For earnings traders, generally one of the best mixture is discovering shares which are oversold and that additionally supply dividends. Not solely are dividends a improbable solution to develop wealth long-term, the dependable earnings can support traders whereas they await the inventory to rebound. Listed here are two shares which have largely trailed the S&P 500 over the previous three years, however that provide long-term secure companies and respectable dividend yields.

Boost your portfolio

McCormick (NYSE: MKC) is a world chief in taste, spices, and seasoning, in two segments that generate over $6.5 billion in annual gross sales throughout 150 international locations and territories. It has a protracted checklist of title manufacturers that boast main share positions in lots of markets.

Simply this week, McCormick declared a quarterly dividend of $0.42 per share, marking the a centesimal 12 months of consecutive dividend funds by the spice firm. The dividend yield presently sits at a good 2%.

One of many progress drivers within the enterprise comes from administration’s Complete Steady Enchancment (CCI) financial savings program, which helped drive a 60-basis-point enchancment in gross margins in the course of the second quarter, in comparison with the prior 12 months. Administration expects the development to proceed with greater gross margins in the course of the second half of 2024, in comparison with the primary half.

Administration can also be focusing innovation on particular higher-growth product alternatives, which ought to assist reverse slowing gross sales quantity general. It is also true that McCormick’s divestment of a small canning enterprise is presently weighing on gross sales outcomes.

As administration focuses on greater progress alternatives whereas bettering gross margins with its CCI program, the corporate has confirmed it should proceed to return worth to shareholders whereas they await the inventory value to realize traction sooner or later.

Family title

Whereas traders may not acknowledge or comply with Stanley Black & Decker (NYSE: SWK) inventory, chances are high it is nonetheless a family title for you. The corporate is a world chief in instruments and out of doors merchandise, and operates manufacturing amenities globally. Stanley Black & Decker owns a powerful checklist of different manufacturers that embrace DeWalt and Craftsman, amongst others.

Stanley Black & Decker finds itself in an identical place to McCormick as it really works diligently to scale back its value construction and develop margins. The excellent news is that it is seen important progress, with Q2 gross margins leaping 28.4%, or up 600 foundation factors in comparison with the prior 12 months.

As Stanley Black & Decker makes use of these cost-cutting financial savings to additional progress in its highly effective manufacturers, it is also lowering debt. The corporate’s value reducing and powerful money technology throughout Q2 supported $1.2 billion in debt discount. Buyers should not overlook its respectable dividend yield of three%.

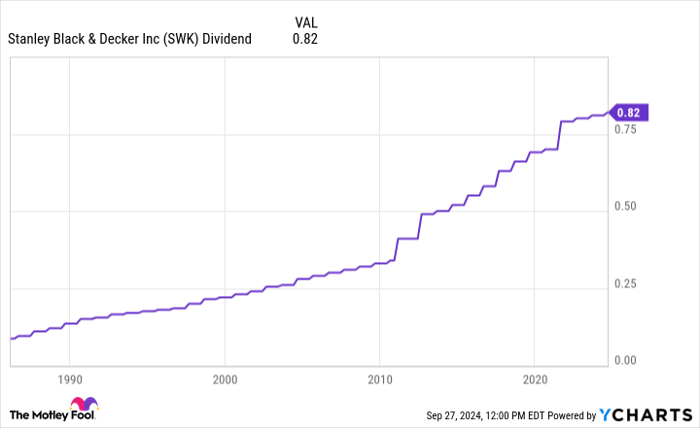

As the corporate continues to chop prices and reinvest in high-opportunity merchandise and types, it stays a stable long-term maintain for earnings traders. Simply take a look at how constantly Stanley Black & Decker has dished out dividends over time.

SWK Dividend knowledge by YCharts.

Purchase now

Each of those corporations have trailed the broader S&P 500 for the previous three years, however they’re working diligently to enhance working efficiencies and lower prices. Each corporations personal a listing of stellar manufacturers that may and can energy progress once more with innovation and reinvestment. It’s going to take time for his or her shares to regain traction out there, however they’re positioned to rebound within the years forward — and offer respectable dividend yields whereas traders wait.

Must you make investments $1,000 in Stanley Black & Decker proper now?

Before you purchase inventory in Stanley Black & Decker, take into account this:

The Motley Idiot Inventory Advisor analyst workforce simply recognized what they consider are the 10 best stocks for traders to purchase now… and Stanley Black & Decker wasn’t one in all them. The ten shares that made the lower might produce monster returns within the coming years.

Take into account when Nvidia made this checklist on April 15, 2005… should you invested $1,000 on the time of our suggestion, you’d have $728,325!*

Inventory Advisor offers traders with an easy-to-follow blueprint for achievement, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of September 30, 2024

Daniel Miller has no place in any of the shares talked about. The Motley Idiot recommends McCormick. The Motley Idiot has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.