The medical sector is often of curiosity throughout financial uncertainty, particularly when it results in heightened inventory market volatility.

With buyers feeling the jitters from tariff considerations and rising geopolitical tensions, a number of healthcare shares have made their means onto the coveted Zacks Rank #1 (Sturdy Purchase) record.

Jazz Prescribed drugs – JAZZ

Standing out by way of worth, Jazz Prescribed drugs’ JAZZ sturdy earnings are laborious to disregard as a specialty biopharmaceutical firm specializing in neuroscience and oncology.

Deriving most of its income from sleep problem medication, Jazz Prescribed drugs’ complete gross sales are projected to rise by over 5% in fiscal 2025 and FY26 with projections north of $4 billion. Extremely worthwhile, Jazz Prescribed drugs’ earnings are slated to extend 10% this yr to a whopping $23.12 per share, from EPS of $20.90 in 2024. Moreover, FY26 EPS is projected to extend one other 2%.

Picture Supply: Zacks Funding Analysis

The cherry on high is that at $140, Jazz Prescribed drugs inventory trades at simply 6X ahead earnings. Spiking +14% yr up to now, JAZZ shares are nonetheless at a steep low cost to their Zacks Medical-Biomedical and Genetics Business common of 19.3X ahead earnings, with the benchmark S&P 500 at 21.8X.

Picture Supply: Zacks Funding Analysis

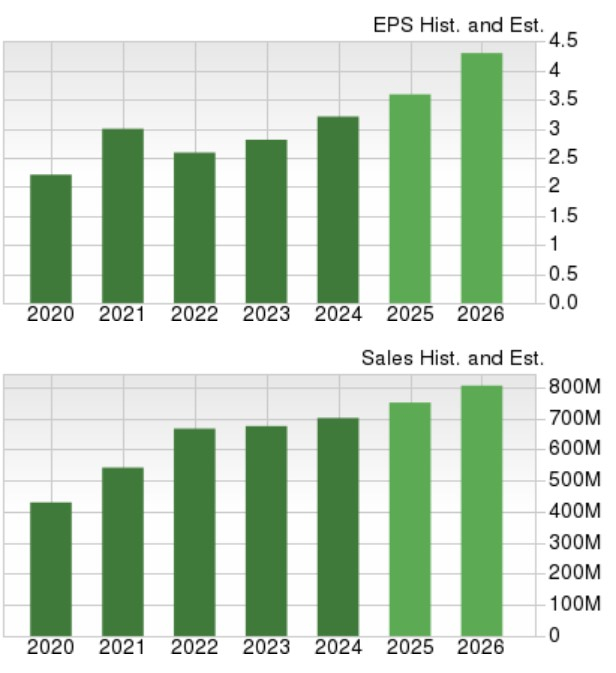

Pacira BioSciences – PCRX

Additionally shining by way of worth is Pacira BioSciences PCRX, one other specialty biopharmaceutical firm with an emphasis on proprietary merchandise to be used in hospitals and ambulatory surgical procedure facilities.

Buying and selling at $23, PCRX is at a 6.5X ahead earnings a number of with EPS projected to extend 12% in FY25 and forecasted to develop one other 20% subsequent yr to $4.30. Regular high line progress is within the forecast as nicely with PCRX hovering over +20% YTD and buying and selling beneath the optimum degree of lower than 2X gross sales.

Picture Supply: Zacks Funding Analysis

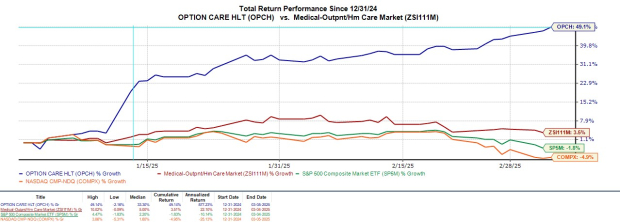

Choice Care Well being – OPCH

Buying and selling at 52-week highs of $34 a share, Choice Care Well being’s OPCH inventory is standing out as a supplier of infusion and residential care administration options. Choice Care affords condition-specific medical administration applications for quite a lot of well being circumstances together with gastrointestinal abnormalities, infectious illnesses, most cancers, bleeding problems, and coronary heart failures amongst others.

Echoing Choice Care’s numerous medical choices is the corporate’s consistency, reaching or exceeding the Zacks EPS Consensus for 10 consecutive quarters.

Beginning to fulfill growth expectations, Choice Care’s inventory has soared +50% in 2025. As one of many market’s high performers this yr, OPCH nonetheless trades at an affordable 20X ahead earnings a number of. Along with its robust purchase score, OPCH has an general “A” VGM Zacks Fashion Scores grade for the mix of Worth, Progress, and Momentum.

Picture Supply: Zacks Funding Analysis

Backside Line

These extremely ranked medical shares have the worth and important providers that buyers could also be in search of as tariff considerations and geopolitical tensions have began to rattle markets. Correlating with their robust purchase rankings is that earnings estimate revisions have continued to pattern larger for Jazz Prescribed drugs, Pacira BioSciences, and Choice Care Well being.

Zacks Names #1 Semiconductor Inventory

It is only one/9,000th the scale of NVIDIA which skyrocketed greater than +800% since we really useful it. NVIDIA remains to be robust, however our new high chip inventory has way more room to growth.

With robust earnings progress and an increasing buyer base, it is positioned to feed the rampant demand for Synthetic Intelligence, Machine Studying, and Web of Issues. International semiconductor manufacturing is projected to blow up from $452 billion in 2021 to $803 billion by 2028.

See This Stock Now for Free >>

Jazz Pharmaceuticals PLC (JAZZ) : Free Stock Analysis Report

Pacira BioSciences, Inc. (PCRX) : Free Stock Analysis Report

Option Care Health, Inc. (OPCH) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.