Over the last couple of weeks, belief in the power industry has actually ended up being really bearish. After Oil costs came to a head back in mid-2022 at around $130 a barrel, they have actually been grinding reduced. Most lately oil costs damaged down listed below $70, which appeared to be a significant degree for lots of capitalists.

However after damaging down, oil costs have actually turned around greater fairly boldy, and also are currently back over the $70 degree. It is feasible that after such an extended period of favorable belief, the oil market required to drink the late arrivals prior to establishing an additional bull relocation higher.

Additionally, a pair weeks earlier, OPEC openly devoted to restricting manufacturing and also tightening up oil supply, therefore placing a flooring below the marketplace.

A number of power supplies seem establishing for an additional rally, and also making use of the Zacks Ranking, I have actually determined 3 that look especially encouraging. Based upon their positions, it is most likely that these supplies will certainly outmatch over the following couple of months.

Photo Resource: TradingView

The Same Level Pacific

The Same Level Pacific PARR takes care of and also keeps power and also framework organizations. The firm’s runs refining, retail, and also logistics for power possessions. PARR likewise markets and also disperses petroleum from the Western United State and also Canada to refining centers in the Midwest, Gulf Coastline, East Coastline and also to Hawaii. The same level Pacific was previously called The same level Oil Firm, and also is headquartered in Houston, Texas.

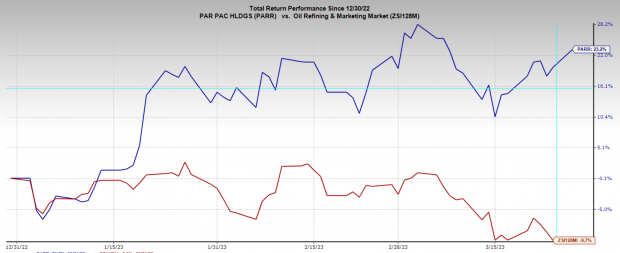

Up until now this year The same level Pacific has actually executed very well, despite the weak point in oil costs. PARR has actually substantially outshined the sector and also wide market. Over the last 3 years the supply is up 300%.

Photo Resource: Zacks Financial Investment Study

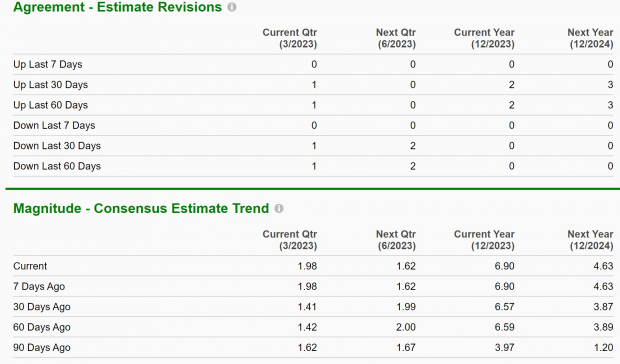

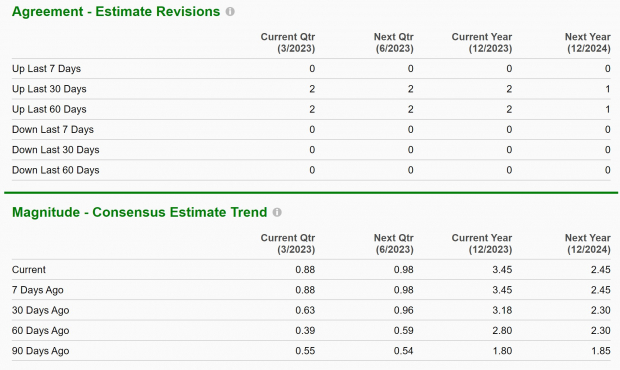

PARR is a Zacks Ranking # 1 (Solid Buy) supply, suggesting higher trending revenues alterations. While present quarter and also following quarter price quotes have actually seen some blended alterations, present year and also following year have actually been updated substantially. Following year’s revenues have actually been modified greater by 286%.

Photo Resource: Zacks Financial Investment Study

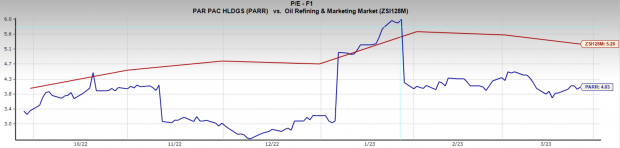

Parr Pacific is presently trading at a 1 year forward revenues multiple of 4x, which remains in line with its two-year typical, and also simply listed below the sector typical 5x.

Photo Resource: Zacks Financial Investment Study

CVR Power

Headquartered in Sugar Land, Texas, CVR Power CVI is an independent refiner and also marketing expert of high worth transport gas such as gas and also diesel. CVI possesses and also runs a coking medium-sour petroleum refinery in Kansas and also a petroleum refinery in Oklahoma. Business offers merchants, railways, ranches and also various other refineries and also marketing professionals.

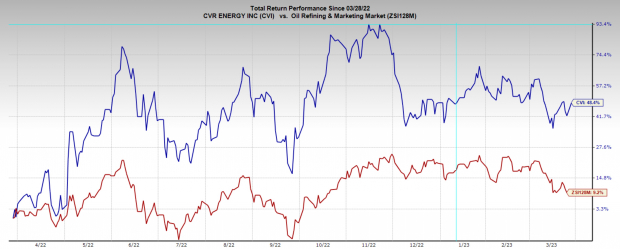

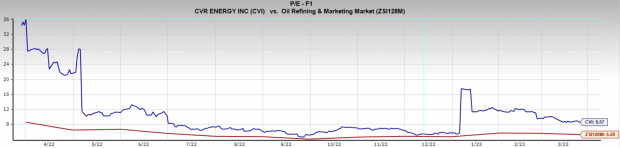

CVR Power is presently a Zacks Ranking # 1 (Solid Buy) supply, suggesting higher trending revenues alterations. CVI has actually been a solid carrying out supply over the in 2014 although the higher activity has actually quit given that oil costs turned around in 2014. CVI likewise supplies a substantial returns return of 6.8%.

Photo Resource: Zacks Financial Investment Study

Over the following couple of revenues durations sales are anticipated to drop, however present quarter revenues are still anticipated to increase 4,300% YoY to $0.88 per share. Over the last 60 days experts have actually with one voice modified revenues greater throughout all reporting durations. Present year revenues assumptions have actually virtually folded the last 3 months.

Photo Resource: Zacks Financial Investment Study

CVI is trading at a 1 year forward revenues multiple of 9x, which is listed below its 10-year typical of 12x, and also over the sector typical 5x.

Photo Resource: Zacks Financial Investment Study

Valero Power

Valero Power VLO is a deeply varied oil refinery firm with 15 plants throughout the united state, Canada, and also the Caribbean and also capability to improve 3.2 million barrels a day. Most of VLO’s refinery plants lie in the Gulf Coastline with simple accessibility to export centers, increasing margins. Valero lately reported solid fourth-quarter outcomes with a 13% upside shock on EPS.

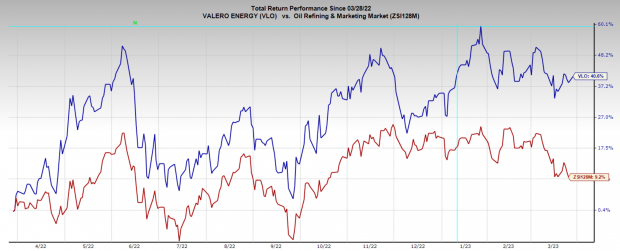

VLO supply has actually been an extremely solid entertainer over the in 2014. Despite the significant relocation lower in the cost of oil, Valero supply has actually continued to be solid.

Photo Resource: Zacks Financial Investment Study

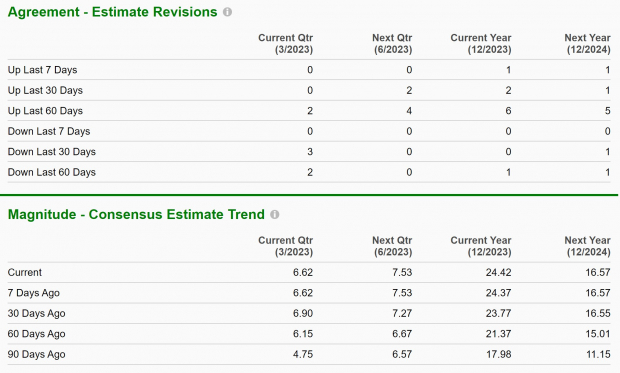

Valero Power makes a Zacks Ranking # 2 (Buy), suggesting higher trending revenues alterations. Present quarter revenues are anticipated to climb up 186% YoY to $6.62 per share, while present quarter sale are anticipated to go down -13% to $33.5 billion.

Although there have actually been some minor alterations lower in the present quarter lately, revenues have actually still been modified a lot greater over the last 3 months. Additionally, all various other revenues durations have actually been modified substantially greater, with present year revenues updated by 36%.

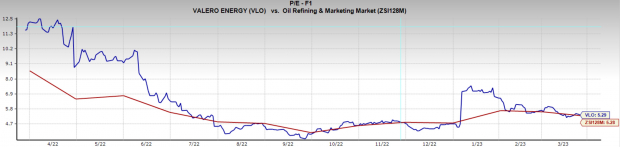

Photo Resource: Zacks Financial Investment Study

VLO is trading at an extremely affordable 5x 1 year forward revenues, which remains in line with the sector and also well listed below its five-year typical of 13x. VLO likewise supplies a reward return of 3.2%, which has actually been elevated by approximately 4.8% yearly over the last 5 years.

Photo Resource: Zacks Financial Investment Study

Final Thought

Despite the outstanding efficiency that the power industry set up in 2022, most of the supplies still have affordable evaluations. If you match that with the truth that most of these supplies have boosting revenues, you have an extremely engaging arrangement for a bull run. Capitalists that fit violating the present bearish belief in the power market might be awarded by acquiring currently.

Simply Launched: Zacks Top 10 Supplies for 2023

Along with the financial investment concepts reviewed over, would certainly you such as to find out about our 10 leading choices for 2023?

From creation in 2012 with November, the Zacks Top 10 Supplies profile has actually tripled the marketplace, getting an excellent +884.5% versus the S&P 500’s +287.4%. Our Supervisor of Study has actually currently brushed with 4,000 business covered by the Zacks Ranking and also handpicked the most effective 10 tickers to purchase and also keep in 2023. Do not miss your possibility to still be amongst the initial to participate these just-released supplies.

Valero Energy Corporation (VLO) : Free Stock Analysis Report

CVR Energy Inc. (CVI) : Free Stock Analysis Report

Par Pacific Holdings, Inc. (PARR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The sights and also viewpoints revealed here are the sights and also viewpoints of the writer and also do not always mirror those of Nasdaq, Inc.