As the vital part to innovation of all kinds, semiconductors are an essential bellwether for the state of the economic climate. After fixing almost -50% in 2022, the Semiconductor ETF SMH is off to a fantastic beginning this year, leading the marketplace greater.

The semiconductor market powers the electronic devices market, as well as in 2021 sales got to $556 billion, with a document 1.15 trillion semiconductor devices marketed. The semiconductor market remains to experience solid development with an ordinary yearly development price around 13%, although it is come with by substantial volatility.

The intermittent, high volatility pattern of development for the market, while testing, can give outstanding chances for critical financiers. Thinking about the market lately experienced a deep improvement, it appears feasible that an acquiring chance has actually occurred. If the economic climate as well as the marketplace can keep energy, semis might be a fantastic location to spend.

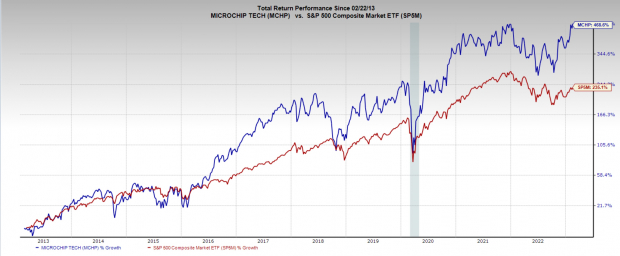

Picture Resource: Zacks Financial Investment Study

Integrated Circuit Modern Technology

Integrated Circuit Modern Technology MCHP is a programmer as well as manufacturer of specialized microprocessors for the automobile, commercial, computer, interactions, illumination, power products, safety and security, as well as cordless connection sectors.

MCHP is leading in the market concerning 8, 16, as well as 32 little bit controller, which has actually played a significant duty in leading line development. Moreover, the business has actually taken advantage of the healing of need in commercial, automobile, as well as customer electronic devices adhering to the resuming of the economic climate. In addition to the remainder of the market, supply-chain restraints have actually been a headwind.

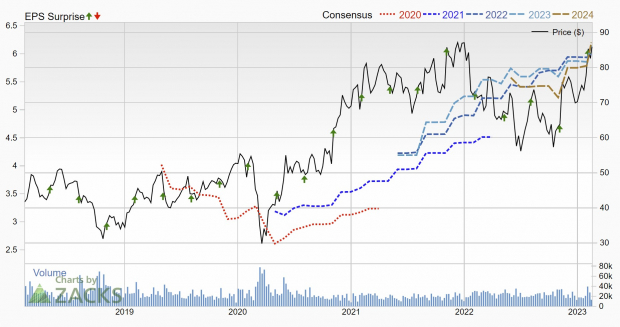

Picture Resource: Zacks Financial Investment Study

Nevertheless, Integrated circuit Technologies has strong development leads, as well as presently flaunts a Zacks Ranking # 1 (Solid Buy), suggesting a solid profits alteration pattern. Existing quarter sales are anticipated to expand 20% YoY to $2.2 billion. Existing year sales are anticipated to expand 23% YoY to $8.4 billion, an outstanding development price for such a big business.

In Addition, over the last 90 days, assumptions for perpetuity frameworks have actually been changed considerably greater. Experts have actually remained in a close to consentaneous choice in elevating the profits assumptions for MCHP.

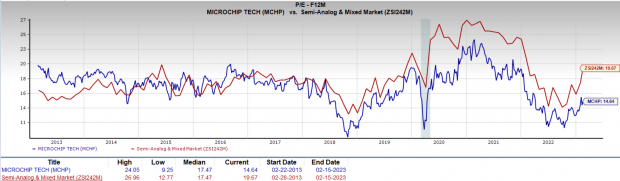

Picture Resource: Zacks Financial Investment Study

Picture Resource: Zacks Financial Investment Study

MCHP is likewise rather attractive from an evaluation point of view. Trading at 14.6 x 1 year onward P/E places it listed below its 10-year average of 17.5 x, as well as well listed below the market standard of 19.6 x. Moreover, MCHP uses a 1.7% reward return.

Picture Resource: Zacks Financial Investment Study

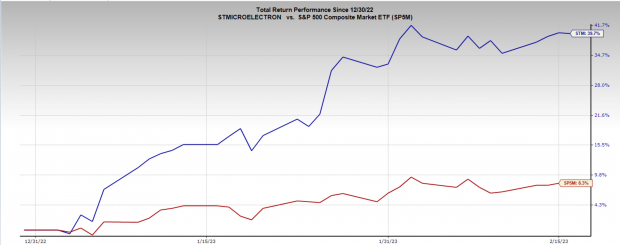

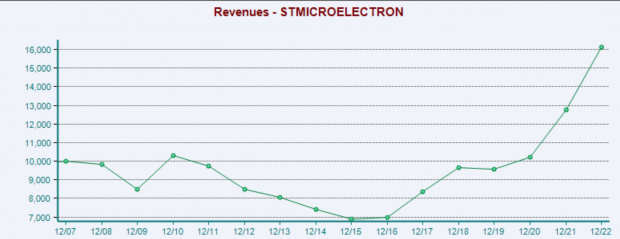

STMicroelectronics

STMicroelectronics STM is just one of the greatest names in the marketplace today, publishing a 40% return YTD, with an engaging technological profession configuration to sweeten the offer. STM is a Swiss based designer as well as maker of automobile as well as electronic semiconductor items, as well as the biggest manufacturer in Europe.

Picture Resource: Zacks Financial Investment Study

STM presently has a Zacks Ranking # 2 (Buy), suggesting a favorable profits alteration pattern. STM had actually been a slower development company in the chip market, yet that has actually lately changed in a significant method. After flattish development for almost a years, STM has actually expanded sales 25% in each of the last 2 years.

Picture Resource: Zacks Financial Investment Study

Furthermore, the profits alterations greater are rather substantial. Existing quarter profits have actually been changed greater by 20% over the last 90 days, as well as following year profits forecasts have actually climbed up 15% over the very same duration.

Picture Resource: Zacks Financial Investment Study

The technological image is really attractive too. After bursting out of a big debt consolidation, the supply has actually developed a bull flag. An outbreak over $50 needs to push the supply to brand-new perpetuity highs. That stated, anything listed below $48 as well as the technological signal will certainly be revoked.

Picture Resource: TradingView

The evaluation image for STM is likewise fascinating. Presently trading at 12x 1 year forward profits, it is considerably listed below its five-year average. Furthermore, STM’s brand-new discovered development needs to additionally boost the numerous it makes.

Picture Resource: Zacks Financial Investment Study

Profits

The Semiconductor market is an interesting, really rewarding, as well as vital market to the economic climate. After experiencing among its numerous intermittent modifications over the in 2015, it appears the market remains in the middle of one more bull run.

Framework Supply Boom to Move America

A huge press to restore the falling apart united state framework will certainly quickly be underway. It’s bipartisan, immediate, as well as inescapable. Trillions will certainly be invested. Lot of money will certainly be made.

The only concern is “Will you get involved in the ideal supplies early when their development capacity is best?”

Zacks has actually launched an Unique Record to aid you do simply that, as well as today it’s complimentary. Discover 5 unique business that seek to acquire one of the most from building and construction as well as repair work to roadways, bridges, as well as structures, plus freight carrying as well as power improvement on a nearly unthinkable range.

Download FREE: How To Profit From Trillions On Spending For Infrastructure >>

STMicroelectronics N.V. (STM) : Free Stock Analysis Report

Microchip Technology Incorporated (MCHP) : Free Stock Analysis Report

VanEck Semiconductor ETF (SMH): ETF Research Reports

To read this article on Zacks.com click here.

The sights as well as point of views shared here are the sights as well as point of views of the writer as well as do not always show those of Nasdaq, Inc.