Amongst the wider automobile market, General Motors ( GM) and also Ford ( F) supply continue to be eye-catching together with auto components representative Genuine Components ( GPC).

All 3 business are well-positioned within the automobile room and also there can be much more upside in advance as we proceed via 2023. Significantly, General Motors, Ford, and also Genuine Components supplies are off to solid begins this month and also have actually outmatched the criteria.

Photo Resource: Zacks Financial Investment Study

Market Placement & & Emphasizes

The majority of car manufacturers are currently concentrated on growth right into electrical lorries and also while Tesla ( TSLA) obtains a lot of the focus General Motors and also Ford are well-positioned. While at a range to Tesla’s 422,875 EVs provided throughout the initial quarter, General Motors and also Ford are 2nd and also 3rd in the residential market specifically.

General Motors marketed 20,670 EVs throughout Q1 which increased 4,423% from 457 EVs marketed in the previous year quarter. When it comes to Ford, its 10,866 EVs marketed throughout Q1 climbed up 41% year over year. Additionally, General Motors is still the biggest united state car manufacturer in regards to overall sales with Ford holding the 3rd area behind Toyota Motors ( TM).

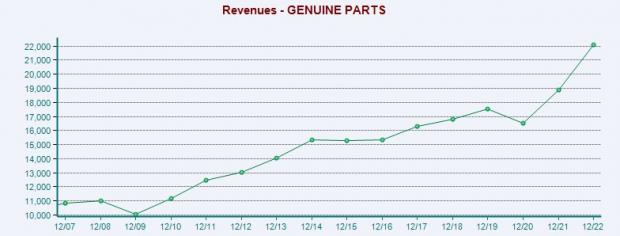

Relative to Genuine Components, the firm stays the biggest vehicle components vendor in the USA. Real Components’ current development has actually been really outstanding after uploading document sales of $5.76 billion throughout the initial quarter.

Photo Resource: Zacks Financial Investment Study

Revenues Quote Modifications

What makes General Motors, Ford, and also Genuine Components supplies much more eye-catching because their desirable first-quarter records is the fad in profits price quote modifications. Revenues quotes have actually trended greater with all 3 business most lately defeating their quarterly top and also profits assumptions.

GM Revenues Price Quotes: General Motors’ monetary 2023 EPS quotes have actually continued to be 9% greater over the last 60 days with FY24 profits quotes climbing 8%.

Photo Resource: Zacks Financial Investment Study

Ford Revenues Price Quotes: Ford’s monetary 2023 EPS quotes have actually leapt 16% in the last 2 months and also FY24 profits quotes are up 6%.

Photo Resource: Zacks Financial Investment Study

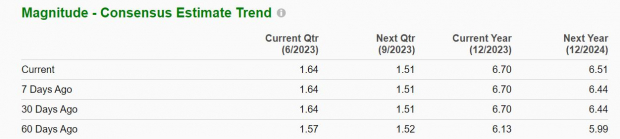

GPC Earrings Price Quotes: Genuine Components profits quotes for monetary 2023 have actually raised by 1% in the last 60 days with FY24 EPS approximates up 2%.

Photo Resource: Zacks Financial Investment Study

Helpful P/E Appraisals

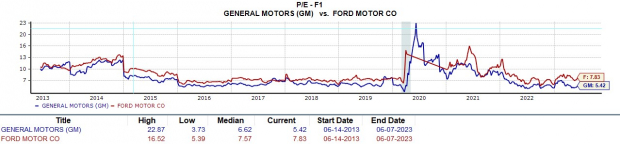

With climbing profits quotes showing there can be much more upside in these automobile supplies their P/E assessments show up to sustain this too.

Concerning General Motors and also Ford, both profession intriguingly listed below the S&P 500’s 19.8 X onward profits and also well underneath their market standard of 10.6 X.

To that note, General Motors trades at $35 a share and also at a 5.4 X onward profits several. This is 76% listed below its years high of 22.8 X while supplying a small price cut to the average of 6.6 X. Trading at $13 a share, Ford supply professions at 7.8 X onward profits which is 52% listed below its very own decade-long high of 16.5 X and also about on the same level with the average of 7.5 X.

Photo Resource: Zacks Financial Investment Study

Rotating to Genuine Components, shares of GPC profession at $154 and also 16.9 X onward profits which is beautifully underneath the criteria. Real Components supply likewise trades basically on the same level with its market standard of 16.9 X and also 28% listed below its years high of 23.4 X while supplying a 10% price cut to the average of 18.9 X.

Photo Resource: Zacks Financial Investment Study

Takeaway

These automobile supplies can remain to climb this month as favorable profits price quote modifications have actually begun to reconfirm they are underestimated considering their reduced P/E assessments. Currently General Motors and also Ford supply both land a Zacks Ranking # 1 (Solid Buy) with Real Components landing a Zacks Ranking # 2 (Buy).

Simply Launched: Free Record Discloses Obscure Techniques to Aid Make Money From the$ 30 Trillion Metaverse Boom

It’s obvious. The metaverse is obtaining heavy steam daily. Simply adhere to the cash. Google. Microsoft. Adobe. Nike. Facebook also rebranded itself as Meta due to the fact that Mark Zuckerberg thinks the metaverse is the following model of the net. The inescapable outcome? Lots of capitalists will certainly obtain abundant as the metaverse advances. What do they recognize that you do not? They understand the business ideal positioned to expand as the metaverse does. And also in a brand-new FREE record, Zacks is exposing those supplies to you. Today, you can download and install, The Metaverse – What is it? And also Exactly how to Earnings with These 5 Pioneering Supplies It discloses details supplies readied to increase as this arising modern technology establishes and also increases. Do not miss your opportunity to gain access to it completely free without any commitment.

>>Show me how I could profit from the metaverse!

Ford Motor Company (F) : Free Stock Analysis Report

Genuine Parts Company (GPC) : Free Stock Analysis Report

General Motors Company (GM) : Free Stock Analysis Report

Toyota Motor Corporation (TM) : Free Stock Analysis Report

Tesla, Inc. (TSLA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The sights and also point of views revealed here are the sights and also point of views of the writer and also do not always mirror those of Nasdaq, Inc.