Most electric vehicle (EV) stocks noticed their share costs swing wildly in 2024. Some corporations noticed their valuations soar, whereas others skilled sharp declines. Following a roller-coaster yr, two EV shares particularly now appear to be bargains.

The 2 corporations beneath clearly have sizable upside potential. However you will need to perceive the dangers concerned earlier than leaping in.

The place to take a position $1,000 proper now? Our analyst crew simply revealed what they consider are the 10 finest shares to purchase proper now. See the 10 stocks »

This EV inventory ought to double its gross sales in 2025

When you’re in search of most development, get acquainted with Lucid Group (NASDAQ: LCID).

Lucid is among the smaller publicly traded EV producers working at present, with a gross sales base that’s lower than 1% the scale of Tesla‘s. This small dimension comes with loads of challenges, the most important of which is monetary. Over time, many EV start-ups have gone bankrupt regardless of a promising begin. That is as a result of beginning an electrical car firm is extraordinarily capital-intensive. It requires billions of {dollars} to design a car, ramp up the mandatory manufacturing services, truly produce the car, after which ship the output to clients, dealing with any guarantee or customer support claims alongside the best way. Plus, this complete course of can take a decade to meet from begin to end, requiring excessive endurance from its investor base that gives the capital to maintain the corporate afloat.

These scale challenges do include a serious benefit: Lucid’s largest days of development are nonetheless forward of it. During the last two quarters, Lucid’s income grew by roughly 70% and 90% respectively yr over yr. Over the following 12 months, analysts predict gross sales will leap 118%, crossing the $1 billion mark for the primary time in firm historical past.

The corporate’s Gravity SUV simply started its gross sales ramp-up final month, whereas administration intends to launch three new midsize mass-market autos within the coming years. Lucid might want to retain the belief of the market to maintain capital flowing whereas it ramps up its gross sales base. But when it might probably maintain itself financially, the following few years ought to see the corporate’s gross sales develop by leaps and bounds.

RIVN Revenue (TTM) knowledge by YCharts

My high choose for this yr and past

If I needed to wager on one EV inventory over the following a number of years, it could be Rivian Automotive (NASDAQ: RIVN).

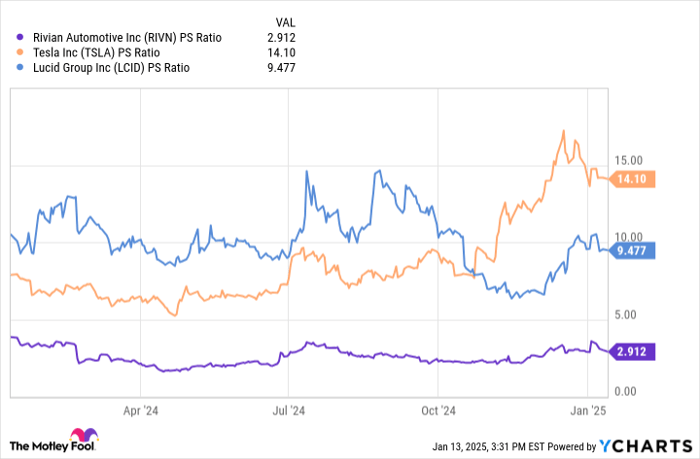

Not like Lucid, Rivian has already confirmed able to increasing its gross sales base considerably. Final yr, annual gross sales topped $5 billion for the primary time, though a current gross sales dip has pushed it underneath that mark for the newest trailing-12-month interval. This pullback in development has brought about the corporate’s price-to-sales a number of to compress properly beneath the competitors. However when you’re keen to remain affected person, you possibly can lock up a incredible valuation earlier than Rivian experiences one other gross sales spurt.

RIVN PS Ratio knowledge by YCharts

Presently, Rivian is caught in a interval of stagnating development. Its two luxurious fashions — each of which might price upward of $100,000 with sure choices — have reached short-term market saturation. With out further new fashions, significantly extra inexpensive fashions, Rivian is struggling to seek out methods to develop, particularly given the slowing development in demand throughout the EV sector as an entire final yr.

Subsequent yr, the watch for development could possibly be over. Not solely will Rivian have up to date generations of its luxurious lineup prepared for shoppers, nevertheless it additionally expects to launch three new fashions — all priced beneath $50,000 — that may see the corporate faucet the mass marketplace for the primary time. Plus, Rivian just lately secured a multibillion-dollar partnership with Volkswagen, infusing the corporate with much-needed money to assist it survive till subsequent yr’s inflection level.

To make certain, Rivian is not only a purchase for January. It will take years for this story to play out. Nevertheless, the corporate’s meager valuation and clearly outlined catalysts in 2025 make this a gorgeous possibility for risk-tolerant, long-term development traders.

Must you make investments $1,000 in Rivian Automotive proper now?

Before you purchase inventory in Rivian Automotive, take into account this:

The Motley Idiot Inventory Advisor analyst crew simply recognized what they consider are the 10 best stocks for traders to purchase now… and Rivian Automotive wasn’t certainly one of them. The ten shares that made the reduce might produce monster returns within the coming years.

Take into account when Nvidia made this record on April 15, 2005… when you invested $1,000 on the time of our suggestion, you’d have $816,504!*

Inventory Advisor supplies traders with an easy-to-follow blueprint for achievement, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of January 13, 2025

Ryan Vanzo has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Tesla. The Motley Idiot has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.