Furnishings maker American Woodmark ( AMWD) as well as program tv carrier Nexstar Media Team ( NXST) are 2 customer optional supplies that are extremely engaging currently.

Rising incomes price quotes suggest there might be much more upside in American Woodmark as well as Nexstar supply with both showing off a Zacks Ranking # 1 (Solid Buy).

Enhancing EPS Expectation

As one of the biggest makers of cooking area as well as bathroom cupboards, American Woodmark needs to be capturing capitalists’ focus.

Adhering to an extremely solid year that saw EPS at $7.62, American Woodmark’s incomes are anticipated to dip -14% in its existing monetary 2024 however rebound as well as climb 9% in FY25 at $7.13 per share. Extra appealing is that incomes quote modifications are significantly greater.

Financial 2024 EPS price quotes have actually climbed up 22% over the last 60 days with FY25 incomes price quotes increasing 15%. This is an indicator that American Woodmark supply might maintain rising with shares of AMWD currently up +43% this year.

Photo Resource: Zacks Financial Investment Research Study

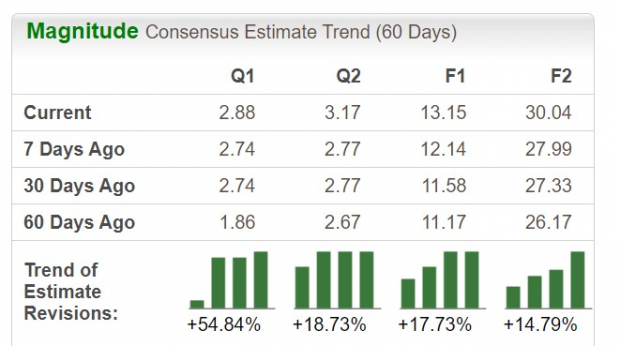

Rotating to Nexstar, its supply is down -11% this year however shows up to have actually struck oversold area. While the tv broadcasting as well as network firm’s fast development has actually reduced in the last few years its profits continues to be durable as well as much more growth might exist in advance.

To that factor, Nexstar’s incomes are anticipated to go down -51% this year however rebound as well as skyrocket 128% in FY24 at $30.04 per share. Also much better, over the last 2 months, Nexstar’s FY23 as well as FY24 EPS price quotes have actually leapt 18% as well as 15% specifically.

Photo Resource: Zacks Financial Investment Research Study

Eye-catching P/E Evaluations

What makes the increasing incomes price quotes much more fascinating is American Woodmark as well as Nexstar’s eye-catching P/E appraisals.

American Woodmark supply professions at $69 a share as well as 10.9 X ahead incomes. This is approximately on the same level with its sector standard as well as well listed below the S&P 500’s 20.4 X.

Moreover, this year’s rally appears like it might proceed taking into consideration American Woodmark supply still trades 61% listed below its decade-long high of 28.2 X as well as at a 35% discount rate to the mean of 16.8 X.

Photo Resource: Zacks Financial Investment Research Study

In a similar way, Nexstar’s P/E appraisal is well listed below the benchmark trading at $158 a share as well as 13.1 X ahead incomes.

This is well underneath its sector standard of 19.1 X as well as Nexstar supply professions 35% listed below its very own decade-long high of 77.1 X as well as practically on the same level with the mean of 12.9 X.

Photo Resource: Zacks Financial Investment Research Study

Profits

The rising incomes price quotes integrated with their eye-catching P/E appraisals make American Woodmark as well as Nexstar Media Team’s supply eye-catching now. This mostly credits to their Zacks Ranking # 1 (Solid Buy) as the overview for both business has actually come to be extremely tempting to capitalists.

Zacks Names “Solitary Best Choose to Dual”

From hundreds of supplies, 5 Zacks specialists each have actually picked their favored to increase +100% or even more in months to find. From those 5, Supervisor of Research study Sheraz Mian hand-picks one to have one of the most eruptive advantage of all.

It’s an obscure chemical firm that’s up 65% over in 2014, yet still economical. With unrelenting need, rising 2022 incomes price quotes, as well as $1.5 billion for redeeming shares, retail capitalists might enter any time.

This firm might measure up to or exceed various other current Zacks’ Supplies Ready To Dual like Boston Beer Business which skyrocketed +143.0% in little bit greater than 9 months as well as NVIDIA which grew +175.9% in one year.

Free: See Our Top Stock And 4 Runners Up

American Woodmark Corporation (AMWD) : Free Stock Analysis Report

Nexstar Media Group, Inc (NXST) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The sights as well as point of views revealed here are the sights as well as point of views of the writer as well as do not always mirror those of Nasdaq, Inc.