Fed chair Jerome Powell helped reassure markets yesterday, stating the present path of financial coverage shouldn’t be affected regardless of rising tariff issues.

That mentioned, Powell acknowledged that President Trump’s tariff insurance policies are contributing to inflation and will delay progress in decreasing it. Conserving this in thoughts, buyers should still be eying defensive positions within the portfolio, with the patron staples sector beginning to stand out.

Notably, a number of shopper meals and beverage shares have made their manner onto the Zacks Rank #1 (Robust Purchase) listing and have hovered close to 52-week peaks amid latest market volatility.

Pilgrim’s Delight – PPC

Carving out a distinct segment within the ready meals class, Pilgrim’s Delight PPC inventory is up +15% in 2025 and has now soared +130% within the final two years. Conserving buyers engaged is that regardless of the intensive rally, Pilgrim’s inventory trades at simply 9.5X ahead earnings and has continued to broaden internationally as a supplier of frozen, contemporary, and value-added hen merchandise.

Along with its robust purchase ranking, PPC checks an total “A” VGM Zacks Model Scores grade for the mix of Worth, Progress, and Momentum.

Picture Supply: Zacks Funding Analysis

Primo Manufacturers Company – PRMB

Specializing in wholesome hydration, Primo Manufacturers Company PRMB has a portfolio of packaged branded drinks which can be distributed throughout greater than 200,000 stores. As a beverage distributor in each state and Canada, the corporate’s manufacturers embody Poland Spring, Pure Life, Saratoga, and Mountain Valley amongst others.

Primo Manufacturers inventory is up +4% 12 months thus far and has additionally soared over +100% within the final two years. Buying and selling simply over $30, PRMB shares are at an inexpensive 20.4X ahead earnings a number of and provide a good 1.25% annual dividend.

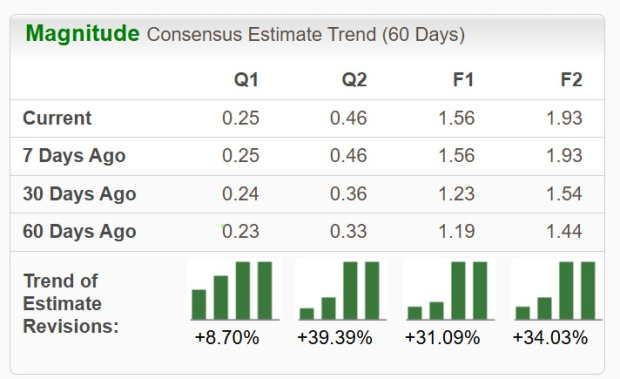

Extra intriguing, is that earnings estimate revisions have spiked during the last 60 days with Primo Manufacturers anticipated to submit excessive double-digit EPS development in fiscal 2025 and FY26.

Picture Supply: Zacks Funding Analysis

Premier Meals – PRRFY

Rounding out the listing is Premier Meals PRRFY, a distributor of meals and beverage merchandise in the UK and different European international locations. At $12 a share, the chance to reward seems to be favorable with PRRFY buying and selling at 13.3X ahead earnings. It is a nice low cost to its Zacks Meals-Miscellaneous Business common of 16.1X with the S&P 500 at 21.4X.

Anticipating 7% EPS development in FY25 and FY26, Premier Meals inventory gives a modest 0.79% annual dividend. Plus, EPS estimates for FY25 and FY26 are barely up within the final 30 days with PRRFY rising +5% YTD and sitting on +50% beneficial properties during the last two years.

Picture Supply: Zacks Funding Analysis

Conclusion & Closing Ideas

Throughout an financial downturn, the demand for meals, drinks, and different important services and products stays fixed or may even see an uptick whereas different areas of the financial system expertise a slowdown.

Whereas Jerome Powell’s rhetoric was reassuring, extra market volatility may nonetheless be forward on account of tariff issues which makes these high shopper meals and beverage shares very engaging in the meanwhile.

Zacks Names #1 Semiconductor Inventory

It is only one/9,000th the scale of NVIDIA which skyrocketed greater than +800% since we beneficial it. NVIDIA continues to be robust, however our new high chip inventory has way more room to increase.

With robust earnings development and an increasing buyer base, it is positioned to feed the rampant demand for Synthetic Intelligence, Machine Studying, and Web of Issues. International semiconductor manufacturing is projected to blow up from $452 billion in 2021 to $803 billion by 2028.

See This Stock Now for Free >>

Pilgrim’s Pride Corporation (PPC) : Free Stock Analysis Report

Premier Foods PLC. (PRRFY) : Free Stock Analysis Report

Primo Brands Corporation (PRMB) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.