Insurance coverage large Progressive Company PGR and banking chief PNC Monetary Providers Group PNC are two top-rated finance shares to contemplate after exceeding their Q3 high and backside line expectations on Tuesday.

Right here’s a quick assessment of their Q3 experiences and a take a look at why now remains to be time to purchase Progressive shares which have soared practically +60% 12 months to this point and PNC’s inventory which has risen over +20% in 2024.

Picture Supply: Zacks Funding Analysis

Progressive’s Q3 Outcomes

Zacks Rank #1 (Sturdy Purchase)

Attributed to a pointy spike in internet premiums written, Progressive’s Q3 gross sales of $19.43 billion beat estimates by 2% and elevated 24% from $15.7 billion within the comparative quarter. Capitalizing on its market place and talent to implement larger premium charges, Progressive’s Q3 EPS of $3.58 skyrocketed 71% from $2.09 per share a 12 months in the past.

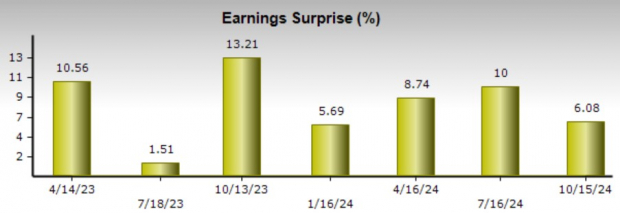

This additionally beat Q3 EPS estimates of $3.40 by 5% with it noteworthy that Progressive has surpassed the Zacks EPS Consensus for 5 consecutive quarters posting a really spectacular common earnings shock of 19.85% in its final 4 quarterly experiences.

Picture Supply: Zacks Funding Analysis

PNC’s Q3 Outcomes

Zacks Rank #2 (Purchase)

Posting Q3 gross sales of $5.43 billion, PNC’s high line expanded 3% 12 months over 12 months and was in a position to beat estimates of $5.36 billion by 1%. Q3 EPS of $3.49 beat estimates of $3.29 a share by 6%. This was regardless of PNC’s backside line contracting from $3.60 per share within the prior-year quarter as a result of decrease buyer curiosity funds and setting apart a bigger reserve to cowl any unpaid loans.

Nonetheless, CEO Invoice Demchak said that PNC is well-positioned to capitalize on its market place as effectively and will obtain document internet curiosity revenue (NII) in 2025. Plus, PNC has exceeded earnings expectations for seven consecutive quarters posting a mean EPS shock of seven.63% in its final 4 quarterly experiences.

Picture Supply: Zacks Funding Analysis

PGR & PNC’s Engaging Valuation (P/E)

Notably, EPS estimates for Progressive and PNC’s fiscal 2024 and FY25 have continued to development larger over the past 30 days which magnifies their cheap ahead P/E multiples of 19.6X and 14.4X respectively.

Picture Supply: Zacks Funding Analysis

Takeaway

After exceeding Q3 expectations, earnings estimate revisions could proceed to development larger for Progressive and PNC within the coming weeks. This might definitely prolong the 12 months to this point rally in these high finance shares which stay viable long-term investments, particularly at their present ranges.

Solely $1 to See All Zacks’ Buys and Sells

We’re not kidding.

A number of years in the past, we shocked our members by providing them 30-day entry to all our picks for the entire sum of solely $1. No obligation to spend one other cent.

1000’s have taken benefit of this chance. 1000’s didn’t – they thought there have to be a catch. Sure, we do have a motive. We would like you to get acquainted with our portfolio companies like Shock Dealer, Shares Below $10, Know-how Innovators,and extra, that closed 228 positions with double- and triple-digit positive aspects in 2023 alone.

The PNC Financial Services Group, Inc (PNC) : Free Stock Analysis Report

The Progressive Corporation (PGR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.