Fairly a couple of REITs (Actual Property Invesment Trusts) have made their approach onto the Zacks Rank #1 (Robust Purchase) record with a number of standing out when it comes to affordability.

Buying and selling below $20 a share, these REIT shares have annual dividend yields over 10% which can definitely peak buyers’ curiosity.

MFA Monetary

At $12, MFA Financials’ MFA inventory at present has a ten.96% annual dividend yield. Extra intriguing is that MFA trades at simply 7.8X ahead earnings with the corporate’s focus being on mortgage-backed securities.

Justifying that MFA could certainly be low-cost primarily based on its inventory worth and P/E valuation is that annual earnings are anticipated to be just about flat this 12 months however projected to rise 1% in fiscal 2025 to $1.62 per share. Plus, earnings estimate revisions for FY24 and FY25 are up 5% within the final 60 days.

Picture Supply: Zacks Funding Analysis

NexPoint Actual Property

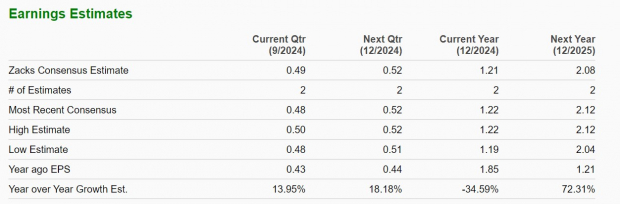

Constructive earnings estimate revisions have been compelling for NexPoint Actual Property NREF as nicely which originates, constructions, and invests in first mortgage loans, mezzanine loans, and structured financings in industrial actual property properties.

At $15 a share, NREF is at a 12.5X ahead earnings a number of with EPS projected to be down -34% in FY24 however anticipated to rebound and soar 72% in FY25 to $2.08. Even higher, FY24 EPS estimates have spiked 18% within the final two months with FY25 EPS estimates up 2%.

Picture Supply: Zacks Funding Analysis

Moreover, NexPoint’s dividend is at 13.2% which even tops its Zacks REIT and Fairness Belief Trade common of 11.42% and obliterates the S&P 500’s 1.24% common.

Picture Supply: Zacks Funding Analysis

Two Harbors Investments

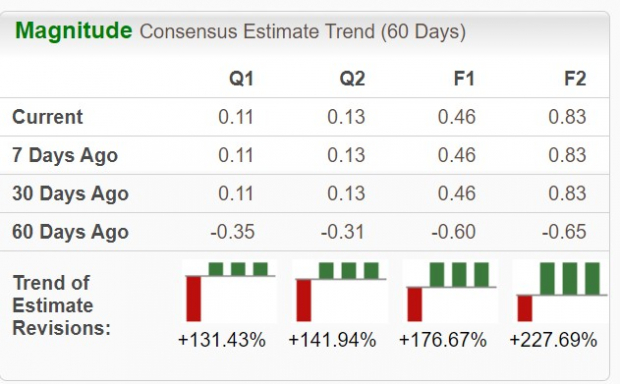

Whereas Two Harbors Investments TWO ahead P/E valuation of 30.1X just isn’t low-cost, earnings estiamtes have skyrocketed.

With its inventory buying and selling at $13, Two Harbors manages residential mortgage-backed securities and is now anticipated to submit a suprise revenue of $0.46 per share in FY24 in comparison with estimates that known as for an adjusted lack of -$0.60 a share 60 days in the past.

Higher nonetheless, FY25 EPS estimates have soared to $0.83 from expectations of a lack of -$0.65 a share two months in the past. Two Harbors’ 13.12% annual dividend yield ought to definitely maintain buyers engaged given the corporate’s strengthening outlook.

Picture Supply: Zacks Funding Analysis

Backside Line

The Fed’s resolution to chop charges ought to enhance the operations for a lot of monetary sector firms and the pattern of constructive earnings estimate revisions could be very interesting for these home REITs. This strongly suggests extra upside and makes now an excellent time to purchase contemplating their attractive dividends.

5 Shares Set to Double

Every was handpicked by a Zacks skilled because the #1 favourite inventory to achieve +100% or extra in 2024. Whereas not all picks could be winners, earlier suggestions have soared +143.0%, +175.9%, +498.3% and +673.0%.

A lot of the shares on this report are flying below Wall Road radar, which offers an important alternative to get in on the bottom flooring.

Today, See These 5 Potential Home Runs >>

Two Harbors Investments Corp (TWO) : Free Stock Analysis Report

MFA Financial, Inc. (MFA) : Free Stock Analysis Report

NexPoint Real Estate Finance, Inc. (NREF) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.