This weekend, we are going to look at among the long-term market cycles throughout varied belongings to assist set the stage for the approaching months as we start to look towards 2025. All charts under come from cycles.org, which is from the Basis for the Research of Cycles, of which I’m a member.

1. S&P 500

The strongest weekly cycle is the 180-week cycle for the . It has marked some notable tops and bottoms up to now, significantly in 2000 and 2008 for each the tops and bottoms. Extra not too long ago, it marked the 2022 high and was barely late in marking the 2023 low.

The setup exhibits that the index is now nearly peaking on the cycle, whereas the cyclic RSI signifies that the index has already reached overbought situations. This implies that we’re nearing a degree the place the index both consolidates in a sideways sample, much like what was seen in 2015 and 2016 or in 2018 and far of 2019, or experiences a pullback much like that of 2000, 2008, and 2022.

Given valuations at present are rather more akin to the 2000 and 2008 cycles, I’d favor a sharper pullback, as shares weren’t all that costly in 2015, 2016, 2018, and 2019, by comparability.

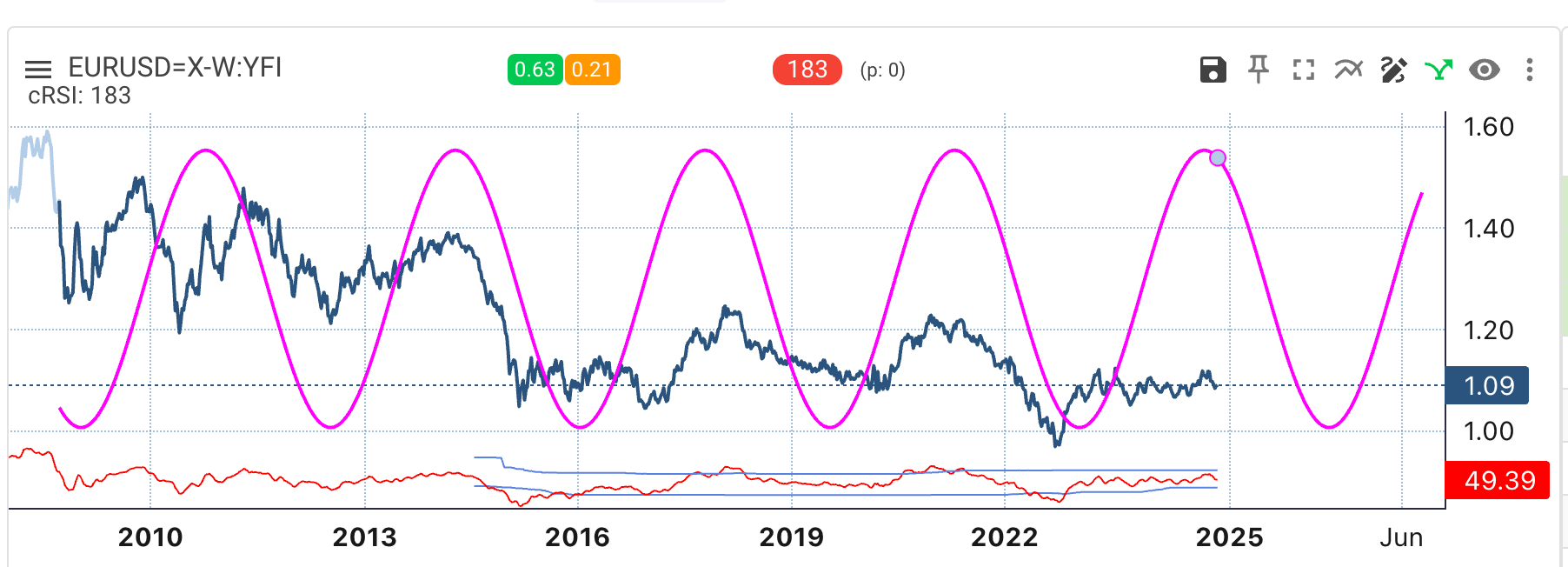

2. US Greenback

The can be at a degree the place we are going to probably see it strengthen towards the euro (). The euro has gone by a reasonably lengthy interval of sideways consolidation, and now the 183-week cycle means that this consolidation is coming to an finish, with the subsequent leg of the greenback strengthening approaching.

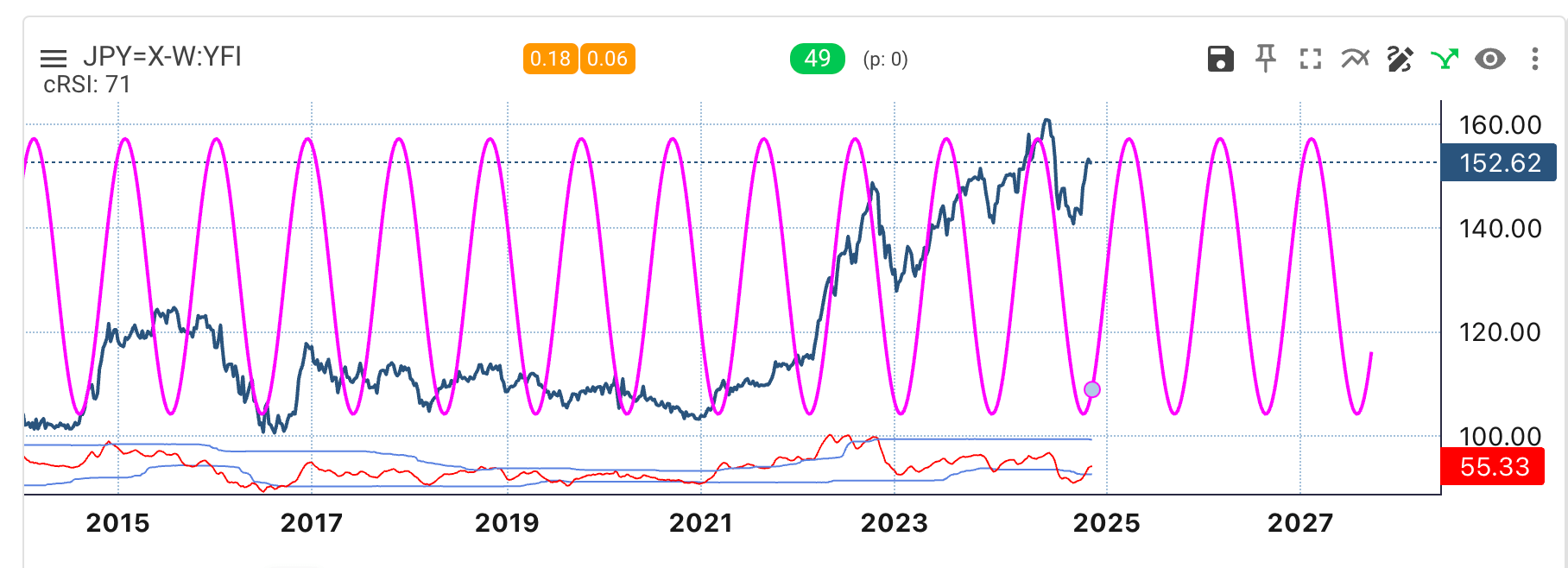

Curiously, the second most dominant cycle within the yen (), the 49-week cycle, exhibits that the yen might weaken towards the greenback by March.

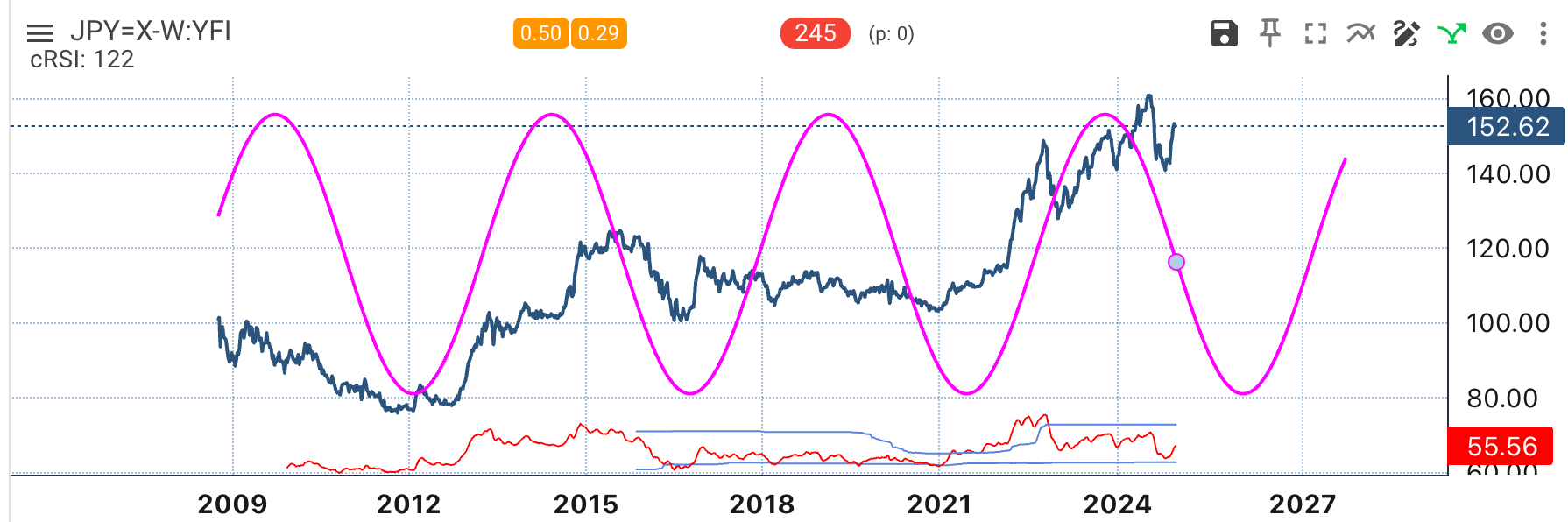

Nevertheless, the dominant cycle, the 245-week cycle, exhibits that the yen strengthens versus the greenback by the summer time of 2025. General, this means that over the close to time period, we may even see the yen strengthen versus the greenback by the summer time. This might make sense if the BOJ begins to lift charges once more beginning in January or March.

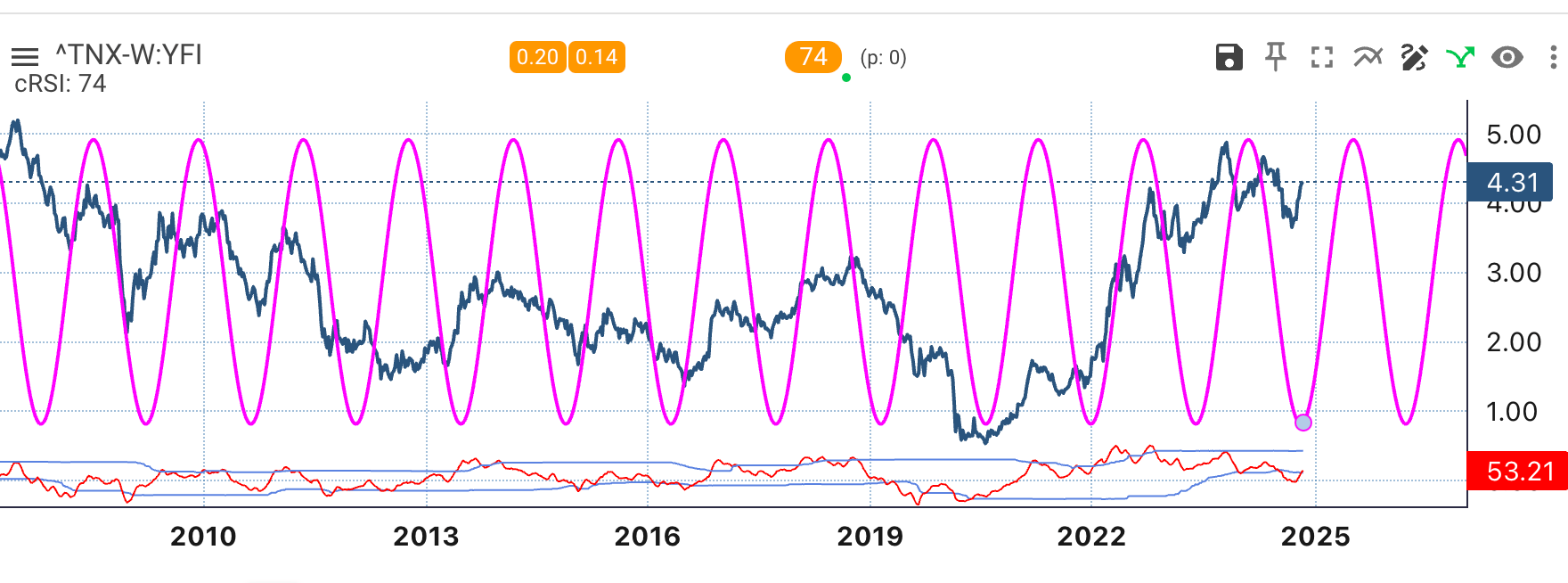

3. 10-12 months Charge

For the , it seems that the weekly cycles are pointing to charges rising at the very least till the summer time of 2025. Charges have probably bottomed, as indicated by the dominant 74-week cycle and the cyclic RSI, which exhibits that charges have hit oversold situations.