Worth investing is centered round leaping on shares buying and selling at a reduction, with the concept the market will finally ‘catch up’ and acknowledge their true worth, which might result in critical positive factors.

In any case, all of us get pleasure from a superb deal.

And the technique can turn into much more profitable when including within the Zacks Rank, permitting us to seek out shares that analysts have just lately turn into optimistic about.

Three top-ranked shares buying and selling at attractive valuation ranges – JD.com JD, KB Dwelling KBH, and AllianceBernstein AB – might all be thought-about. Let’s take a more in-depth take a look at every.

JD.com

JD.com operates as an internet direct gross sales firm in China. The inventory sports activities the highly-coveted Zacks Rank #1 (Sturdy Purchase), with earnings expectations drifting larger throughout a number of timeframes.

Shares presently commerce at a 7.8X ahead 12-month earnings a number of, a fraction of the 39.0X five-year median and five-year highs of 84.9X. The ahead 12-month price-to-sales ratio resies at 0.3X, above properly beneath the 0.5X five-year median.

The corporate’s quarterly consistency is worthy of highlighting, beating the Zacks Consensus EPS estimate in every of its final ten releases. Beneath is a chart illustrating the corporate’s income on a quarterly foundation.

Picture Supply: Zacks Funding Analysis

KB Dwelling

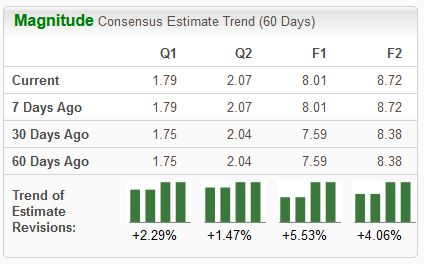

KB House is a well known homebuilder in the US. Analysts have turn into bullish throughout the board, elevating their earnings expectations and pushing the inventory right into a Zacks Rank #1 (Sturdy Purchase).

Picture Supply: Zacks Funding Analysis

Shares presently commerce at a 7.3X ahead 12-month earnings a number of, a number of ticks beneath the five-year median and highs of 12.5X in 2020. The ahead 12-month price-to-sales ratio presently stands at 0.6X, once more beneath five-year highs of 0.8X.

AllianceBernstein

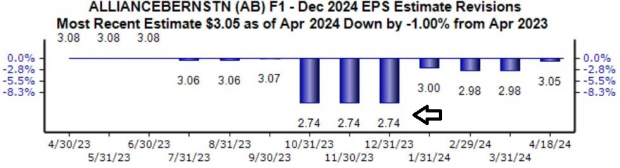

AllianceBernstein, a present Zacks Rank #2 (Purchase), gives diversified funding administration providers, primarily to pension funds, endowments, international monetary establishments, and particular person traders.

The revisions pattern for its present fiscal yr has shifted notably optimistic because the starting of 2024, with the $3.05 Zacks Consensus EPS estimate suggesting 14% year-over-year development.

Picture Supply: Zacks Funding Analysis

Shares presently commerce at a ten.2X ahead 12-month earnings a number of, properly beneath the 11.5X five-year median and highs of 16.3X in 2022. The ahead 12-month price-to-sales ratio stands at 1.0X, in step with the five-year median and beneath highs of 1.5X in 2021.

Backside Line

Worth traders are at all times searching for offers, anticipating the remainder of the group to finally catch onto the reductions and result in vital positive factors.

And if you pair this technique with the Zacks Rank, which is targeted on earnings estimate revisions, it’s a lot simpler to seek out mispriced shares with nice near-term potential.

All three shares above – JD.com JD, KB Dwelling KBH, and AllianceBernstein AB – might entice value-focused traders, additional underpinned by their Type Scores of ‘A’ and ‘B’ for Worth.

Prime 5 Dividend Shares for Your Retirement

Zacks targets 5 well-established corporations with strong fundamentals and a historical past of elevating dividends. Extra importantly, they’ve the assets and can to seemingly pay them sooner or later.

Click on now for a Particular Report filled with unconventional knowledge and insights you merely gained’t get out of your neighborhood monetary planner.

See our Top 5 now – the report is FREE >>

AllianceBernstein Holding L.P. (AB) : Free Stock Analysis Report

KB Home (KBH) : Free Stock Analysis Report

JD.com, Inc. (JD) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.