Macro variables presently driving the economic situation, such as rising cost of living, price walkings, supply chain concerns, the family member stamina in labor etc have a different influence on gamers in the incredibly varied Web– Solutions market.

Nevertheless, given that this is a capital-intensive market with high dealt with expenses of procedure as well as the rather consistent requirement to broaden capability, price walkings simply aren’t really favorable for it. This in addition to still-elevated rising cost of living as well as recurring worries concerning an economic downturn in the homicide is evaluating on supplies. Appraisals went down via 2022, developing some possibilities. 2023 is getting on much better, specifically after the initial incomes records began can be found in.

Our choices are Autohome ATHM as well as Baidu BIDU.

Concerning the Market

Web – Solutions firms are mostly those that count on massive software program as well as equipment framework, described as their residential properties, to supply different solutions to customers. Individuals can get the solutions by accessing these residential properties with their individual linked gadgets from virtually throughout the globe.

Firms in the industry usually run 2 versions: ad-based, where the solution is supplied totally free, as well as ad-free, where they bill for the solution. Alphabet, Baidu as well as Akamai are several of the bigger gamers while Dropbox, Etsy, Shopify, Uber, Lyft as well as Trivago are several of the arising ones.

Due to the variety of solutions supplied, it is hard to determine industrywide variables that might impact all gamers. Macro variables such as rising cost of living, price walkings, supply chain concerns etc impact various gamers in different ways

Variables Forming The Market

- Being a capital-intensive market, there is the requirement to increase funds to construct out pricey framework. Funds are additionally required to keep this framework. For that reason, the increasing rate of interest setting, which raises running price is a web adverse for the market. This will certainly remain to harm the overview in the close to tool term. In addition, in case of an economic downturn, which might strike in the 2nd fifty percent of 2023 or in 2024, income development as well as for that reason, price absorption will certainly be harder for market gamers.

- It do without claiming that raised digitization of various facets of day-to-day live is a vehicle driver for the whole market since digitization basically moves job online, which is where Access provider are needed. To that degree, the pandemic has actually shown course-altering for the market as a result of the massive quantity of deals that relocated online. As well as individuals are not quiting every one of these benefits to return to their old means. Income development suffered in the initial 3 quarters of 2022, yet is most likely to reveal a bounce-back in the 4th quarter, in accordance with Alphabet’s development.

- Alphabet’s numbers overmuch affect the team’s efficiency, as a result of its enormous dimension when contrasted to a lot of the various other gamers in the market. The development of the mounted base of linked gadgets past Computers as well as mobile phones to IoT, auto as well as much more is developing extra possibilities for targeting. The possession of numerous gadgets immediately drives individuals to make use of these solutions much more as they significantly automate regular duties.

- Financial obligation degrees have actually been supporting in the last couple of quarters, after the rise in the June 2020 quarter. However financial investment in set properties proceeds at an increased rate, as the market adapts to a greater degree of service, blog post pandemic. Purchases additionally continue to be on the program, as getting brand-new expertises is necessary to remain in advance of several of the tight competitors in the room. In 2022, Alphabet alone obtained 257 companies.

- Web traffic procurement is among one of the most essential motorists of income, so firms buy advertising and marketing or structure neighborhoods that can attract much more customers to their on the internet residential properties as well as obtain them to invest even more time there, similar to a shopkeeper would certainly attempt to maintain a potential customer within the shop.

- Some big gamers, consisting of those supplying framework solutions, expand by consolidating various other such big gamers for accessibility to their clients. Because the individual touch is lacking in an on the internet shop, numerous count on cookies as well as various other innovations to track customers, accumulate information on them as well as profile them in order to much better comprehend their requirements.

- As these firms have actually expanded gradually, several of them have actually accumulated such a wide range of info on their customers that the information itself is currently assisting them construct expert system (AI) to create earnings from brand-new innovations as well as solutions as well as additionally reduced the price of procedure. Because of this, ad-based solutions are no more taken into consideration totally free in some components of the globe as well as the EU particularly has actually mounted a complicated regulation in GDPR that calls for company to get specific approval from customers prior to accumulating their information.

- While not all services are improved the exact same range or have the exact same consumer reach, the extent for development is massive. For firms that are currently seeking research study in AI, the potential customers are also brighter.

Zacks Market Ranking Indicates A Dirty Overview

The Zacks Internet – Services market is housed within the more comprehensive Zacks Computer and Technology industry. It lugs a Zacks Market Ranking # 156, which positions it amongst the lower 38% of greater than 250 Zacks-classified markets.

The team’s Zacks Industry Rank, which is primarily the typical ranking of all the participant supplies, shows that there are most likely to be couple of possibilities in the room. However the varied variety of firms suggests that supply choice is still feasible.

Considering the accumulated incomes quote modifications over the previous year, we see consistent declines, one of the most substantial of which remained in July and afterwards once again in October, probably as a result of the Fed’s hawkish position as well as concerns of an approaching economic downturn. Furthermore, the addition of specific bigger firms like Alphabet in the team can alter standards. Generally, the market’s incomes quote for 2022 is down 26.4% from February 2022. The typical incomes quote for 2023 is down 20.2%.

Historically, the leading 50% of the Zacks-ranked markets outmatches the lower 50% by an aspect of greater than 2 to 1. So the market’s placing in the lower 50% of the Zacks-ranked markets need to be taken into consideration an adverse, also if an economic downturn is not a done offer as well as there are numerous variables suggesting that it might not be unfathomable.

Prior to we provide a couple of supplies that you might intend to take into consideration for your profile, allow’s have a look at the market’s current stock-market efficiency as well as appraisal image.

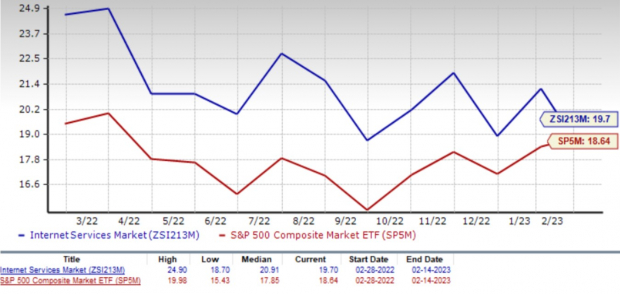

Market Delays on Stock Exchange Efficiency

Over the previous year, the market has actually traded at a price cut to the S&P 500 as well as basically in accordance with the more comprehensive Zacks Computer system as well as Modern Technology Market.

The market has actually shed 30.7% of its worth over this duration contrasted to the S&P 500 index’s loss of 9.2% as well as more comprehensive industry’s loss of 17.8%.

One-Year Rate Efficiency

Picture Resource: Zacks Financial Investment Research Study

Market’s Present Evaluation

On the basis of onward 12-month price-to-earnings (P/E) proportion, which is a typically made use of numerous for valuing innovation firms, we see that the market is presently trading at a 19.70 X numerous, which is a price cut to its average worth of 20.91 X over the previous year. Nevertheless, this is a costs to the S&P 500’s 18.64 X along with the industry’s 22.74 X, recommending an abundant appraisal.

Onward year Price-to-Earnings (P/E) Proportion

Picture Resource: Zacks Financial Investment Research Study

2 Strong Wagers

Autohome Inc. (ATHM): Headquartered in Beijing, PRC, Autohome runs an on the internet system for auto dealerships as well as customers. The firm supplies customers interactive web content as well as devices to research study, accumulate discount rates as well as deals, as well as get autos via its 3 internet sites, autohome.com.cn, che168.com, as well as ttpai.cn as well as the Autohome Shopping center system. It supplies membership, advertising and marketing, listing, information items as well as various other platform-based solutions to dealerships. It additionally assists in bidding process for previously owned cars as well as automobile funding as well as insurance policy.

Autohome’s success originates from its concentrate on a one-stop, closed-loop ecological community, which has actually raised its strength also despite lockdowns in China as well as increased its customer reach to document degrees. It is additionally leveraging its brand names to advertise video-based web content. On the dealership side, it saw specific stamina in the last quarter in brand-new power cars (NEVs) as well as information items.

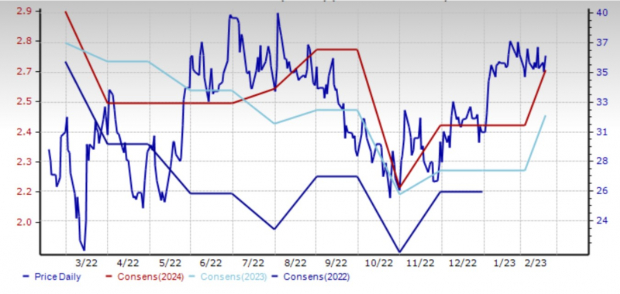

Autohome defeated the December quarter incomes quote by 18.0% on income that defeat by 3.2%. In the last 7 days, experts have actually increased their 2023 quote by 9 cents (3.6%). Experts presently anticipate 2023 income as well as incomes development of 4.3% as well as 6.3%, specifically.

The shares of this Zacks Ranking # 1 (Solid Buy) supply are up 24.7% over the previous year.

Rate as well as Agreement: ATHM

Picture Resource: Zacks Financial Investment Research Study

Baidu Inc. (BIDU): Beijing based Baidu supplies search, feed, brief video clip, advertising as well as various other internet as well as app-based solutions in China. It additionally supplies different PaaS, SaaS, as well as IaaS based cloud solutions as well as options; self-driving solutions, consisting of maps, automated valet auto parking, independent navigating pilot; electrical cars, as well as robotaxi fleets, along with Xiaodu clever gadgets. Even more, the firm offers iQIYI, an on the internet home entertainment solution, consisting of initial as well as accredited web content; various other video clip web content as well as subscription; as well as on the internet advertising and marketing solutions. Baidu, Inc. has critical collaboration with Zhejiang Geely Holding Team.

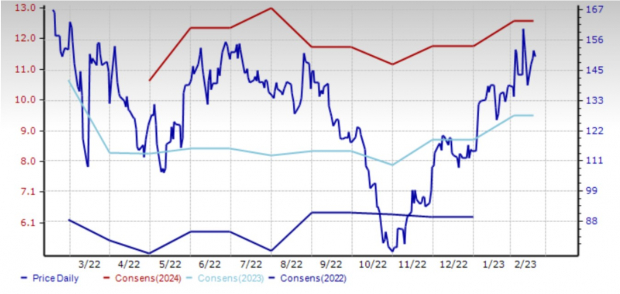

Via 2022, Baidu saw progressive healing in its internet marketing service, consistent development in its AI Cloud income, along with substantial progression in smart driving. Beauty Go, its trip hailing solution is being scaled up with great outcomes. As well as its mobile ecological community is anticipated to proceed producing solid capital to money its financial investment in AI Cloud as well as smart driving, which will certainly assist keep its management in the brand-new AI service as well as drive long-term service development

Baidu is yet to report December quarter results yet experts show up hopeful considered that its price quotes get on the surge. For 2023, experts are anticipating income as well as incomes development of a corresponding 9.7% as well as 34.6%.

The shares of this # 1-ranked firm are down 10.4% over the previous year.

Rate as well as Agreement: BIDU

Picture Resource: Zacks Financial Investment Research Study

Framework Supply Boom to Move America

A large press to restore the falling apart united state framework will certainly quickly be underway. It’s bipartisan, immediate, as well as unavoidable. Trillions will certainly be invested. Ton of money will certainly be made.

The only concern is “Will you enter the ideal supplies early when their development capacity is best?”

Zacks has actually launched an Unique Record to assist you do simply that, as well as today it’s totally free. Discover 5 unique firms that aim to get one of the most from building as well as fixing to roadways, bridges, as well as structures, plus freight carrying as well as power change on a practically unbelievable range.

Download FREE: How To Profit From Trillions On Spending For Infrastructure >>

Baidu, Inc. (BIDU) : Free Stock Analysis Report

Autohome Inc. (ATHM) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The sights as well as viewpoints revealed here are the sights as well as viewpoints of the writer as well as do not always mirror those of Nasdaq, Inc.