sector standard of 12.9 X. Nevertheless, CINF professions 31% listed below its decade-long high of 31.3 X as well as at an 8% discount rate to the average of 23.5 X with the increasing revenues quotes supplying more assistance to its P/E assessment.

Photo Resource: Zacks Financial Investment Research Study

Profits

The increasing revenues quote modifications are an excellent indication for these Returns Aristocrats together with their trustworthy rewards. This is additionally assuring to capitalists that might have questions concerning discovering possibilities in the more comprehensive economic industry. Hereof, Aflac as well as Cincinnati Financial appear like sensible choices as well as there can definitely be much more upside in their supplies.

5 Supplies Ready To Dual

Each was handpicked by a Zacks professional as the # 1 favored supply to acquire +100% or even more in 2021. Previous suggestions have actually skyrocketed +143.0%, +175.9%, +498.3% as well as +673.0%.

The majority of the supplies in this record are flying under Wall surface Road radar, which offers an excellent possibility to participate the first stage.

Today, See These 5 Potential Home Runs >>

Aflac Incorporated (AFL) : Free Stock Analysis Report

Cincinnati Financial Corporation (CINF) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The sights as well as viewpoints revealed here are the sights as well as viewpoints of the writer as well as do not always show those of Nasdaq, Inc.