The S&P 500 formally went into a brand-new booming market on Thursday. The tech-heavy Nasdaq started its brand-new bull run back in May. Both indexes rose off their lows as Wall surface Road expected cooling down rising cost of living, completion of Fed tightening up, and also a go back to revenues development in 2024.

In the progressive globe of Wall surface Road, the majority of these favorable assistance variables stay in position. That stated, the marketplace will certainly obtain crucial updates on rates of interest and also rising cost of living following week in the type of the Fed’s FOMC conference and also May’s CPI launch.

If rising cost of living maintains air conditioning and also the Fed stops briefly, the marketplace might be all set to press also greater throughout the traditionally peaceful and also low-volume summer season on Wall surface Road. And also the method the marketplace looks today, capitalists do not appear also worried regarding rising cost of living or the opportunity of greater prices.

Picture Resource: Zacks Financial Investment Study

In addition to that, there are indications that capitalists are beginning to acquire supplies beyond mega-cap technology. As soon as various other markets begin to climb up, after that Wall surface Road could be looking also much better.

And Also, there is expanding belief that also if the huge technology supplies topple once more, the huge fund supervisors will certainly need to acquire the dips since any person that lost out on purchasing completion of 2022 or very early 2023 just can not pay for to obtain left.

In general, capitalists with lasting perspectives need to prevent market timing as it can avoid you from joining rallies– such as the one we remain in presently. And also bear in mind that both the S&P 500 and also the Nasdaq still trade sturdily listed below their heights.

Today we check out 2 highly-ranked Zacks supplies that have actually squashed the marketplace over the last 5 years which run tested services that need to assist them maintain expanding for many years ahead.

ServiceNow ( CURRENTLY)

ServiceNow supplies cloud-based electronic operations solutions and also options to almost 8,000 business consumers. Currently intends to assist automate electronic process, with an item profile created to assist increase operations automation throughout locations like IT, HUMAN RESOURCES, and also past. ServiceNow’s consumers are spread throughout almost every element of the economic climate, from healthcare and also modern technology to monetary solutions and also customer items.

Picture Resource: Zacks Financial Investment Study

ServiceNow has currently and also will certainly remain to take advantage of the consistent wave of technical development that requires services from all markets to adjust and also invest greatly to prosper and also keep up. Currently flaunts collaborations with the similarity Microsoft ( MSFT) and also numerous others. ServiceNow’s essential offerings and also effective membership design (which air conditioner counts for regarding 95% of income) are showcased by a decade-straight of 20% or greater income growth that took it from under $300 million in sales in 2012 to $7.25 billion in 2022.

ServiceNow covered our Q1 approximates in late April and also its positive EPS alterations assist it get hold of a Zacks Ranking # 1 (Solid Buy) today. Zacks approximates ask for the firm to upload about 22% sales development in both 2023 and also 2024 to raise to $10.69 billion in overall income. On the other hand, its modified revenues are forecasted to climb up by 26% and also 25%, specifically to assist expand its run of extremely constant and also remarkable growth.

Picture Resource: Zacks Financial Investment Study

currently supply has actually increased about 1,300% in the last ten years vs. the Zacks Technology Market’s 260%. Like numerous development names, ServiceNow obtained squashed throughout the 2022 decline as Wall surface Road was compelled to alter evaluations. NOW is selling line with Technology over the last 3 years. And also ServiceNow presently trades around 20% listed below its highs, despite the fact that it is up 38% YTD.

ServiceNow is trading over its 50-day relocating standard, and also it struck that favorable gold cross in very early March. NOW is much from a worth supply. Yet its PEG proportion has actually come continuously down over the last 5 years, with it presently trading at a 50% price cut to its very own mean throughout that stretch and also 90% listed below its very own highs. Wall surface Road is still happy to compensate in the meantime’s development, and also 26 of the 30 brokerage firm suggestions Zacks has are “Solid Buys.”

Eaton ( ETN)

Eaton is a power administration company that’s stayed in business for over 100 years. ETN assists its consumers boost and also handle their electric, hydraulic, mechanical power systems, and also a lot more. Eaton invested the previous a number of years overhauling its procedures to take advantage of growing megatrends such as renewable resource and also EVs, along with wider electrification and also digitalization.

The fast growth of wind, solar, and also numerous various other non-fossil fuel-based power resources calls for huge quantities of financial investment in power systems and also framework. In addition to that, huge swaths of electric grids in the U.S and also worldwide remain in alarming requirement of repair services, financial investment, and also in a lot of cases, massive overhauls. Eaton’s service sections consist of Electric Americas, Electric Global, Aerospace, Automobile, and also eMobility.

Picture Resource: Zacks Financial Investment Study

Eaton’s income climbed up by 10% in 2021 and also 6% in 2022, and also it increased its financial 2023 revenues and also sales advice adhering to a solid very first quarter that likewise saw it upload document Q1 sector margins and also increase its stockpile by 51%.

Present Zacks approximates ask for one more 9% income development in 2023 and also 6% greater in 2024 to get to $24 billion. On the other hand, its modified revenues are forecasted to climb up by 12% in FY23 and also one more 9% in FY24.

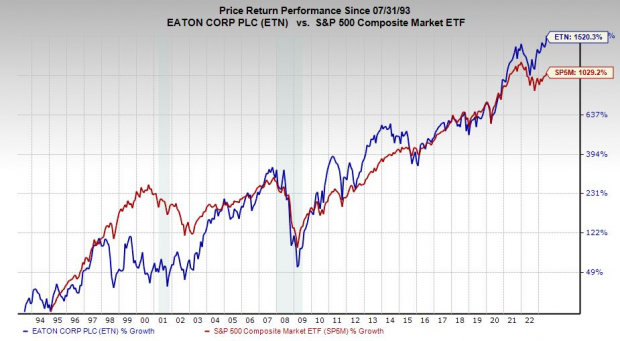

ETN shares have actually climbed up by 130% in the last 5 years vs. its Zacks Econ market’s 18% and also the S&P 500’s 57%. This becomes part of an 850% run over the previous two decades to greater than double the criteria (with its outperformance going back also much longer– see graph). Much more lately, ETN has actually stood out 36% in the previous one year to strike fresh documents, consisting of an 18% YTD rise.

Picture Resource: Zacks Financial Investment Study

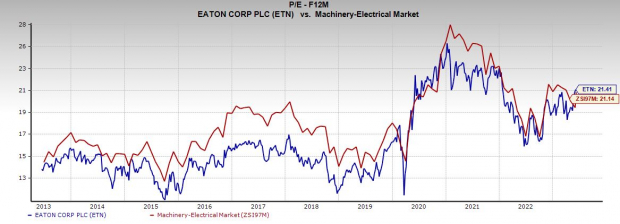

Although Eaton has actually squashed its market, it trades practically straight in accordance with its peers at 21.4 X onward 12-month revenues and also at a 17% price cut to its very own decade-long highs at 21.4 X onward 12-month revenues.

ETN’s enhanced revenues expectation assists it land a Zacks Ranking # 2 (Buy) presently. And also, Eaton’s returns returns 1.9% to increase its highly-ranked Production– Electronic devices market.

( Disclosure: Ben Rains possesses ETN in the Zacks Option Power Innovators solution)

4 Oil Supplies with Huge Benefits

Worldwide need for oil is with the roofing system … and also oil manufacturers are battling to maintain. So despite the fact that oil costs are well off their current highs, you can anticipate huge benefit from the business that provide the globe with “black gold.”

Zacks Financial investment Research study has actually simply launched an immediate unique record to assist you rely on this pattern.

In Oil Market ablaze, you’ll find 4 unanticipated oil and also gas supplies placed for huge gains in the coming weeks and also months. You do not intend to miss out on these suggestions.

Download your free report now to see them.

Microsoft Corporation (MSFT) : Free Stock Analysis Report

Eaton Corporation, PLC (ETN) : Free Stock Analysis Report

ServiceNow, Inc. (NOW) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The sights and also viewpoints revealed here are the sights and also viewpoints of the writer and also do not always mirror those of Nasdaq, Inc.