Among the most effective means to discover solid long-lasting financial investments is to seek supplies that have actually enhanced returns continually. Supplies referred to as returns aristocrats are those that have actually increased their returns settlements yearly back to back for at the very least 25 years. The supplies I share listed below have a high Zacks Ranking and also have actually increased returns for greater than half a century running.

If the financial image were to end up being considerably much more unpredictable, returns supplies like these will certainly play an essential duty in offering a feeling of assurance for capitalists. Additionally, also if the economic climate remains solid, these are still fantastic business to buy.

3M

3M MMM is a worldwide corporation generating a varied variety of items that extend throughout several markets. It runs with 4 sectors: Safety and security and also Industrial, Transport and also Electronic Devices, Healthcare, and also Customer. MMM was started in 1902 and also has yearly profits of $35 billion.

3M has actually increased its returns 64 years straight. 3M’s returns presently generates 5.9%. This constant development is mirrored by similarly regular development in sales and also profits over that time and also shows exactly how essential and also extensively made use of MMM items are. Furthermore, it reveals monitoring’s dedication to rearranging earnings to investors, while additionally remaining to reinvest in the firm to introduce brand-new items and also expand sales.

Photo Resource: Zacks Financial Investment Study

MMM is a Zacks Ranking # 2 (Buy) supply, showing higher trending profits modifications. While sales and also profits quotes were decreased due to the assumptions of a slowing down economic climate, experts lately started to update those quotes. Existing year sales development is anticipated to slow down -7% YoY to $31.8 billion, yet following year sales are forecasted to return to development of 1.9% to $32.55 billion. Furthermore, following year profits are anticipated to expand 6.8% to $9.23 per share.

Photo Resource: Zacks Financial Investment Study

MMM is trading at a 1 year forward profits multiple of 12x, which is near its five-year low of 10x, and also well listed below its five-year mean of 19x.

Photo Resource: Zacks Financial Investment Study

Federal Real Estate Investment Company

Federal Real Estate Investment Company FRT is a property investment company (REIT) that has, handles, and also establishes costs retail and also mixed-use residential or commercial properties in the United States. Federal Real estate Investment company’s retail residential or commercial properties are secured by grocery stores, medicine shops or high-volume, value-oriented sellers, which offer customer needs. FRT has 103 residential or commercial properties that are reported as 93% inhabited.

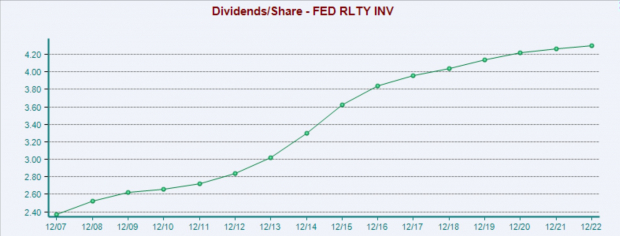

FRT has actually been elevating returns for 55 years, and also the supply presently flaunts a 4.4% returns return.

Photo Resource: Zacks Financial Investment Study

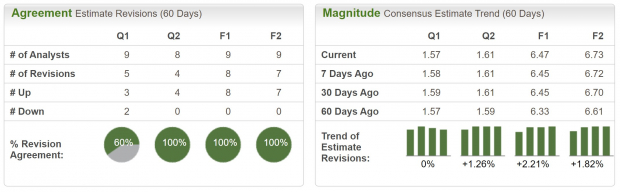

Federal Real estate Investment company makes a Zacks Ranking # 2 (Buy), showing higher trending profits modifications. Sales development is additionally anticipated throughout period, with the present quarter forecasting 8% YoY development to $277 million.

Photo Resource: Zacks Financial Investment Study

FRT is trading at a 1 year forward profits multiple of 15x, which is listed below its five-year mean of 20x, and also listed below the wide market ordinary 19x.

Photo Resource: Zacks Financial Investment Study

While the present financial setting appears fairly unpredictable, especially for the industrial property market, FRT still has some motivating tailwinds. Much of its possessions being in high end places, with positive demographics, which ought to significantly blunt the impacts of a financial downturn. Furthermore, a boosting retail property setting has actually been assisting leasing task in current quarters.

With a durable service design, and also solid leads, capitalists can anticipate ongoing development of returns settlements for many years ahead.

W.W. Grainger

W.W. Grainger GWW is a business-to-business supplier of upkeep, fixing and also operating services and products. WGG consumers stand for a large variety of markets consisting of federal government, production, transport, industrial and also specialists. W.W. Grainger’s items consist of material-handling devices, security and also safety and security materials, lights and also electric items, power and also hand devices, pumps and also pipes materials, cleansing and also upkeep materials, and also metalworking devices.

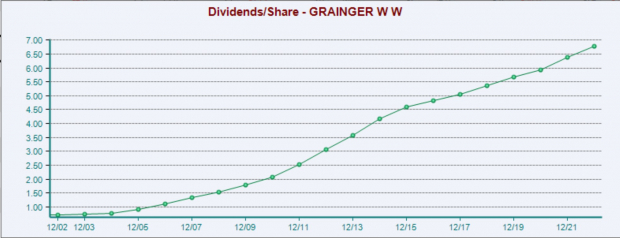

W.W. Grainger has actually increased returns for 51 successive years, and also the supply presently provides a reward return of 1.1%.

Photo Resource: Zacks Financial Investment Study

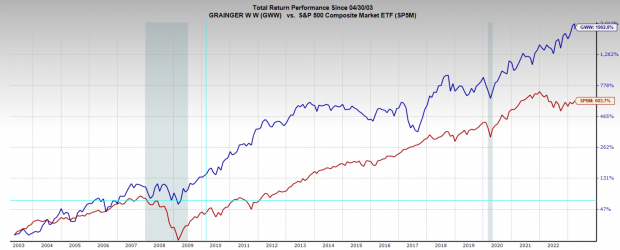

Over the last two decades GWW supply has actually done as highly as any type of capitalist can really hope. Over that duration the supply has actually valued 1900%, which is an exceptionally outstanding 16% annualized. A lot more outstanding is that this return was accomplished with significantly reduced volatility than the wide market.

W.W. Grainger is a wonderful instance of a much less popular supply silently making its capitalists abundant over lots of years.

Photo Resource: Zacks Financial Investment Study

GWW presently has a Zacks Ranking # 2 (Buy), showing higher trending profits modifications. Sales and also profits assumptions were currently exceptionally audio, with present quarter sales anticipated to expand 11.6% YoY to $4.1 billion, and also present year profits anticipated to climb up 21% YoY to $8.55 per share.

Despite those solid forecasts, experts are still updating profits assumptions. Experts have actually with one voice updated profits quotes throughout durations.

Photo Resource: Zacks Financial Investment Study

W.W. Grainger presently trades at a 1 year forward profits multiple of 19x, which is best in accordance with its 20-year mean of 19x and also listed below the sector ordinary 21x.

Photo Resource: Zacks Financial Investment Study

Profits

Reward development supplies usually create an engaging enhancement to capitalists profiles. With a solitary sign of returns development, these business show a number of the features a solid long-lasting financial investment ought to have. Also far better is that these supplies have near term stimulants due to their higher trending profits modifications, and also high Zacks Ranks.

For returns farmers like these, continually elevating returns has actually come to be an essential pitch to capitalists. This is an excellent point for the supply owners, due to the fact that monitoring will certainly constantly be concentrated on elevating the returns settlements and also will not obtain side tracked by any type of various other inadequate resources allowance tasks.

Free Record: Must-See Hydrogen Supplies

Hydrogen gas cells are currently made use of to offer effective, ultra-clean power to buses, ships and also also healthcare facilities. This modern technology gets on the brink of a huge advancement, one that can make hydrogen a significant resource of America’s power. It can also completely transform the EV sector.

Zacks has actually launched an unique record exposing the 4 supplies professionals think will certainly supply the greatest gains.

Download Cashing In on Cleaner Energy today, absolutely free.

3M Company (MMM) : Free Stock Analysis Report

W.W. Grainger, Inc. (GWW) : Free Stock Analysis Report

Federal Realty Investment Trust (FRT) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The sights and also viewpoints revealed here are the sights and also viewpoints of the writer and also do not always mirror those of Nasdaq, Inc.