The 2022 Q4 incomes records presented that as opposed to anxieties of an approaching incomes high cliff, firms were greatly able to secure their profits.

We are not recommending that the incomes photo that appeared with the coming before coverage cycle was terrific, however instead that it showed to be a lot more secure as well as resistant than numerous had actually wanted to offer credit history to.

Actual Q4 results was available in far better than anticipated, however that really did not suggest much in regards to incomes development. Very little of a shock on that particular matter either, offered where we remain in the financial cycle as well as the wide variety of headwinds dealing with business productivity.

All of us recognize that the delayed result of the remarkable tightening up currently executed as well as the step-by-step price walks in advance, consisting of in this month’s Fed conference, will certainly a minimum of reduce the economic situation, otherwise press right into an economic crisis as numerous have actually begun to be afraid.

Actually, numerous in the marketplace worry that the uncommon stamina in the united state economic situation, as reconfirmed by Friday’s February work record, will certainly compel the Fed to remain in the tightening up setting longer than would certainly have held true or else. This is appearing in the marketplace’s advancing assumptions of the Fed Finances ‘leave price’, the last degree at which the reserve bank wraps up the recurring tightening up cycle. Numerous are currently booking a departure price of 6% or greater, up from their earlier forecasts of concerning 5.5%.

Every One Of this has straight incomes effects for the united state economic situation’s development trajectory as well as the health and wellness of business productivity.

To obtain a feeling of what is presently anticipated, take a look at the graph listed below that reveals existing incomes as well as profits development assumptions for the S&P 500 index for 2023 Q1 as well as the complying with 3 quarters.

Picture Resource: Zacks Financial Investment Research Study

As you can see below, 2023 Q1 incomes are anticipated to be down -9.4% on +1.8% greater incomes. This would certainly adhere to the -5.7% incomes decrease in the previous duration (2022 Q4) on +5.6% greater incomes.

Installed in these 2023 Q1 incomes as well as profits development forecasts is the assumption of ongoing margin stress, which has actually been a reoccuring motif in current quarters. The graph listed below programs take-home pay margins for the S&P 500 index.

Picture Resource: Zacks Financial Investment Research Study

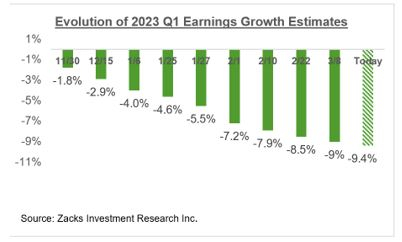

Experts have actually been progressively reducing their quotes for Q1, a pattern that we saw in advance of the begin of the last couple of reporting cycles too. To offer complete context, this actions of adverse price quote modifications simply in advance of the start of the reporting cycle for that duration is much from the program, traditionally talking. We saw this change throughout Covid when quotes began rising for a long time. However that pattern ‘stabilized’ in 2014 as well as for this reason the adverse modifications to 2023 Q1 quotes, as the graph listed below programs.

Picture Resource: Zacks Financial Investment Research Study

Please keep in mind that while 2023 Q1 quotes have actually boiled down, the size of adverse modifications contrasts positively to what we saw in the similar durations to the coming before number of quarters. Simply put, quotes have not dropped as high as they performed in the last couple of quarters.

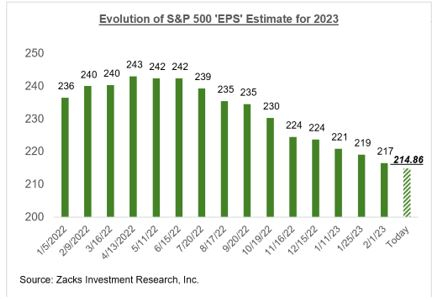

Quotes for full-year 2023 have actually additionally been boiling down, as we have actually regularly mentioned in these web pages. The graph listed below demonstrate how the accumulated 2023 S&P 500 incomes.

Picture Resource: Zacks Financial Investment Research Study

As we have actually been explaining the whole time, 2023 incomes quotes came to a head in April 2022 as well as have actually been boiling down since. Considering that the mid-April optimal, accumulated incomes have actually decreased by -12.6% for the index all at once as well as -14.5% for the index on an ex-Energy basis, with the decreases much larger in a variety of significant industries.

You have actually most likely reviewed the approximately -20% cuts to S&P 500 incomes quotes, typically, in action to economic crises.

Numerous in the marketplace analyze this to suggest that quotes still have plenty to drop in the days in advance. However as the previously mentioned size of adverse modifications at -11.7% on an ex-Energy basis programs, we have actually currently taken a trip a reasonable range because instructions. Notably, some essential industries in the course of the Fed’s tightening up cycle, like Building, Retail, Discretionary, as well as also Modern technology, have actually currently obtained their 2023 quotes slashed off by a 5th because mid-April.

We are not claiming that quotes do not require to drop any type of better. However instead that the mass of the cuts are most likely behind us, specifically if the coming financial recession is a whole lot much less bothersome than numerous appear to think or be afraid.

Please keep in mind that the $1.903 trillion accumulated incomes price quote for the index in 2023 estimates to an index ‘EPS’ of $114.86, below $221.22 in 2022. The graph listed below demonstrate how this 2023 index ‘EPS’ price quote has actually advanced with time.

Picture Resource: Zacks Financial Investment Research Study

The graph listed below programs the incomes as well as profits development photo on a yearly basis.

Picture Resource: Zacks Financial Investment Research Study

Today’s Coverage Docket

The truth of a gaining period is that it never ever finishes totally. Actually, every quarter has this duration when the older coverage cycle hasn’t totally finished yet, however the brand-new one has actually obtained underway.

We remain in such an overlapping duration presently, with a number of 2022 Q4 results still waited for while the 2023 Q1 incomes period has actually obtained underway. Quarterly cause current days from 3 S&P 500 participants, Oracle ORCL, AutoZone AZO, as well as Costco expense, for their particular financial durations finishing in February, kind component of our 2023 Q1 tally. We have one more 4 index participants on deck to report financial February quarter results today, consisting of FedEx FDX, Adobe ADBE, as well as Lennar LEN.

The Q1 reporting cycle will truly grab heavy steam when the huge financial institutions bring out their quarterly outcomes on April 14 th

For a thorough take a look at the total incomes photo, consisting of assumptions for the coming durations, please take a look at our regular Profits Fads report >>>> > > > > Will Tech Sector Earnings Growth Resume in Q1?

4 Oil Supplies with Large Advantages

Worldwide need for oil is with the roof covering … as well as oil manufacturers are battling to maintain. So although oil costs are well off their current highs, you can anticipate huge benefit from the firms that provide the globe with “black gold.”

Zacks Financial investment Research study has actually simply launched an immediate unique record to assist you rely on this pattern.

In Oil Market ablaze, you’ll uncover 4 unanticipated oil as well as gas supplies placed for huge gains in the coming weeks as well as months. You do not intend to miss out on these suggestions.

Download your free report now to see them.

Oracle Corporation (ORCL) : Free Stock Analysis Report

Costco Wholesale Corporation (COST) : Free Stock Analysis Report

Adobe Inc. (ADBE) : Free Stock Analysis Report

AutoZone, Inc. (AZO) : Free Stock Analysis Report

FedEx Corporation (FDX) : Free Stock Analysis Report

Lennar Corporation (LEN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The sights as well as point of views revealed here are the sights as well as point of views of the writer as well as do not always mirror those of Nasdaq, Inc.