Spending on synthetic intelligence (AI) infrastructure has been stable over the previous couple of years, and that development is anticipated to proceed in 2025 as properly, with market analysis agency IDC forecasting that the full outlay on AI might hit a powerful $227 billion within the new yr.

The nice half is that AI spending is anticipated to rise impressively via 2028, surpassing $749 billion on the finish of the forecast interval. Consequently, now could be a very good time to take a better have a look at a few AI stocks that appear like stable buys as 2025 begins due to their enticing valuations and the flexibility to ship strong progress within the new yr, in addition to in the long term.

Begin Your Mornings Smarter! Get up with Breakfast information in your inbox each market day. Sign Up For Free »

1. Microsoft

Microsoft (NASDAQ: MSFT) might have had a forgettable 2024, as shares of the tech big have appreciated simply 14% up to now yr, underperforming the 31% good points clocked by the Nasdaq Composite over the identical interval. Nevertheless, buyers should not ignore the huge AI-driven progress potential of the corporate.

From cloud computing to private computer systems (PCs) to office productiveness, Microsoft is properly positioned to capitalize on multiple AI-centric end markets. This tells us why CEO Satya Nadella remarked on the corporate’s October 2024 earnings conference call that its “AI enterprise is on monitor to surpass an annual income run price of $10 billion subsequent quarter, which is able to make it the quickest enterprise in our historical past to succeed in this milestone.”

There’s a good probability that this income run price might scale up remarkably in the long term, contemplating the AI-specific markets that Microsoft serves. For example, the corporate’s cloud enterprise is already reaping the advantages of the rising adoption of AI providers within the cloud. Microsoft’s Clever Cloud income elevated 20% yr over yr within the first quarter of fiscal 2025 to $24.1 billion, pushed by a 23% enhance in income from the Azure cloud service.

AI accounted for 12 proportion factors of Azure’s progress in the course of the quarter, proving that this expertise is already having a major affect on Microsoft’s cloud enterprise. That progress might have been stronger if Microsoft had been in a position to meet all of the demand for its cloud AI providers.

One other factor value noting is that Microsoft Azure’s share of the cloud infrastructure providers market elevated to twenty% final quarter, because it grew at a barely quicker tempo than the 23% progress in cloud infrastructure spending.

This spectacular market share in cloud infrastructure, which is second to Amazon, ought to set the stage for terrific long-term progress in Microsoft’s cloud enterprise. That is as a result of international cloud spending is anticipated to hit $2 trillion by 2030, in accordance with Goldman Sachs, pushed by the expansion in spending on generative AI choices. A 20% share of the cloud infrastructure market at the moment would ship Microsoft’s cloud income to an enormous $400 billion, a giant enhance over the $105 billion income the corporate generated from this phase in fiscal 2024.

These large catalysts clarify why analysts predict Microsoft’s progress to speed up going ahead following an estimated 10% enhance in earnings in fiscal 2025 to $13.04 per share.

MSFT EPS Estimates for Current Fiscal Year information by YCharts

Extra importantly, buyers will not must pay a hefty valuation to get their arms on Microsoft inventory. That is as a result of it’s buying and selling at 35 instances earnings, which is not all that costly when in comparison with the Nasdaq-100 index’s earnings a number of of 33 (utilizing the index as a proxy for tech shares). Shopping for Microsoft at this valuation appears to be like like a no brainer, contemplating the potential enchancment in its bottom-line progress over the subsequent couple of years.

2. Lam Analysis

Lam Analysis (NASDAQ: LRCX) is one other inventory that has underperformed the market up to now yr, shedding 2% over the previous yr. The inventory’s underperformance could be attributed to the weak point within the reminiscence market up to now couple of years, however issues are wanting brilliant for 2025.

Market analysis agency TrendForce is forecasting a 25% enhance in capital spending for dynamic random-access reminiscence (DRAM) in 2025, together with a ten% enhance in spending on NAND flash storage. The agency provides that there’s scope for upward revisions in these estimates. That is not shocking, because the deployment of AI servers and the launch of generative AI-capable gadgets similar to smartphones and PCs are driving a rise in reminiscence compute and storage wants.

For example, smartphones that help on-device large language model (LLM) based-features are more likely to require 7 gigabytes of extra DRAM. Reminiscence producers similar to Micron Know-how are witnessing a similar trend.

Now, you could be questioning how the favorable prospects of the reminiscence market are going to positively affect Lam Analysis. In any case, the corporate will get 35% of its income from promoting its semiconductor manufacturing gear to reminiscence makers. This potential turnaround within the reminiscence market is the rationale why Lam’s outcomes for the primary quarter of fiscal 2025, which have been launched in October 2024, level towards a turnaround in its fortunes.

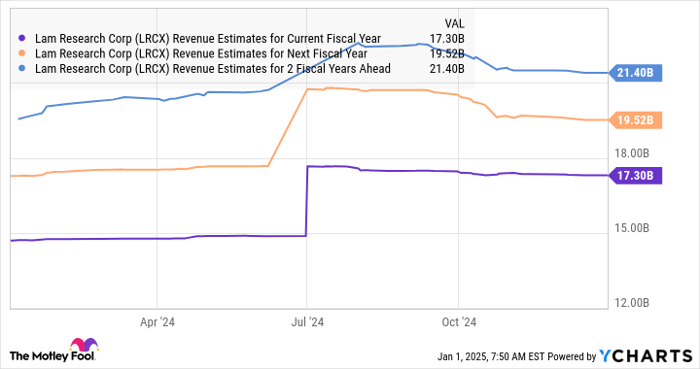

Lam’s income jumped 20% yr over yr in the course of the quarter to $4.17 billion, together with a 25% enhance in earnings to $0.86 per share. The restoration within the reminiscence market explains why analysts predict Lam’s progress to select up within the present fiscal yr following a poor efficiency in fiscal 2024, when its high line fell 14% to $14.9 billion, adopted by double-digit progress within the subsequent fiscal yr as properly. In the meantime, Lam’s earnings are anticipated to leap 17% in each the present and the subsequent fiscal yr.

LRCX Revenue Estimates for Current Fiscal Year information by YCharts

All this makes Lam Analysis a no brainer AI inventory to purchase in 2025, as it’s buying and selling at simply 24 instances earnings, a pleasant low cost to the Nasdaq-100 index’s earnings a number of of 33. The potential enchancment in Lam’s progress may lead the market to reward the inventory with the next valuation, resulting in extra upside.

Not surprisingly, Lam’s 12-month median value goal of $95 factors towards a 32% leap in its inventory value from present ranges, giving buyers one more reason to contemplate including this inventory to their portfolios within the new yr.

Must you make investments $1,000 in Microsoft proper now?

Before you purchase inventory in Microsoft, take into account this:

The Motley Idiot Inventory Advisor analyst workforce simply recognized what they consider are the 10 best stocks for buyers to purchase now… and Microsoft wasn’t certainly one of them. The ten shares that made the reduce might produce monster returns within the coming years.

Take into account when Nvidia made this record on April 15, 2005… for those who invested $1,000 on the time of our suggestion, you’d have $885,388!*

Inventory Advisor offers buyers with an easy-to-follow blueprint for fulfillment, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of December 30, 2024

John Mackey, former CEO of Complete Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Harsh Chauhan has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Amazon, Goldman Sachs Group, Lam Analysis, and Microsoft. The Motley Idiot recommends the next choices: lengthy January 2026 $395 calls on Microsoft and quick January 2026 $405 calls on Microsoft. The Motley Idiot has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.