To date, 73% of the businesses within the Zacks Finance sector have been capable of surpass their quarterly earnings expectations led by JPMorgan (JPM), Citigroup (C), and different massive banks.

With JPMorgan and Citigroup optimistically kicking off the primary quarter earnings season for financials, many finance shares moved increased once more right now. Moreover, a number of top-rated finance shares are standing out forward of their Q1 reviews on Monday, April 22, and now could also be a great time to purchase.

Brown & Brown BRO

Providing a broad vary of insurance coverage services, Brown & Brown’s inventory appears enticing with its operations primarily in america, in addition to in London, Bermuda, and the Cayman Islands.

Brown & Brown’s Q1 EPS is projected to climb 24% to $1.04 versus $0.84 a share within the prior yr quarter. Quarterly gross sales are anticipated to rise 8% to $1.21 billion. Even higher, annual earnings are forecasted to leap 26% in fiscal 2024 to $3.55 per share. Plus, one other 8% EPS progress is anticipated subsequent yr and excessive single-digit progress is anticipated on Brown & Brown’s prime line in FY24 and FY25.

Picture Supply: Zacks Funding Analysis

Fairness Way of life Properties ELS

One REIT to look at on Monday is Fairness Way of life Properties which runs a self-administered portfolio of dwelling gross sales and rental operations together with manufactured houses and leisure automobile communites and marinas.

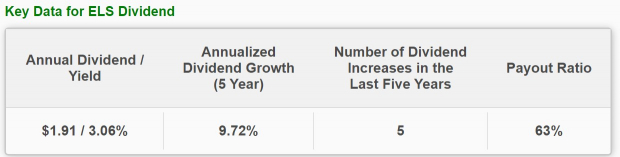

Fairness Way of life’s Q1 earnings are slated to extend 4% to $0.77 a share with gross sales projected to rise 5% to $389.49 million. Total, 5% EPS progress is predicted in FY24 with FY25 earnings forecasted to rise one other 6% to $3.08 per share.Whole gross sales are anticipated to extend by single digits in FY24 and FY25 and Fairness Way of life’s 3.06% annual dividend is beginning to look extra enticing to revenue buyers. To that time, Fairness Way of life has elevated its payout in every of the final 5 years with a 9.72% annualized dividend progress charge throughout this era.

Picture Supply: Zacks Funding Analysis

Globe Life GL

As an insurance coverage holding firm, Globe Life’s Q1 EPS is projected to rise 10% to $2.80 per share with gross sales anticipated to rise 5% to $1.43 billion. Globe Life’s subsidiaries embody insurance coverage firms that market particular person life and supplemental medical insurance to lower-middle to middle-income households all through the U.S.

Globe Life is anticipating 8% EPS progress in FY24 and FY25. Whole gross sales are projected to rise 5% this yr after which edge up one other 4% in FY25 to $6.1 billion. Extra intriguing, Globe Life is beginning to look extraordinarily undervalued at a 5.6X ahead earnings a number of and affords a 1.48% annual dividend.

Picture Supply: Zacks Funding Analysis

Takeaway

With Brown & Brown, Fairness Way of life Properties, and Globe Life thought to have posted sound quarterly progress throughout Q1 they’re certinaly three finance shares to look at. In the mean time, all of them land a Zacks Rank #2 (Purchase) and it wouldn’t be shocking if their shares transfer increased subsequent week if they’ll reconfrim a good outlook.

High 5 Dividend Shares for Your Retirement

Zacks targets 5 well-established firms with stable fundamentals and a historical past of elevating dividends. Extra importantly, they’ve the sources and can to probably pay them sooner or later.

Click on now for a Particular Report filled with unconventional knowledge and insights you merely gained’t get out of your neighborhood monetary planner.

See our Top 5 now – the report is FREE >>

Brown & Brown, Inc. (BRO) : Free Stock Analysis Report

Equity Lifestyle Properties, Inc. (ELS) : Free Stock Analysis Report

Globe Life Inc. (GL) : Free Stock Analysis Report

JPMorgan Chase & Co. (JPM) : Free Stock Analysis Report

Citigroup Inc. (C) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.