The U.S. presidential election is true across the nook, and plenty of buyers could be questioning which shares may gain advantage most, based mostly on who will grow to be the subsequent president.

However basing your funding selections on election outcomes is not a surefire recipe for achievement. And for those who’re investing for the lengthy haul, even a four-year presidential time period might conceivably be thought of short-term within the grand scheme of issues.

Supercharged growth stocks Tremendous Micro Laptop (NASDAQ: SMCI), MicroStrategy (NASDAQ: MSTR), and Viking Therapeutics (NASDAQ: VKTX) have all outperformed synthetic intelligence (AI) big Nvidia because the final election. The three shares have returned 1,940%, 1,160%, and 1,040%, respectively, since Nov. 3, 2020, dwarfing the semiconductor big’s not-too-shabby 960% inventory return.

And undoubtedly, it will have been tough, if not inconceivable, to forecast on the time that they might have soared as a lot as they’ve.

Tremendous Micro Laptop: Up 1,940%

Tech firm Tremendous Micro Laptop, which additionally goes by simply Supermicro, did not present up on many progress buyers’ radars till the previous couple of years. It makes servers and offers companies with IT infrastructure that may be crucial in serving to firms develop AI fashions.

Whereas its enterprise has been booming lately, that wasn’t due to Biden’s election win. The expansion had extra to do with the surge in AI-related spending, as a result of emergence of ChatGPT and all of the hype that got here with the chatbot. Though the enterprise was rising previous to that, Supermicro’s high line took off at a way more fast tempo in simply the previous two years.

SMCI Revenue (Annual) knowledge by YCharts.

At the moment, Supermicro nonetheless doubtlessly makes for a superb AI inventory to personal, however the massive query mark I’ve in regards to the enterprise pertains to its thin margins. If it may well strengthen its gross earnings, then mixed with the incredible progress prospects it possesses, Supermicro can stay a sizzling purchase, and show its short-sellers unsuitable within the course of.

MicroStrategy: Up 1,160%

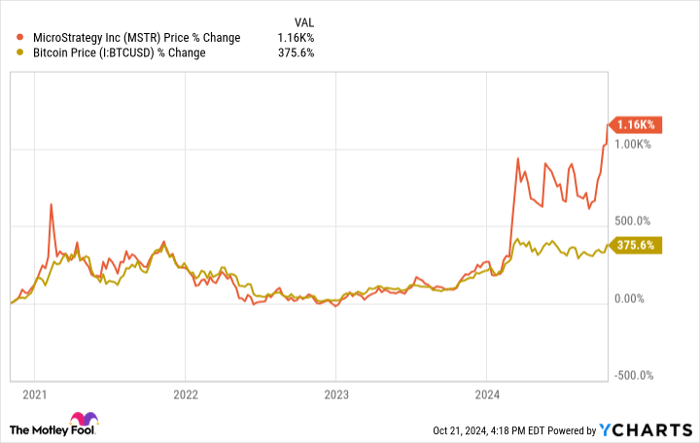

One other inventory that is benefiting from AI-fueled hype is MicroStrategy. The corporate offers firms with enterprise intelligence options and makes use of AI. However it began rallying sooner than the shares on this record, and that is on account of its publicity to Bitcoin. MicroStrategy prides itself on being the most important company holder of Bitcoins, which implies as the worth of Bitcoin rose, so too did MicroStrategy’s valuation.

In 2021, meme shares and crypto had been sizzling investing themes, and unsurprisingly, MicroStrategy’s inventory additionally soared. However whereas Bitcoin has rallied considerably because the final election, MicroStrategy has generated superior good points, and that may very well be as a result of added pleasure AI has injected into the tech stock lately.

MicroStrategy’s outcomes have not been all that spectacular, nonetheless. The corporate has struggled with producing constant income progress and any enhance its enterprise will get from AI stays questionable at this stage. This is among the riskier shares to personal and it is extra of a crypto play than the rest. MicroStrategy has incurred a internet loss in three of its previous 4 quarters.

Viking Therapeutics: Up 1,040%

The smallest acquire on this record comes from healthcare company Viking Therapeutics. And like the opposite shares listed right here, its good points have had little if something to do with who received the final election. As an alternative, it has been the corporate’s promising weight reduction drug that has lit a fireplace underneath Viking’s valuation.

Traders are bullish on the corporate’s weight problems drug, VK2735, which has demonstrated encouraging ends in medical trials in serving to individuals drop pounds. In a latest section 2 trial, individuals misplaced round 15% of their weight after utilizing the drug for 13 weeks. It is progressing on to section 3 and the corporate additionally has an oral model of the drug, which is coming into section 2 trials.

Viking would not have an authorised product simply but however the hope is that if VK2735 obtains approval from regulators, the corporate may very well be a giant participant within the anti-obesity market, which may very well be price $200 billion by 2031.

The inventory is not an acceptable funding for all buyers given the chance concerned, however with a market cap of simply over $7 billion, Viking has the potential for extra good points sooner or later if VK2735 finally ends up coming to market.

Elections aren’t long-term drivers of inventory returns

To reiterate, elections, or any political occasion for that matter, do not drive shares in the long term. What issues ultimately is the standard of the underlying enterprise and its prospects. The three shares talked about above outperformed the inventory market favourite, Nvidia, indicating how the market costs future progress prospects fairly precisely over the long term.

To cite Ben Graham, “Within the brief run, the market is a voting machine however in the long term, it’s a weighing balance.” So buyers could be higher off doing due diligence on shares than speculate how totally different presidential administrations might have an effect on them over the brief time period.

Don’t miss this second likelihood at a doubtlessly profitable alternative

Ever really feel such as you missed the boat in shopping for probably the most profitable shares? Then you definitely’ll wish to hear this.

On uncommon events, our skilled group of analysts points a “Double Down” stock suggestion for firms that they assume are about to pop. In case you’re fearful you’ve already missed your likelihood to speculate, now could be one of the best time to purchase earlier than it’s too late. And the numbers communicate for themselves:

- Amazon: for those who invested $1,000 once we doubled down in 2010, you’d have $21,365!*

- Apple: for those who invested $1,000 once we doubled down in 2008, you’d have $44,619!*

- Netflix: for those who invested $1,000 once we doubled down in 2004, you’d have $412,148!*

Proper now, we’re issuing “Double Down” alerts for 3 unbelievable firms, and there will not be one other likelihood like this anytime quickly.

*Inventory Advisor returns as of October 21, 2024

David Jagielski has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Bitcoin and Nvidia. The Motley Idiot has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.