An everlasting debate among the many funding group is whether or not it’s preferable to guess on the horse or the jockey of a selected firm. On this case, the horse is a metaphor for the {industry} and enterprise mannequin of the corporate in query. The jockey refers back to the senior administration group, and particularly the CEO, who steers and directs the corporate.

Can a enterprise mannequin or {industry} be so compelling or robust that any jockey might basically lead it to victory? Whereas there isn’t a doubt that some mixture of the 2 play a job in success, some funding methods place extra emphasis on one or the opposite parts.

The talk has lately resurfaced in excessive profile trend given the latest handing off of the reins to a brand new CEO at Starbucks (SBUX). Different examples abound, particularly on the retail aspect, of recent management being introduced in to rejuvenate a model.

Right here we spotlight two small caps underneath protection by Zacks which illustrate this debate and supply potential traders an possibility to decide on their private choice.

Kingsway Monetary Providers (KFS) operates by way of two key segments: Prolonged Guarantee and Kingsway Search Xcelerator (KSX). The Prolonged Guarantee phase presents car service agreements (VSAs) and guarantee merchandise throughout america for vehicles, HVAC techniques, and business refrigeration. In 2023, the phase contributed $68.2 million in service charge and fee revenues (down 7.8% from 2022).

The KSX phase, which focuses on enterprise providers, generated $35 million in income in 2023 (up 81.9% from 2022). The corporate expects this phase to develop into an more and more bigger a part of whole income. The phase relies on the “search fund” mannequin and is supported by empirical proof from a 2022 Stanford Enterprise Faculty examine which concluded that search funds generated superior returns from 1984-2021.

In equity, the KSX phase can also be betting on the horse, deciding on sure industries which meet sure development standards. However the outsized emphasis on the jockey is the noteworthy. The corporate sometimes hires the CEOs for the acquired firms from prime MBA packages. The corporate additionally seeks confirmed management abilities and has a propensity to rent candidates with navy expertise.

Kingsway Monetary Providers (KFS) seems close to an inflection level for operational efficiency. Our Impartial score relies on the necessity for extra proof that the acquired firms are being successfully digested and assembly efficiency targets.

The inventory is presently buying and selling at 2.1X trailing 12-month EV/Gross sales TTM, which compares to 2.3X for the Zacks sub-industry, 1.2X for the Zacks sector and 5.3X for the S&P 500 Index. Over the previous 5 years, the inventory has traded as excessive as 2.9X and as little as 0.9X, with a five-year median of two.

Picture Supply: Zacks Funding Analysis

TSS Inc. (TSSI) exemplifies the horse analogy because it participates within the rising {industry} of information facilities and its reference to the exponential development of AI. The corporate delivers advanced IT options, together with rack and techniques integration, configuration providers, information heart administration, and strategic procurement. TSS Inc. serves a broad spectrum of consumers, from information heart operators to modular information heart (MDC) amenities, addressing quickly evolving calls for, particularly round AI and accelerated computing infrastructure.

The surge in demand for AI-enabled infrastructure has been a major catalyst for TSS. The corporate invested closely in increasing its manufacturing capability in second-quarter 2024, which has already began to contribute to its income development. TSS Inc. (TSSI) started delivering AI-enabled rack integration options in June 2024, and the corporate expects this pattern to proceed accelerating all through 2024 and past, positioning TSS as a key participant in AI-driven information heart infrastructure.

Internet revenue noticed a major bounce, rising 345% year-over-year to $1.4 million, primarily pushed by greater profitability in its core companies. Adjusted EBITDA additionally noticed a notable rise of 62%, reaching $2 million. The corporate’s concentrate on high-margin segments appears to have mitigated the influence of income decline in its procurement phase, enhancing general profitability.

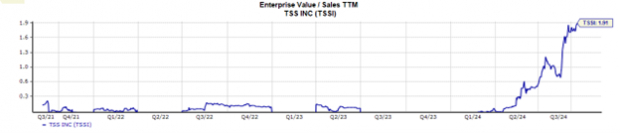

The inventory is presently buying and selling at 1.80X trailing 12-month EV Gross sales/TTM, which compares to 2.10X for the Zacks sub-industry, 3.37X for the Zacks sector and 5.13X for the S&P 500 index.

Picture Supply: Zacks Funding Analysis

Analysis Chief Names “Single Finest Choose to Double”

From 1000’s of shares, 5 Zacks consultants every have chosen their favourite to skyrocket +100% or extra in months to come back. From these 5, Director of Analysis Sheraz Mian hand-picks one to have essentially the most explosive upside of all.

This firm targets millennial and Gen Z audiences, producing practically $1 billion in income final quarter alone. A latest pullback makes now a really perfect time to leap aboard. In fact, all our elite picks aren’t winners however this one might far surpass earlier Zacks’ Shares Set to Double like Nano-X Imaging which shot up +129.6% in little greater than 9 months.

Free: See Our Top Stock And 4 Runners Up

TSS Inc. (TSSI): Free Stock Analysis Report

Kingsway Financial Services, Inc. (KFS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.