There are lots of amazing large-cap supplies for sale today that long-lasting financiers could wish to begin acquiring in June and also past.

With the debt-ceiling bargain virtually done, Wall surface Road can start to concentrate a lot more on the reality that the excellent 2023 efficiencies of Nvidia, Meta, and also the various other largest technology business on earth have actually papered over the instead ordinary revealing from the majority of the S&P 500. Financiers that can tolerate the opportunity of even more near-term disadvantage must begin browsing for all the offers out there out there today.

The very best financiers do not require to attempt to call bases on private supplies. Rather, financiers with long-lasting perspectives must look for tried and tested business trading at instead eye-catching degrees by their very own historic criteria.

Several of the most effective times to purchase well established titans are when they are apparently ice chilly. Financiers are typically favorable to purchase supplies at what could quickly show to be the near-term tops and also extremely worried to purchase solid supplies at degrees that will likely look ‘inexpensive’ years from currently.

Right here are 2 large-cap supplies that have greater than increased the S&P 500 over the previous two decades that flaunt tried and tested service versions that must grow for several years to find. Both supplies are additionally trading at costs and also appraisals that make them possibly eye-catching long-lasting buys today.

NextEra Power ( NEE)

NextEra Power runs among the biggest electrical energies, Florida Power & & Light Business, in the united state, which solutions over 12 million individuals. NEE is additionally among the largest manufacturers of wind and also solar power on earth.

NextEra is a battery storage space leader too, and also it is subjected to the prospective long-lasting benefit of nuclear power. The business incorporates the big development capacity of renewable resource and also the security of an electrical energy.

Photo Resource: Zacks Financial Investment Research Study

NEE flaunts an about $150 billion market cap and also it is the biggest holding in the Utilities Select Field SPDR ETF (XLU). NextEra broadened its acquired renewables and also storage space stockpile in the very first quarter to increase its overall stockpile to approximately 20.4 gigawatts.

NEE declared both its 2023 incomes support and also its long-lasting economic overview, that includes solid fundamental growth and also reward development. NextEra’s reward presently generates 2.6% and also it has actually elevated its payment by approximately 11% yearly over the previous 5 years.

NextEra’s profits is forecasted to expand by 26% in FY23 to $26.48 billion and afterwards climb up 8% greater following year to assist increase its profits by 7% and also 9%, specifically, based upon Zacks price quotes. NEE’s FY24 incomes overview has actually climbed progressively given that very early 2022 and also it has actually continually covered our EPS price quotes in recent times. And also, 9 of the 13 broker agent referrals Zacks has for NEE are “Solid Buys,” without any “Sells.”

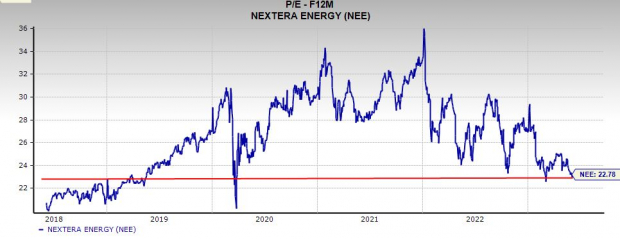

Photo Resource: Zacks Financial Investment Research Study

NEE supply has actually climbed up by 270% in the previous years and also 770% in the last two decades, with an overall return of approximately 1,500% vs. the S&P 500’s 330% run over the last two decades and also 575% overall return. This outperformance consists of over 2 years of current slowness, highlighted by some huge backwards and forwards relocations. NextEra presently trades around where it remained in September of 2020 and also over 20% listed below its documents.

The slump has NEE trading 33% under its highs at 22.8 X onward 12-month incomes and also not also much over its decade-long mean. NextEra is teasing with some possibly uneasy technological degrees. Yet maybe positioned to burst out of its depression at some time and also perhaps award financiers that are thinking of holding the supply for many years and also years to find. NextEra presently lands a Zacks Ranking # 3 (Hold).

Residence Depot ( HD)

Residence Depot supply has actually dropped around 30% from its documents as Wall surface Road started to cost in reducing need after the pandemic residence structure and also renovation investing treasure trove. The residence renovation power published 20% profits development in FY20 and also over 14% greater sales in FY21 vs. approximately around 6% top-line development throughout the 5 previous years. At the same time, its modified incomes rose by around 17% and also 29%, specifically.

Photo Resource: Zacks Financial Investment Research Study

Residence Depot was never ever mosting likely to have the ability to maintain that scorching rate as the economic climate returned closer to regular. Yet sales still stood out 4% in 2022 to assist increase by modified incomes by 7%. Residence Depot after that offered rather unsatisfactory monetary 2023 support when it reported its Q1 results on Might 16.

Actually, HD alerted that its yearly sales would certainly succumb to the very first time given that 2009. Zacks approximates ask for Residence Depot’s profits to slide by 3.5% from $157 billion to around $152 billion and afterwards pop 2% to $155 billion in FY24. At the same time, its modified incomes are forecasted to slide by 10% in 2023 and afterwards recover to the song of a 7% gain following year.

Residence Depot’s longer-term overview stays undamaged given that Millennials are currently driving the real estate market and also Child Boomers are ultimately retiring and also relocating. And also, residence contractors really did not overbuild throughout the covid boom, which implies there is lots of benefit. As well as the ordinary residence in the united state is aging, most likely causing even more fixings and also remodels.

Photo Resource: Zacks Financial Investment Research Study

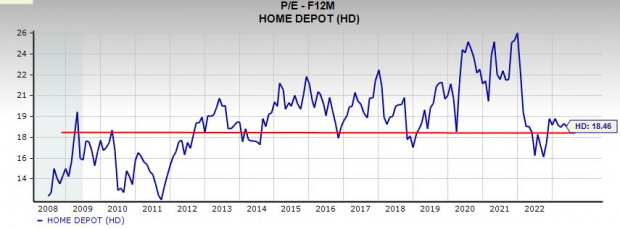

Residence Depot lands a Zacks Ranking # 3 (Hold) today and also its incomes overview for FY24 is just down by around 5% given that its Q1 record. Fourteen of the 24 broker agent referrals Zacks has for HD are “Solid Buys,” without any sell rankings. As Well As its Structure Products– Retail room lands in the leading 7% of over 250 Zacks sectors. Residence Depot’s reward returns 2.9% right now and also it has actually elevated its payment by 15% on an annualized basis over the previous 5 years.

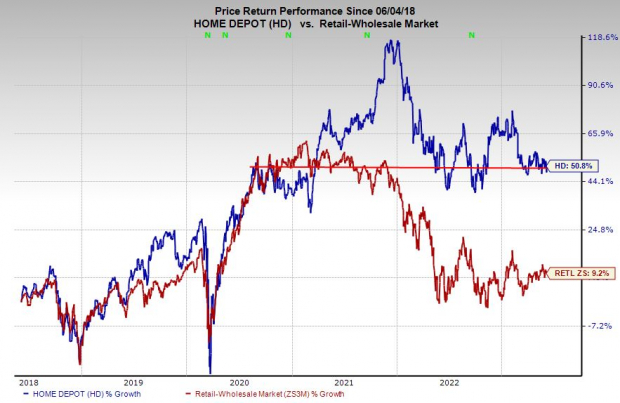

HD shares have actually climbed up around 266% in the last years and also 1,100% in the previous 15 years to surprise the S&P 500’s 240% 15-year relocation and also its Zacks Econ Field’s 300%. Residence Depot is presently neck-and-neck with the criteria in the tracking 5 years, with it down 8% in the previous 2.

HD supply is trading around where it remained in the summertime of 2020. Residence Depot is additionally trading at an 8% discount rate to its very own 10-year mean at 18.5 X onward 12-month incomes.

( Disclosure: Ben Rains has NEE in the Zacks Option Power Innovators solution)

The New Gold Thrill: Exactly How Lithium Batteries Will Make Millionaires

As the electrical automobile change broadens, financiers have a possibility to target big gains. Numerous lithium batteries are being made & & need is anticipated to raise 889%.

Download the brand-new FREE report revealing 5 EV battery stocks set to soar.

NextEra Energy, Inc. (NEE) : Free Stock Analysis Report

The Home Depot, Inc. (HD) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The sights and also viewpoints revealed here are the sights and also viewpoints of the writer and also do not always mirror those of Nasdaq, Inc.