The Industrial Products industry is commonly a great location of the economic situation to discover development and also technology with these leads more challenging ahead throughout in the middle of high rising cost of living.

With that said being stated, right here are 2 Industrial Products supplies that have actually skyrocketed this year as their development leads continue to be fascinating.

Altair Design ( ALTR)

Amongst the Industrial Products industry, Altair Design supply attracts attention showing off a Zacks Ranking # 1 (Solid Buy) and also its Design R and also D Providers Sector in the leading 17% of over 250 Zacks sectors.

Altair is concentrated on the advancement and also wide application of simulation modern technology to manufacture and also enhance layouts, procedures, and also choices for company efficiency.

Altair’s revenues quote modifications have actually remained to trend greater over the last one month. Financial 2023 EPS price quotes have actually currently risen 12% throughout the quarter with FY24 approximates up 9%. Altair’s revenues are anticipated to climb 11% this year and also dive an additional 13% in FY24 at $1.12 per share. On the leading line, sales are anticipated to be up 8% in FY23 and also surge an additional 6% following year to $654.63 million.

Photo Resource: Zacks Financial Investment Study

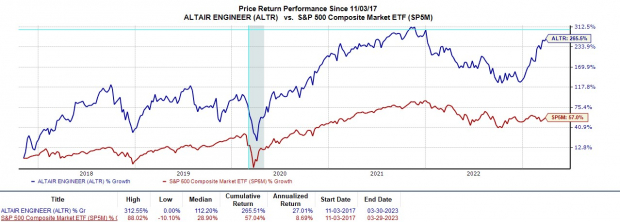

Trading around $70 a share, Altair’s development recently is beginning to warrant the costs being spent for the supply after going public in 2017. To that factor, Altair supply is up an excellent +56% year to day to greatly outshine the S&P 500’s +5% and also the Engineering/R&& D Solutions Markets +7%.

Much more excellent, Altair supply has actually currently climbed up +265% given that its 2017 IPO to squash the criteria and also its Zacks Subindustry’s +53% throughout this duration.

Photo Resource: Zacks Financial Investment Study

The Manitowoc Firm ( MTW)

The development of The Manitowoc Firm is fascinating also. Manitowoc supply likewise sporting activities a Zacks Ranking # 1 (Solid Buy) with the Manufacturing-Construction and also Mining Sector in the leading 7% of all Zacks sectors.

Manitowoc is a leading supplier of crafted training remedies, consisting of lattice-boom cranes and also boom vehicles. Especially, revenues quote modifications have actually skyrocketed 66% for FY23 over the last 90 days with FY24 price quotes leaping 50%.

Financial 2023 revenues are currently predicted to decrease -20% after an extremely strong year that saw EPS at $1.06 in FY22. Nonetheless, financial 2024 revenues are anticipated to rebound and also expand 35% at $1.14 per share. Sales are anticipated to be up 1% this year and also surge an additional 2% in FY24 to $2.10 billion.

Photo Resource: Zacks Financial Investment Study

Trading at $16 a share, Manitowoc supply has actually skyrocketed +82% this year to greatly outshine the S&P 500 and also the Machinery-Construction/Mining Markets -6%. Much more excellent, over the last 3 years, Manitowoc supply is currently up +96% to quickly defeat the criteria and also a little leading its Zacks Subindustry’s +92%.

Photo Resource: Zacks Financial Investment Study

Profits

The climbing revenues quote modifications are a wonderful indicator that the solid efficiencies in Altair and also Manitowoc supply can proceed together with their fast development over the last couple of years. Additionally, both supplies resemble practical financial investments to take into consideration for 2023 and also past.

Is THIS the Ultimate New Clean Power Resource? (4 Ways to Earnings)

The globe is significantly concentrated on getting rid of nonrenewable fuel sources and also increase use eco-friendly, tidy power resources. Hydrogen gas cells, powered by the most bountiful material in deep space, can offer a limitless quantity of ultra-clean power for several sectors.

Our immediate unique record exposes 4 hydrogen supplies keyed for huge gains – plus our various other leading tidy power supplies.

The Manitowoc Company, Inc. (MTW) : Free Stock Analysis Report

Altair Engineering Inc. (ALTR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The sights and also point of views revealed here are the sights and also point of views of the writer and also do not always mirror those of Nasdaq, Inc.