Rising revenues price quote alterations are among the main drivers in the higher motion of supplies. For customer food business, it’s additionally a solid indicator that usage is boosting.

Food usage will certainly constantly be required, making several food-producing business extremely practical financial investments. Below is a check out 2 such supplies that capitalists must take into consideration acquiring today.

General Mills ( GIS)

With a Zacks Ranking # 2 (Buy) General Mills is an international producer as well as marketing expert of top quality foods that capitalists will certainly wish to take into consideration. General Mills’ Food– Miscellaneous Sector is additionally in the leading 30% of over 250 Zacks Industries.

There will certainly remain to be a necessary demand for a number of General Mills’ primary item classifications, that include ready-to-eat grains, hassle-free dishes, treats, costs gelato, cooking blends, as well as components.

Following its newest as well as favorable financial second-quarter cause December, General Mills additionally raised its full-year expectation for natural web sales, changed operating revenue, as well as changed watered down EPS development.

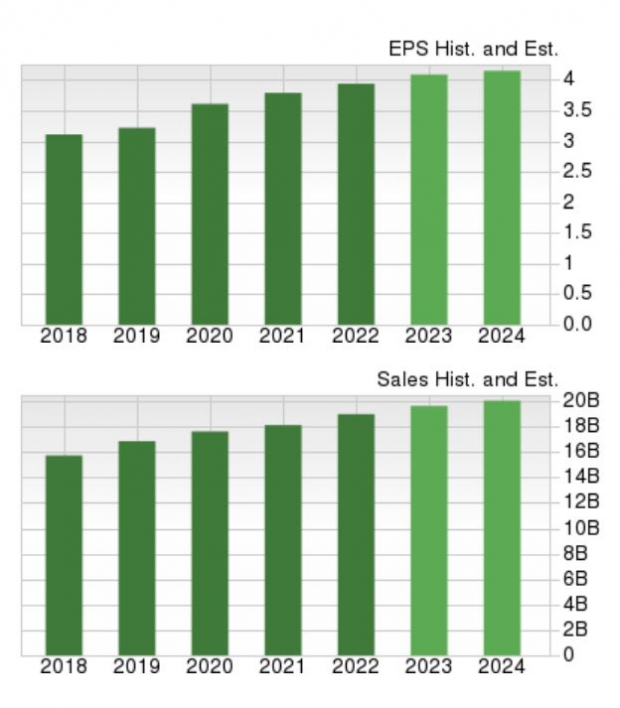

Picture Resource: Zacks Financial Investment Research Study

To that factor, revenues price quote alterations have actually remained to trend greater for General Mills’ financial 2023 as well as have actually begun to rise for FY24 once again. Profits are currently anticipated to be up 6% this year as well as surge an additional 5% in FY24 at $4.39 per share.

On the leading line, sales are anticipated to increase 5% in FY23 as well as side up an additional 3% in FY24 to $20.56 billion. Extra significantly, financial 2024 sales would certainly stand for 22% development from pre-pandemic degrees with 2019 sales at $16.86 billion.

Picture Resource: Zacks Financial Investment Research Study

General Mills’ development has actually been extremely consistent making GIS a reputable supply to maintain in the profile. And also, the development of General Mills’ The United States And Canada Foodservice Sector is extremely interesting with web sales boosting 22% over the last 6 months.

The increase is mostly credited to the enhancement of TNT Crust, an Eco-friendly Bay Wisconsin-based producer of top notch icy pizza crusts for local as well as nationwide pizza chains that General Mills got last June.

Picture Resource: Zacks Financial Investment Research Study

Last quarter, chief executive officer Jeff Harmening specified in the middle of continuous volatility in the operating setting the firm continues to be concentrated on driving their Accelerate method by purchasing brand name structure as well as technology, reinforcing abilities, as well as remaining to improve its profile.

Significantly, beyond TNT crust, General Mills additionally got Tyson Foods’ ( TSN) family pet reward company in 2014 to proceed expanding right into the family pet grocery store after getting in the room in 2018. As General Mills remains to expand its company breadth this year’s little decrease in GIS supply is beginning to resemble a purchasing chance.

Year to day General Mills supply is down -6% near the Food-Miscellaneus Markets -5% as well as underperforming the S&P 500’s +3%. Nonetheless, over the last 3 years, GIS supply is still up +53% to conveniently cover the criteria as well as its Zacks Subindustry’s +15% with Tyson Foods supply as a wider Customer Staples instance down -14%.

Picture Resource: Zacks Financial Investment Research Study

Hershey ( HSY)

As the biggest delicious chocolate producer in The United States and Canada, The Hershey Firm is extremely eye-catching currently with its supply showing off a Zacks Ranking # 1 (Solid Buy).

Hershey’s Food– Confectionery Sector is presently in the leading 6% of all Zacks Industries. While delicious chocolate usage might not appear like a requirement the revenues price quote alterations promote themselves as well as show need is greater.

And Also, Hershey is a leader in delicious chocolate as well as non-chocolate confectionary as well as additionally produces vital kitchen products like cooking components, garnishes, drinks, blends, as well as spreads amongst others.

Picture Resource: Zacks Financial Investment Research Study

Throughout the quarter, Hershey’s financial 2023 as well as FY24 EPS quotes have actually increased 4% as well as 6% specifically. Profits are currently forecasted to leap 10% this year as well as surge an additional 8% in FY24 at $10.14 per share. Sales are anticipated to be up 8% in FY23 as well as surge an additional 3% in FY24 to $11.64 billion. Remarkably, Monetary 2024 would certainly stand for 45% development from pre-pandemic degrees with 2019 sales at $7.98 billion.

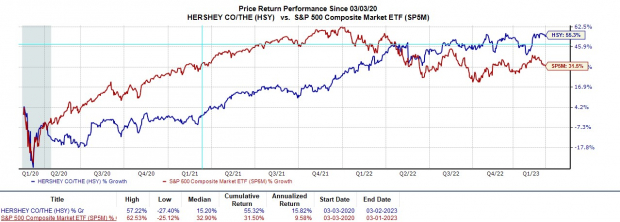

Picture Resource: Zacks Financial Investment Research Study

This gets on top of 2022 providing what Hershey stated was among its best years in background in spite of rising cost of living, supply chain interruptions, as well as macroeconomic unpredictability for several customers. Hershey highlighted throughout its Q4 record on February 2 that it finished the year with combined web sales up 14% to $2.65 billion together with take-home pay boosting 18.5% at $396.3 million.

Hershey supply is up +14% over the in 2014 to mostly surpass the S&P 500’s -11% as well as somewhat leading the Food-Confectionery Markets +13%. Also much better, in the last 3 years Hershey’s +55% has actually conveniently defeated the criteria as well as is simply over its Zacks Subindustry’s +54%.

Picture Resource: Zacks Financial Investment Research Study

Profits

Both General Mills as well as The Hershey Firm are staples of American culture as well as are corporations amongst worldwide food usage too. This looks most likely to proceed in the years ahead. The increasing revenues price quote alterations are a terrific indicator that both General Mills as well as Hershey’s supply might improve their extremely solid efficiencies over the last couple of years as well as be a foundation in capitalists’ profiles.

Is THIS the Ultimate New Clean Power Resource? (4 Ways to Revenue)

The globe is progressively concentrated on getting rid of nonrenewable fuel sources as well as increase use sustainable, tidy power resources. Hydrogen gas cells, powered by the most bountiful compound in deep space, might offer an unrestricted quantity of ultra-clean power for numerous markets.

Our immediate unique record discloses 4 hydrogen supplies keyed for huge gains – plus our various other leading tidy power supplies.

Hershey Company (The) (HSY) : Free Stock Analysis Report

General Mills, Inc. (GIS) : Free Stock Analysis Report

Tyson Foods, Inc. (TSN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The sights as well as point of views shared here are the sights as well as point of views of the writer as well as do not always show those of Nasdaq, Inc.