In a position to impressively exceed their Q3 expectations, a couple of top-rated tech shares are standing out in what has been an thrilling buying and selling week.

With markets seeing a post-election increase and the Fed implementing one other price lower of 25 foundation factors, listed here are two intriguing tech shares to contemplate after posting favorable Q3 outcomes on Thursday.

Arista Networks – ANET

Zacks Rank #1 (Robust Purchase)

Cloud supplier Arista Networks ANET is among the hottest tech shares hovering over +70% yr up to now and sitting on +200% positive aspects within the final two years.

Down -7% on Friday, the post-earnings selloff in ANET seems to be some revenue taking and should result in higher shopping for alternatives. To that time, Arista has exceeded earnings expectations in each quarter for the reason that firm went public in 2014.

Persevering with this astonishing streak, Arista’s Q3 EPS of $2.40 comfortably exceeded expectations of $2.09 by 15%. 12 months over yr, Arista’s backside line stretched 31% from EPS of $1.83 within the comparative quarter.

Pushed by its AI capabilities, sturdy demand for Arista’s shopper to cloud networking options led to Q3 gross sales of $1.81 billion, a 20% improve from a yr in the past. Beating Q3 gross sales estimates of $1.75 billion, Arista has surpassed prime line expectations for 20 consecutive quarters.

Moreover, Arista introduced a collaboration with Meta META to develop its AI choices which could possibly be an extra catalyst to the corporate’s continued development and investor sentiment.

Picture Supply: Zacks Funding Analysis

Fortinet – FTNT

Zacks Rank #2 (Purchase)

Offering community safety options, Fortinet’s FTNT inventory has spiked +8% in right this moment’s buying and selling session after Q3 EPS of $0.63 crushed estimates of $0.51 a share by 23%. This was a 53% spike from $0.41 a share within the prior-year quarter.

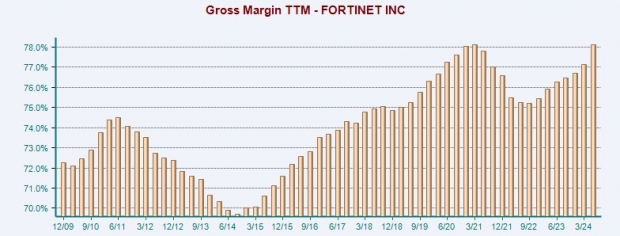

Gross sales of $1.5 billion edged estimates of $1.47 billion and have been up 13% YoY. Traders are additionally applauding Fortinet’s achievement of file gross margins (83.2%) and working margins (36.1%) which led to the corporate elevating its income and working margin steerage.

Picture Supply: Zacks Funding Analysis

Backside Line

Conserving in thoughts {that a} decrease inflationary atmosphere will be very favorable for tech corporations, Arista Networks and Fortinet are actually two shares to regulate after their robust Q3 outcomes.

Free: 5 Shares to Purchase As Infrastructure Spending Soars

Trillions of {dollars} in Federal funds have been earmarked to restore and improve America’s infrastructure. Along with roads and bridges, this flood of money will pour into AI knowledge facilities, renewable power sources and extra.

In, you’ll uncover 5 stunning shares positioned to revenue essentially the most from the spending spree that’s simply getting began on this area.

Download How to Profit from the Trillion-Dollar Infrastructure Boom absolutely free today.

Fortinet, Inc. (FTNT) : Free Stock Analysis Report

Arista Networks, Inc. (ANET) : Free Stock Analysis Report

Meta Platforms, Inc. (META) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.