Beneficiant dividend yields may be harmful. Double-digit dividend yields usually present an organization is in serious trouble, the place a stalwart collection of boosted payouts could not drive inventory costs larger. On the identical time, cash-machine companies can energy their payouts from extreme money flows, leading to a powerful yield that may final for a few years.

Luckily, a few completely wholesome high-yield dividend stocks are on fireplace sale proper now. Learn on to see how Worldwide Enterprise Machines (NYSE: IBM) and Darden Eating places (NYSE: DRI) would slot in an income-oriented inventory portfolio in the present day.

Why these yields stand out

The common American financial savings account affords an annual share yield of roughly 0.5%. The S&P 500 (SNPINDEX: ^GSPC) market index has seen a mean dividend yield of 1.6% during the last 5 years and at the moment stands at simply 1.3%.

With dividend yields of three.5% for Darden shares and three.1% for IBM’s inventory, these cash-sharing veterans are on a unique stage. Amongst these well-liked wealth-storage choices, solely the person shares can outrun the federal government’s long-term inflation target of roughly 2% per yr.

Numerous giants with shared strengths

These two family names haven’t got a lot in widespread at first look. Large Blue is a legend of the computing sector, establishing a promising artificial intelligence (AI) enterprise simply in time for a large AI growth. Darden manages full-service restaurant chains, similar to Olive Backyard, Bahama Breeze, and Longhorn Steakhouse. The corporate is increasing its worldwide enterprise whereas transforming many home places. Apples, meet oranges.

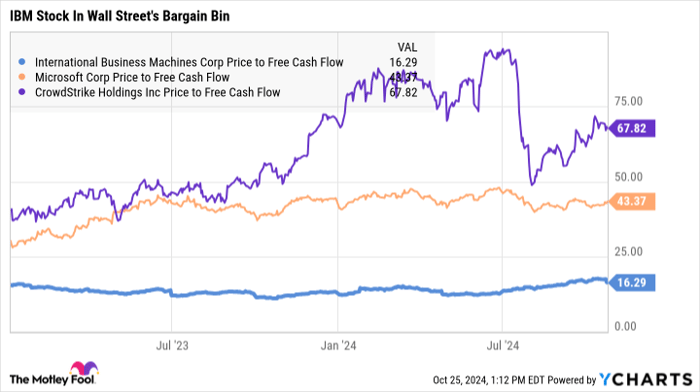

IBM Free Cash Flow information by YCharts.

However they really have quite a bit in widespread the place it issues essentially the most. The 2 companies are rising their gross sales and accumulating sturdy money earnings. In addition they have a dedication to sharing their money flows with buyers within the type of robust and rising dividends.

IBM generated $12.4 billion of free cash flows during the last 4 quarters. It funneled 49% of that surplus money into dividend checks. Darden used 64% of its $992 million free money movement for a similar goal. Each dividend insurance policies are absolutely funded by present money earnings, and so they have room to develop with out inflicting a monetary disaster.

IBM Price to Free Cash Flow information by YCharts.

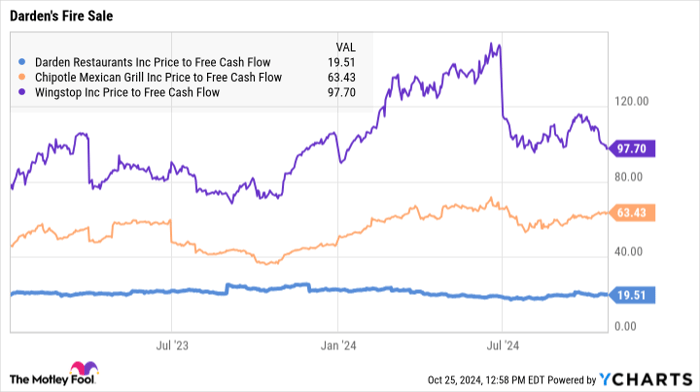

DRI Price to Free Cash Flow information by YCharts.

It is time to lock in these wealthy yields

Lastly, Darden and IBM are firmly established leaders of their respective industries, with convincing progress plans for the foreseeable future. But, their shares look fairly inexpensive subsequent to market-darling rivals. Shopping for the shares proper now will lock in these juicy dividend yields and supply loads of alternative to get pleasure from worth features in the long term.

Bear in mind, Darden has been round for practically a century, and IBM is much more skilled. These deep-pocketed earnings turbines ought to stick round for many years to come back, constructing shareholder wealth alongside the best way because of beneficiant dividend insurance policies.

Don’t miss this second probability at a doubtlessly profitable alternative

Ever really feel such as you missed the boat in shopping for essentially the most profitable shares? Then you definitely’ll need to hear this.

On uncommon events, our professional staff of analysts points a “Double Down” stock suggestion for firms that they assume are about to pop. Should you’re anxious you’ve already missed your probability to take a position, now could be the very best time to purchase earlier than it’s too late. And the numbers converse for themselves:

- Amazon: if you happen to invested $1,000 once we doubled down in 2010, you’d have $21,154!*

- Apple: if you happen to invested $1,000 once we doubled down in 2008, you’d have $43,777!*

- Netflix: if you happen to invested $1,000 once we doubled down in 2004, you’d have $406,992!*

Proper now, we’re issuing “Double Down” alerts for 3 unimaginable firms, and there will not be one other probability like this anytime quickly.

*Inventory Advisor returns as of October 21, 2024

Anders Bylund has positions in Worldwide Enterprise Machines. The Motley Idiot has positions in and recommends Chipotle Mexican Grill, CrowdStrike, Microsoft, and Wingstop. The Motley Idiot recommends Worldwide Enterprise Machines and recommends the next choices: lengthy January 2026 $395 calls on Microsoft, quick December 2024 $54 places on Chipotle Mexican Grill, and quick January 2026 $405 calls on Microsoft. The Motley Idiot has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially mirror these of Nasdaq, Inc.