There is a wide range of spending designs around, whether that be value-focused or targeting a particular sector.

Naturally, some additionally favor to customize their spending design to target mostly large-cap supplies.

Large-cap supplies are a staple in virtually every profile. They are reputable, have extra expert insurance coverage, and also regularly pay rewards, all without a doubt substantial advantages that make them so preferred amongst financiers.

For those with a cravings for large-caps, 3 firms– Kroger Co. KR, PPG Industries PPG, and also Digital Arts EA– have actually all seen their near-term profits expectation change favorably and also bring strong forecasted development.

Below is a graph highlighting the efficiency of each year-to-date, with the S&P 500 mixed in as a standard.

Picture Resource: Zacks Financial Investment Research Study

Kroger Co.

Established In 1883, the veteran merchant runs roughly 2,700 retailers under different banners and also departments in 35 states. The supply currently lugs a beneficial Zacks Ranking # 2 (Buy).

Shares aren’t extended in regards to assessment, with the existing 10.9 X onward profits numerous resting perfectly under the 12.4 X five-year typical and also the Zacks Retail and also Wholesale market standard.

KR sporting activities a Design Rating of “A” for Worth.

Picture Resource: Zacks Financial Investment Research Study

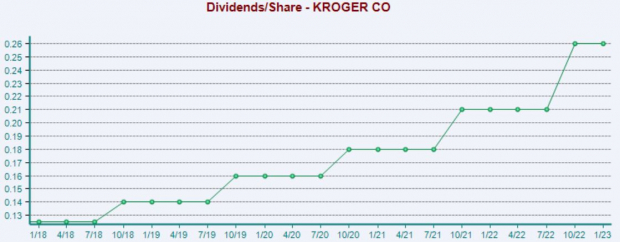

For those looking for an earnings stream, KR shares have actually that covered; the firm’s yearly reward presently generates 2.1%, with its payment expanding by an outstanding 15% over the last 5 years.

Picture Resource: Zacks Financial Investment Research Study

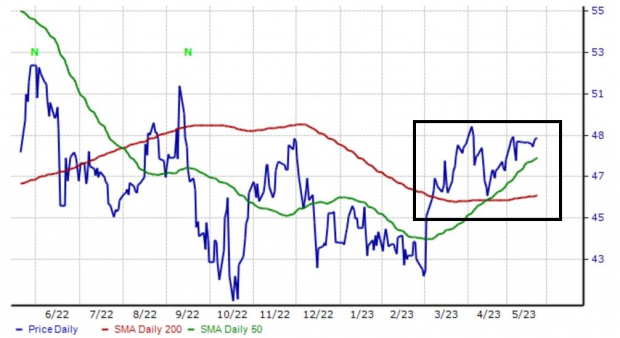

KR shares have additionally just recently experienced the ‘Golden Cross,’ as we can see detailed in the graph below. The Golden Cross takes place when the much shorter 50-day relocating standard increases over the 200-day relocating standard.

Picture Resource: Zacks Financial Investment Research Study

Digital Arts

Digital Arts is a leading programmer, marketing professional, author, and also representative of computer game software program and also material. Presently, the supply is a Zacks Ranking # 2 (Buy).

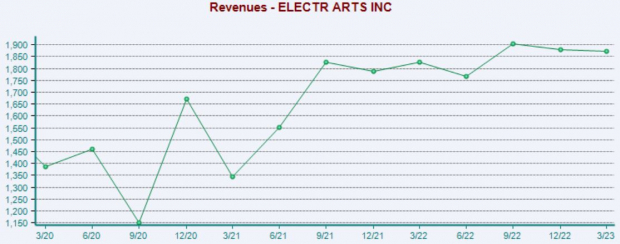

EA published better-than-expected cause its most recent launch, breaking a touch of adverse shocks. The firm reported profits per share of $1.77 on $1.9 billion in profits, showing a 35% EPS beat and also a 13% sales shock.

Picture Resource: Zacks Financial Investment Research Study

Furthermore, it’s difficult to neglect the firm’s development account, with profits anticipated to skyrocket 23.5% in its existing (FY24) and also an added double-digit 10.4% in FY25. Leading line development is additionally noticeable, with sales anticipated to climb up 3.7% and also 7.5% in FY24 and also FY25, specifically.

PPG Industries

PPG Industries is an international provider of paints, finishings, chemicals, specialized products, glass, and also fiberglass. Shares have actually just recently burst out of a year-long variety, with previous resistance currently coming to be an assistance degree.

Picture Resource: Zacks Financial Investment Research Study

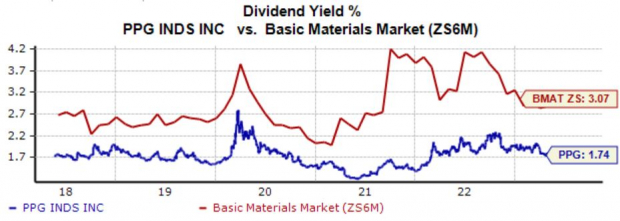

Like Kroger, PPG has actually had little problem significantly awarding its investors, improving its reward payment by almost 7% over the last 5 years. Shares presently produce 1.7% yearly, listed below the Zacks Basic Products market standard by a reasonable margin.

Picture Resource: Zacks Financial Investment Research Study

Profits

Large-cap supplies can aid bring security to a profile, as these supplies are commonly much less unpredictable. Furthermore, they frequently pay rewards and also bring a reputable nature, more advantages that make them precious amongst financiers.

As well as all 3 above– Kroger Co. KR, PPG Industries PPG, and also Digital Arts EA– might be factors to consider for those looking for large-caps with enhanced near-term profits overviews.

Free Record: Top EV Battery Supplies to Get Currently

Just-released record discloses 5 supplies to benefit as countless EV batteries are made. Elon Musk tweeted that lithium rates have actually mosted likely to “outrageous degrees,” and also they’re most likely to maintain climbing up. Therefore, a handful of lithium battery supplies are readied to escalate. Accessibility this record to find which battery supplies to get and also which to stay clear of.

PPG Industries, Inc. (PPG) : Free Stock Analysis Report

The Kroger Co. (KR) : Free Stock Analysis Report

Electronic Arts Inc. (EA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The sights and also point of views shared here are the sights and also point of views of the writer and also do not always mirror those of Nasdaq, Inc.