For those who’re searching for a easy option to generate wealth within the inventory market with little effort, you may’t go fallacious with an exchange-traded fund (ETF).

ETFs commerce like shares, which means you should purchase particular person shares. Nonetheless, every of these shares accommodates a stake in dozens and even a whole bunch of shares. That implies that with only one funding, you may immediately construct a diversified portfolio.

The place to take a position $1,000 proper now? Our analyst crew simply revealed what they consider are the 10 finest shares to purchase proper now. See the 10 stocks »

Whereas all ETFs are totally different, there are two Vanguard funds I personally personal and plan to proceed shopping for for many years.

Picture supply: Getty Photographs.

1. Vanguard S&P 500 ETF

An S&P 500 ETF tracks the S&P 500 (SNPINDEX: ^GSPC), which means it consists of all of the shares inside the index. These shares come from 500 of the biggest firms within the U.S. throughout all corners of the market.

The Vanguard S&P 500 ETF (NYSEMKT: VOO) could be a notably sensible funding due to its low expense ratio of simply 0.03%. With some funds charging charges of round 1% or extra, this will prevent hundreds of {dollars} over time.

Investing in an S&P 500 ETF additionally gives ample diversification. Whereas an honest portion (31%) of this fund is allotted to shares within the tech sector, the remaining is unfold pretty evenly throughout 10 different industries. On the whole, the extra selection you’ve got inside your portfolio, the extra protected you might be towards volatility.

One potential draw back, although, is that this fund can not earn above-average returns. The S&P 500 itself is usually thought-about to signify the general inventory market, and since this ETF is designed to observe the market, it could possibly’t beat the market.

That stated, the market itself has earned an average rate of return of around 10% per year over a long time. For those who had been to take a position, say, $200 monthly whereas incomes 10% common annual returns, here is roughly how that might add up over time:

| Variety of Years | Complete Portfolio Worth |

|---|---|

| 20 | $137,000 |

| 25 | $236,000 |

| 30 | $395,000 |

| 35 | $650,000 |

Knowledge supply: Writer’s calculations through investor.gov.

The Vanguard S&P 500 ETF could be a sensible possibility for these searching for a safer funding that also packs a punch. When you might not earn above-average returns, you may nonetheless generate a whole bunch of hundreds of {dollars} by investing persistently for no less than a few a long time.

2. Vanguard Development ETF

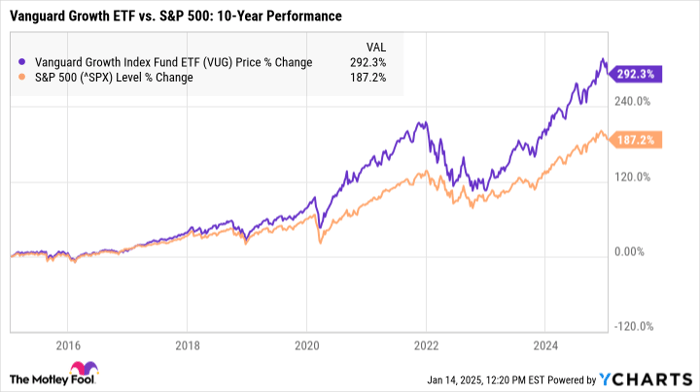

For those who’re searching for an funding that has a historical past of beating the market but can nonetheless restrict your threat, the Vanguard Development ETF (NYSEMKT: VUG) may very well be a superb match in your portfolio.

This ETF is designed to earn above-average returns, and all the shares inside the fund have the potential for critical progress. It accommodates 182 shares, with almost 57% of the fund allotted to shares within the expertise business.

The tech sector usually experiences explosive progress, however it may be extra risky than many different industries. So remember that you just’re prone to see extra extreme ups and downs with this kind of funding in case you select to purchase.

Nonetheless, the long-term earnings might make that turbulence worthwhile. Over the previous 10 years, this ETF has earned a median charge of return of 15.76% per 12 months.

Development ETFs could be considerably unpredictable, although, so it is unclear whether or not this fund will be capable to sustain with these returns going ahead. As an instance you may earn common returns of 15%, 13%, or simply 11% per 12 months. For those who had been to take a position $200 monthly, here is roughly what you may accumulate over time:

| Variety of Years | Complete Portfolio Worth: 11% per 12 months | Complete Portfolio Worth: 13% per 12 months | Complete Portfolio Worth: 15% per 12 months |

|---|---|---|---|

| 20 | $154,000 | $194,000 | $246,000 |

| 25 | $275,000 | $373,000 | $511,000 |

| 30 | $478,000 | $704,000 | $1,430,000 |

| 35 | $820,000 | $1,312,000 | $2,115,000 |

Knowledge supply: Writer’s calculations through investor.gov.

One different benefit of the Vanguard Development ETF is its mixture of blue chip stocks and smaller companies. The highest 10 holdings — which embrace family names like Apple, Microsoft, and Nvidia — make up near 57% of your complete fund.

These shares are bigger and extra secure than many others on this ETF, which may help restrict your threat. On the similar time, although, if any of the smaller shares within the fund take off, it may supercharge your earnings.

There are numerous ETFs to select from, and everybody can have totally different targets and preferences. However these two ETFs have been in my portfolio for years, and I am not planning on promoting anytime quickly.

Must you make investments $1,000 in Vanguard Index Funds – Vanguard Development ETF proper now?

Before you purchase inventory in Vanguard Index Funds – Vanguard Development ETF, contemplate this:

The Motley Idiot Inventory Advisor analyst crew simply recognized what they consider are the 10 best stocks for buyers to purchase now… and Vanguard Index Funds – Vanguard Development ETF wasn’t one in every of them. The ten shares that made the lower may produce monster returns within the coming years.

Think about when Nvidia made this checklist on April 15, 2005… in case you invested $1,000 on the time of our suggestion, you’d have $818,587!*

Inventory Advisor gives buyers with an easy-to-follow blueprint for fulfillment, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of January 13, 2025

Katie Brockman has positions in Vanguard Index Funds-Vanguard Development ETF and Vanguard S&P 500 ETF. The Motley Idiot has positions in and recommends Apple, Microsoft, Nvidia, Vanguard Index Funds-Vanguard Development ETF, and Vanguard S&P 500 ETF. The Motley Idiot recommends the next choices: lengthy January 2026 $395 calls on Microsoft and quick January 2026 $405 calls on Microsoft. The Motley Idiot has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.