Today’s episode of Complete Court Financing at Zacks checks out where the marketplace stands about a week after the Silicon Valley Financial institution collapse. The episode additionally damages down why Wall surface Road is diving back right into huge cap innovation supplies amidst the current stock exchange chaos prior to we go into why capitalists could intend to acquire Adobe, Intuit, as well as Meta System shares in March as well as hold them for the long run.

The last 2 weeks have actually been an instead outrageous up-and-down trip, noted by concerns of a feasible financial market contamination as well as hopes of a much more dovish Fed. Regardless of the decrease to finish the week, the Nasdaq has actually torn greater considering that last Friday amidst the turning back right into huge technology as rates of interest topple as well as the financial market obtains belted.

Fortunately for the marketplace, the Fed as well as united state authorities took instead phenomenal actions to nip any type of possible wide-scale financial as well as monetary dilemma in the bud. Regardless of the backstops as well as aid from bigger establishments, a lot of concern still borders the local financial market.

Photo Resource: Zacks Financial Investment Study

Technology titans remain to stand out as capitalists really feel much more certain in a Fed pivot as well as the capability for these companies to expand throughout the years regardless of the financial setting.

The Nasdaq is up about 13% in 2023 as well as back over both its 50-day as well as 200-day relocating standards. And also, the Nasdaq simply experienced a supposed gold cross– when the shorter-term relocating ordinary climbs up over the longer-term pattern– which technological investors view as a favorable signal.

Wall surface Road is wagering that Jay Powell as well as the Fed beginning to reduced prices by the summertime. As well as the lately toppling 2-year as well as 10-year united state Treasury returns have capitalists really feeling much more certain in purchasing growth-focused technology supplies, particularly at their considerably altered assessments.

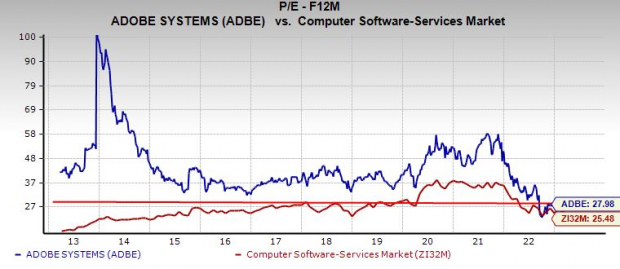

The initial supply we check out is Adobe ( ADBE) after it covered our Q1 FY23 approximates on March 15. The innovative software program giant additionally most importantly elevated its yearly targets regardless of larger financial downturn concerns. Adobe’s profile consists of Photoshop, Best Pro, as well as various other innovative offerings, along with a documents/business profile that includes PDFs, advertising, as well as past.

Adobe is the champ of an essential section of the software program market that’s assisted it post in between 12% to 25% earnings development for 8 straight years. Zacks approximates require sales to expand an additional 9% in FY23 as well as 11% in FY24 to improve modified profits by dual figures. ADBE is additionally wishing its offer to acquire cooperation software program standout Figma is authorized by regulatory authorities.

Photo Resource: Zacks Financial Investment Study

ADBE, which presently lands a Zacks Ranking # 3 (Hold), has actually skyrocketed 725% in the last ten years vs. the Zacks technology market’s 220%. Regardless of the total run as well as its resurgence over the last 6 months, Adobe still trades about 50% listed below its heights. As well as it simply recovered over both its 50-day as well as 200-day relocating standards. ADBE’s dropping rate, combined with its solid profits overview, has it trading right near its current years long-lows at 27.9 X ahead profits.

Intuit ( INTU) is most likely best recognized for TurboTax, however it additionally got Credit rating Fate as well as Mailchimp over the last numerous years. Inuit currently gives e-mail advertising, digital-ad solutions, customer-relationship-management devices, credit rating, as well as various other individual monetary solutions, together with tax obligation, audit, as well as various other business-focused monetary solutions software program.

Intuit, which lands a Zacks Ranking # 3 (Hold) now, smashed our Q2 FY23 EPS approximates in late February as well as is forecasted to publish about 11% sales development this year as well as alongside prolong its touch of double-digit earnings development to a years. INTU’s changed EPS are forecasted to climb up by 16% as well as 13%, specifically.

Photo Resource: Zacks Financial Investment Study

Intuit has actually skyrocketed 530% in the previous ten years vs. the Zacks technology market’s 220%. Yet capitalists can scoop up INTU 15% listed below its ordinary Zacks rate target as well as around 40% under its very own highs. In regards to assessment, Intuit trades right near its very own 10-year mean as well as at a 50% price cut to its highs.

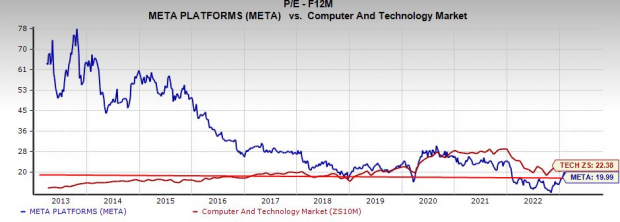

Meta Systems ( META), previously Facebook, has actually gotten on a lift trip up considering that November as the company lastly dedicated to reducing prices as its top-line development slows down. Meta, like Amazon.com as well as others over-hired throughout the pandemic boom. Meta stated in mid-March that would certainly reduce an additional about 10K tasks in the coming months in what Mark Zuckerberg is calling the “year of performance.”

The social media sites titan’s unsatisfactory 2022 is currently in the rearview as well as it prepares to go back to leading as well as profits development as it concentrates once more on its core organizations Facebook, Instagram, as well as WhatsApp, every one of which will certainly get better from a poor year for electronic marketing since its reach runs out this globe. Meta’s ‘month-to-month energetic individuals’ stood out 4% in Q4 to 3.74 billion, while everyday energetic individuals raised 5% to 2.96 billion, or almost 40% of the globe.

Photo Resource: Zacks Financial Investment Study

Meta’s skyrocketing profits overview aids it land a Zacks Ranking # 1 (Solid Buy). The business additionally flaunts a solid annual report as well as it is redeeming lots of supply. The supply has actually increased over 100% considering that very early November, yet Meta is still trading listed below where it was before the covid selloff as well as around 50% off its highs. As well as it is trading at a discount rate to the Zacks Technology market at 19.9 X ahead profits.

7 Ideal Supplies for the Following 1 month

Simply launched: Professionals boil down 7 elite supplies from the existing checklist of 220 Zacks Ranking # 1 Solid Buys. They regard these tickers “Probably for Very Early Rate Pops.”

Considering that 1988, the complete checklist has actually defeated the marketplace greater than 2X over with a typical gain of +24.8% annually. So make certain to offer these carefully picked 7 your prompt interest.

Adobe Inc. (ADBE) : Free Stock Analysis Report

Intuit Inc. (INTU) : Free Stock Analysis Report

Meta Platforms, Inc. (META) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The sights as well as point of views revealed here are the sights as well as point of views of the writer as well as do not always show those of Nasdaq, Inc.