Outdoors of Adobe ADBE, there aren’t many headline names on this week’s earnings lineup however C3.ai AI and United Pure Meals UNFI are two shares to control after reporting favorable quarterly outcomes.

With interesting progress narratives among the many tech and client staples sectors respectively, C3.ai and United Pure Meals have been two of the inventory market’s prime performers this yr and their rallies may proceed.

C3.ai – AI

Inventory Value: $38

Enterprise AI software program supplier C3.ai has been one the most well liked shares within the final three months, hovering over +60% and now sitting on +32% positive factors for the yr. In fact, market demand and excessive sentiment towards synthetic intelligence have contributed to the rally. To that time, C3.ai has a strategic partnership with Microsoft MSFT as its most well-liked AI utility supplier.

Most intriguing is that C3.ai’s promising income progress has continued. Reporting outcomes for its fiscal second quarter on Monday, C3.ai’s Q2 gross sales beat Zacks estimates by 3% and expanded 29% yr over yr to $94.34 million in comparison with $73.23 million within the comparative quarter.

Going public in 2020, C3.ai has moved nearer to displaying its future earnings potential with Q2 EPS at an adjusted lack of -$0.06 which beat expectations of -$0.16 and rose from -$0.13 per share a yr in the past.

Picture Supply: Zacks Funding Analysis

United Pure Meals – UNFI

Inventory Value: $28

Because the main distributor of pure, natural, and specialty meals and non-food merchandise, United Pure’s inventory has seen fairly a rebound in 2024. Hovering +75% YTD, the rally in UNFI should still have legs after United Pure reconfirmed its elevated profitability.

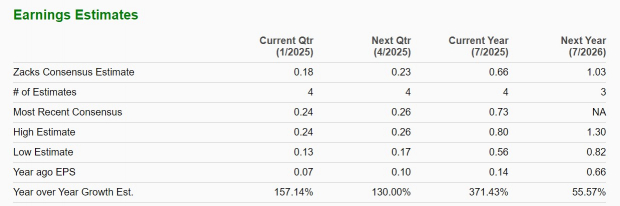

On Tuesday, United Pure reported its fiscal first quarter outcomes with Q1 EPS spiking to $0.16 versus an adjusted lack of -$0.04 a share within the prior-year quarter. Moreover, this crushed the Zack EPS Consensus of $0.01. Quarterly gross sales of $7.87 billion got here in 3% above estimates of $7.61 billion and elevated from $7.55 billion a yr in the past.

Reassuringly, United Pure’s annual earnings are actually anticipated to climb to $0.66 per share in its present fiscal 2025 in comparison with EPS of $0.14 in FY24. Plus, FY26 EPS is projected to soar one other 55% to $1.03 based mostly on Zacks estimates.

Picture Supply: Zacks Funding Analysis

Backside Line

Buying and selling below $40 a share, there might be extra upside in C3.ai and United Pure Meals inventory as earnings estimate revisions are more likely to development greater within the coming weeks. In the mean time, United Pure Meals inventory boasts a Zacks Rank #1 (Robust Purchase) with C3.ai shares sporting a Zacks Rank #2 (Purchase).

Zacks Naming High 10 Shares for 2025

Wish to be tipped off early to our 10 prime picks for everything of 2025?

Historical past suggests their efficiency might be sensational.

From 2012 (when our Director of Analysis Sheraz Mian assumed accountability for the portfolio) by means of November, 2024, the Zacks High 10 Shares gained +2,112.6%, greater than QUADRUPLING the S&P 500’s +475.6%. Now Sheraz is combing by means of 4,400 corporations to handpick the very best 10 tickers to purchase and maintain in 2025. Don’t miss your probability to get in on these shares after they’re launched on January 2.

Be First to New Top 10 Stocks >>

United Natural Foods, Inc. (UNFI) : Free Stock Analysis Report

C3.ai, Inc. (AI) : Free Stock Analysis Report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

Adobe Inc. (ADBE) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.