The This autumn earnings season has remained sturdy with firms from numerous sectors standing out on this week’s lineup. Notably, as of yesterday, earnings from the S&P 500 members have been up 19.2% from This autumn 2023.

In a position to crush their bottom-line expectations on Thursday, listed here are two intriguing shares to regulate within the coming weeks.

Alaska Air Group – ALK

Zacks Rank #1 (Robust Purchase)

Alaska Air Group ALK stood out within the transportation sector as This autumn EPS of $0.97 blasted estimates of $0.47 a share by 106%. Extra spectacular, this soared from $0.30 per share within the prior-year quarter.

Furthemore, final yr’s acquisition of Hawaiian Airways might be very lucerative with Alaska Air Group stating the mixing ought to begin including to its earnings in 2025.

Buying Hawaiian Airways has put the corporate ready to take market share from in style regional carriers like Delta Air Traces DAL and Southwest Airways LUV.

Picture Supply: Zacks Funding Analysis

General, Alaska Air Group’s annual earnings have been up 7% in fiscal 2024 to $4.87 per share.

Providing FY25 EPS steering, Alaska Air Group expects earnings of greater than $5.75 a share with the present Zacks Consensus at $5.90 or 21% progress. Plus, Alaska Air Group’s EPS is projected to soar one other 29% in FY26.

Picture Supply: Zacks Funding Analysis

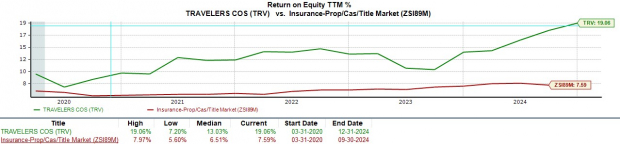

The Vacationers Corporations – TRV

Zacks Rank #3 (Maintain)

Posting a 39% EPS shock, The Vacationers Corporations TRV This autumn earnings got here in at $9.15 a share in comparison with expectations of $6.57. This spiked from EPS of $7.01 within the comparative quarter.

The property casualty insurance coverage large attributed its sturdy fiscal yr to progress in earned premiums, underwriting chance, and a better stage of web funding revenue (NII).

Picture Supply: Zacks Funding Analysis

Highlighting a 19.2% return on fairness, The Vacationers Corporations’ full-year revenue spiked 64% to greater than $5 billion or $21.58 per share versus EPS of $13.13 in 2023. The corporate additionally generated its highest stage of working money circulate at $9.1 billion.

Primarily based on Zacks estimates, The Vacationers Corporations’ annual earnings are anticipated to dip -6% in FY25 however are projected to rebound and rise 9% in FY26 to $22.19 per share.

Picture Supply: Zacks Funding Analysis

Backside Line

Favorable momentum might be forward for Alaska Air Group and The Vacationers Corporations inventory. To that time, many analysts have began to lift their value targets for ALK and TRV after stellar This autumn earnings.

Zacks Names #1 Semiconductor Inventory

It is just one/9,000th the dimensions of NVIDIA which skyrocketed greater than +800% since we advisable it. NVIDIA remains to be sturdy, however our new high chip inventory has way more room to increase.

With sturdy earnings progress and an increasing buyer base, it is positioned to feed the rampant demand for Synthetic Intelligence, Machine Studying, and Web of Issues. World semiconductor manufacturing is projected to blow up from $452 billion in 2021 to $803 billion by 2028.

See This Stock Now for Free >>

The Travelers Companies, Inc. (TRV) : Free Stock Analysis Report

Alaska Air Group, Inc. (ALK) : Free Stock Analysis Report

Delta Air Lines, Inc. (DAL) : Free Stock Analysis Report

Southwest Airlines Co. (LUV) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.