The cryptocurrency market is on a rally, with Bitcoin (BTC) hitting a number of milestones over the previous week. Bitcoin began the 12 months on a excessive, extending its features from 2023. Nevertheless, the rally got here to a halt within the second quarter. Market consultants had predicted that the cryptocurrency nonetheless has a lot potential and the rally would resume within the second half of the 12 months.

The current rally is being fueled by Donald Trump’s landmark victory within the Presidential election coupled with one other rate of interest reduce by the Federal Reserve final week. Given this case, investing in Bitcoin-centric shares like NVIDIA Company NVDA, BlackRock, Inc. BLK and Accenture plc ACN, which have sturdy development potential for the close to time period, can be a prudent alternative.

Bitcoin Rallies Previous $90,000

Final week, Bitcoin surpassed $75,000 for the primary time, hours after the nation went to polls to elect the forty seventh President. The cryptocurrency has not regarded again since then. Bitcoin had earlier hit an all-time excessive of $73,770 in March however suffered over the subsequent three months.

Nevertheless, it staged a rebound in mid-September after the Federal Reserve introduced a 50-basis level rate of interest reduce, ending its financial tightening marketing campaign in its bid to curb the 40-year-high inflation.

The rally was additional fueled final week following Trump’s victory within the election that noticed Bitcoin hitting a contemporary excessive. Earlier this week, Bitcoin surpassed $80,000 for the primary time and on Tuesday, it hit a brand new milestone of $90,000, gaining 34% since Trump’s win. The cryptocurrency was final buying and selling at $87250 and is on monitor to surpass $100,000 within the close to time period.

Trump promised throughout his marketing campaign to make the USA a frontrunner within the digital asset sector, which might contain constructing a strategic Bitcoin reserve and deciding on regulators who’re keen about digital property. The optimistic sentiment is now boosting Bitcoin. Additionally, the Federal Reserve reduce rates of interest by 25 foundation factors final week, its second straight rate of interest reduce in three months, which bodes nicely for the crypto market.

Crypto Shares With Upside

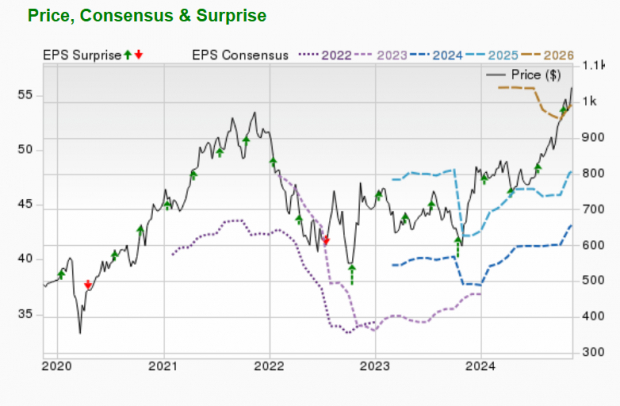

NVIDIA Company

NVIDIA Company is a significant participant within the semiconductor business and has been one of many standout success tales of 2023. As a number one designer of graphic processing items (GPUs), the worth of the NVDA inventory tends to surge in a thriving crypto market. That is primarily as a result of essential function that GPUs play in information facilities, synthetic intelligence, and the mining or manufacturing of cryptocurrencies.

NVIDIA’s anticipated earnings development charge for the present 12 months is greater than 100%. The Zacks Consensus Estimate for current-year earnings has improved 0.7% over the past 60 days. Presently, NVIDIA has a Zacks Rank #2 (Purchase). You’ll be able to see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Picture Supply: Zacks Funding Analysis

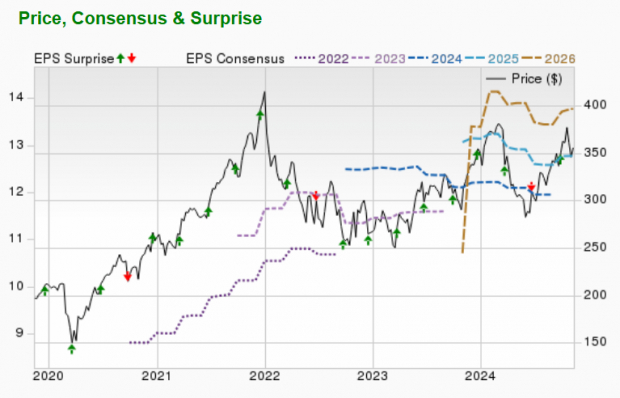

BlackRock

BlackRock is without doubt one of the world’s largest funding managers and is publicly owned. BLK was among the many first corporations from the normal market to affix the Bitcoin ETF race again in June 2023.

BlackRock’s anticipated earnings development charge for the present 12 months is 14.3%. The Zacks Consensus Estimate for current-year earnings has improved 4.4% over the previous 60 days. BLK at present sports activities a Zacks Rank #1.

Picture Supply: Zacks Funding Analysis

Accenture plc

Accenture plc is a worldwide system integrator that provides consulting, expertise and varied different companies. The corporate promotes Ethereum-based blockchain options to companies, aiming to simplify cost processing.

Accenture’s anticipated earnings development charge for the present 12 months is 6.9%. The Zacks Consensus Estimate for current-year earnings has improved 1.4% over the past 60 days. ACN at present carries a Zacks Rank #2.

Picture Supply: Zacks Funding Analysis

7 Greatest Shares for the Subsequent 30 Days

Simply launched: Consultants distill 7 elite shares from the present record of 220 Zacks Rank #1 Sturdy Buys. They deem these tickers “Most Doubtless for Early Worth Pops.”

Since 1988, the complete record has crushed the market greater than 2X over with a median acquire of +23.7% per 12 months. So you should definitely give these hand picked 7 your quick consideration.

Accenture PLC (ACN) : Free Stock Analysis Report

BlackRock, Inc. (BLK) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.