Key Takeaways

- Dividends present a passive earnings stream, giving one other method to revenue from shares past purchase low, promote excessive.

- Dividend Aristocrats are shares which have elevated dividend funds yearly for at the least 25 years.

- Walmart, Kimberly Clark and Altria shares are shares that present dependable dividend funds to stockholders.

All people loves dividends, as they supply a passive earnings stream, restrict drawdowns in different positions, and supply multiple method to revenue from an funding.

And when contemplating dividend-paying shares, these with a historical past of boosting their payout are prime issues, reflecting their dedication to more and more rewarding shareholders.

And with regards to a constant historical past of elevated payouts, look no additional than the Dividend Aristocrats.

Walmart WMT, Kimberly Clark KMB, and Altria MO match the factors. Let’s take a better take a look at every.

Walmart Shares Soar

Walmart shares have been red-hot over the past 12 months, gaining 70% on the again of robust quarterly outcomes and broadly outperforming. The earnings outlook for its present fiscal 12 months has remained bullish, with the $2.47 per share consensus estimate suggesting 12% progress year-over-year.

Picture Supply: Zacks Funding Analysis

The robust share efficiency over the previous 12 months has suppressed the annual dividend yield, however the firm’s 3% five-year annualized dividend progress price exhibits a dedication to more and more rewarding shareholders. The inventory general has delivered a superb mix of progress paired with a shareholder-friendly nature over the previous 12 months.

Under is a chart illustrating the corporate’s dividends paid on a quarterly foundation. Please word that the ultimate worth is tracked on a trailing twelve-month foundation.

Picture Supply: Zacks Funding Analysis

KMB Shares Replicate Protection

KMB shares have been a bit sluggish over the previous 12 months, gaining 6% however underperforming relative to the S&P 500 by a large margin. Nonetheless, the shares’ defensive nature can’t be ignored, with constantly increased dividend payouts additionally a pleasant profit.

The corporate carries a defensive nature due to its placement within the shopper staples sector, as these corporations’ merchandise have an advantageous potential to generate constant demand within the face of many financial conditions.

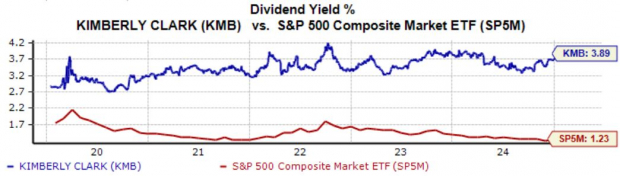

KMB’s grown its dividend by an annualized 2.9% over the past years, with a present payout ratio of 67% additionally not overly regarding. Shares are at the moment yielding a strong 3.9% yearly, greater than triple that of the S&P 500.

Picture Supply: Zacks Funding Analysis

Altria Pays Traders Massive

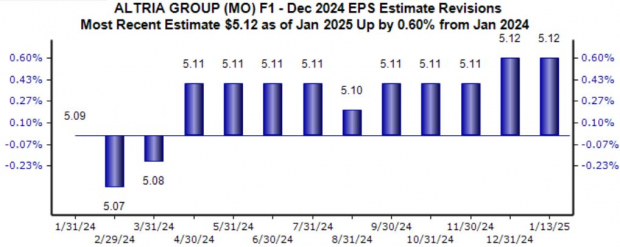

Altria has lengthy been a favourite amongst income-focused traders due to its shareholder-friendly nature, with the inventory additionally at the moment sporting a positive Zacks Rank #2 (Purchase). The earnings outlook for its present fiscal 12 months has remained constructive, with the $5.12 per share anticipated suggesting 4% year-over-year progress.

Picture Supply: Zacks Funding Analysis

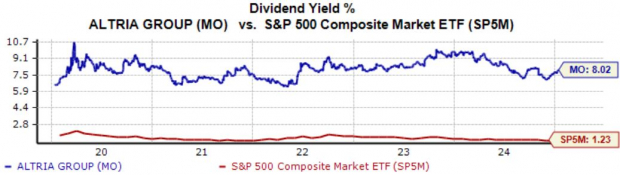

It’s a high-yield inventory, with shares at the moment yielding a large 8% yearly. Dividend progress is there, with the corporate sporting a 4.3% five-year annualized dividend progress price. As proven beneath, the present yield crushes that of the S&P 500.

Picture Supply: Zacks Funding Analysis

Backside Line

All people loves dividends, basically traders’ type of payday. They may also help restrict drawdowns in different positions and supply a passive earnings stream, two key traits that each one market contributors get pleasure from.

And for these searching for corporations with a constant historical past of regular payouts, all three above – Altria MO, Kimberly Clark KMB, and Walmart WMT – match the factors.

Free: 5 Shares to Purchase As Infrastructure Spending Soars

Trillions of {dollars} in Federal funds have been earmarked to restore and improve America’s infrastructure. Along with roads and bridges, this flood of money will pour into AI knowledge facilities, renewable power sources and extra.

In, you’ll uncover 5 stunning shares positioned to revenue probably the most from the spending spree that’s simply getting began on this house.

Download How to Profit from the Trillion-Dollar Infrastructure Boom absolutely free today.

Walmart Inc. (WMT) : Free Stock Analysis Report

Altria Group, Inc. (MO) : Free Stock Analysis Report

Kimberly-Clark Corporation (KMB) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.