Whereas it might really feel counterintuitive to purchase a inventory at an all-time excessive, firms which can be charting a path towards increased earnings can typically justify a file market cap. This precept is why the biggest U.S.-based firms by market cap — like Microsoft — have loved multi-decade growth intervals the place all-time highs are seemingly shattered each few years.

Megacap progress shares are undoubtedly liable for main the broader indexes to new heights, however there are many pockets of the market which can be having fun with their very own rallies.

Oil and gasoline built-in big ExxonMobil (NYSE: XOM), utility Vistra (NYSE: VST), and residential enchancment big Residence Depot (NYSE: HD) are three dividend stocks that simply hit all-time highs. Here is why three Idiot.com contributors picked these shares as candidates for shifting even increased.

Picture supply: Getty Pictures.

Bulls have been energized about shopping for ExxonMobil inventory, however there is not any cause to assume the passion will quickly wane

Scott Levine (ExxonMobil): ExxonMobil is the one supermajor inventory that has outperformed the S&P 500 thus far in 2024. In truth, ExxonMobil has remained so alluring amongst traders this yr that they’ve not too long ago pushed the inventory to its all-time excessive. And nonetheless, ExxonMobil stays a worthwhile consideration — particularly with its dividend, which at the moment affords a ahead yield of three.1%.

Though the year-to-date 8% rise within the worth of U.S. benchmark West Texas Intermediate crude oil absolutely performed some half out there’s urge for food for ExxonMobil inventory, the corporate reported robust second-quarter 2024 monetary outcomes that additionally motivated energy investors to purchase. For its not too long ago accomplished quarter, the corporate reported that the Pioneer merger is already proving fruitful, contributing $500 million in earnings for the quarter. Moreover, the corporate reported free money circulation of $4.9 billion in Q2 2024, contributing to a complete $15 billion in free money circulation for the primary half of 2024.

Whereas ExxonMobil inventory has carried out properly thus far this yr, there is not any cause to suspect it may’t proceed climbing. Ought to the corporate proceed to attain robust outcomes from its Permian property (each these gained by means of the Pioneer merger and others), traders might select to proceed powering their portfolios with ExxonMobil inventory — particularly for the reason that firm might be properly positioned to maintain the dividend, which it has raised for 41 consecutive years.

Buyers will possible preserve their curiosity in shopping for ExxonMobil inventory if the corporate succeeds in growing progress initiatives associated to different vitality, serving to to diversify its enterprise and mitigate the danger of a downturn in oil and gasoline costs. For one, ExxonMobil is working with Air Liquide to develop a hydrogen manufacturing facility. As well as, the corporate is working with Tetra Tech to develop a lithium manufacturing facility situated in Arkansas.

AI funding is fueling demand for nuclear vitality

Lee Samaha (Vistra): Microsoft’s current 20-year energy buying settlement with Constellation Vitality alerts a rising recognition that nuclear energy has an enormous future. The expertise firm must safe a long-term, safe supply of energy for its cloud providers’ knowledge facilities as demand grows for AI-powered purposes.

The deal will end in restarting the Three Mile Island nuclear energy plant and assist Microsoft guarantee it meets its emissions goals, as nuclear reactors do not produce carbon emissions. As well as, they supply an everyday and predictable energy supply with out the intermittency of renewable vitality.

The Constellation deal reads properly for Vistra as a result of the latter has expanded its nuclear functionality this yr through its acquisition of Vitality Harbor in March. The deal added 4,000 megawatts (MW) of nuclear capability to the two,400 MW of nuclear capability Vistra ended 2023 with. As such, 6,400 MW of Vistra’s complete 40,700 MW capability might be in nuclear.

Optimism over Vistra signing potential offers with cloud providers suppliers has led the market to show Vistra into the best-performing stock on the S&P 500 this yr. Furthermore, if the optimism proves to be properly based, Vistra’s long-term earnings and cash-flow prospects might have important upside potential. That might additionally possible end in a dividend hike (recall that Vistra began the yr yielding 2.3%), alongside glorious capital returns for traders.

Residence Depot is full of potential

Daniel Foelber (Residence Depot): 2024 has been a wild trip for Residence Depot traders. In March, the inventory was up properly on the yr and was on its technique to surpassing its all-time excessive from December 2021. However then, Residence Depot suffered a brutal sell-off as investors feared weak consumer spending would influence discretionary purchases like residence enchancment. These fears proved appropriate, as Residence Depot slashed its full-year steerage when it reported second-quarter ends in August.

Within the earnings launch, Residence Depot mentioned the reduce was as a result of the corporate now sees the second-half client demand setting in keeping with the primary half. In different phrases, the macroeconomic state of affairs exhibits no indicators of turning the nook.

So why, traders would possibly marvel, has Residence Depot inventory rocketed 19% increased within the final three months? Given the basics have not modified, the best cause is that investor sentiment has improved, and decrease rates of interest might assist shoppers, the housing market, and in flip, Residence Depot.

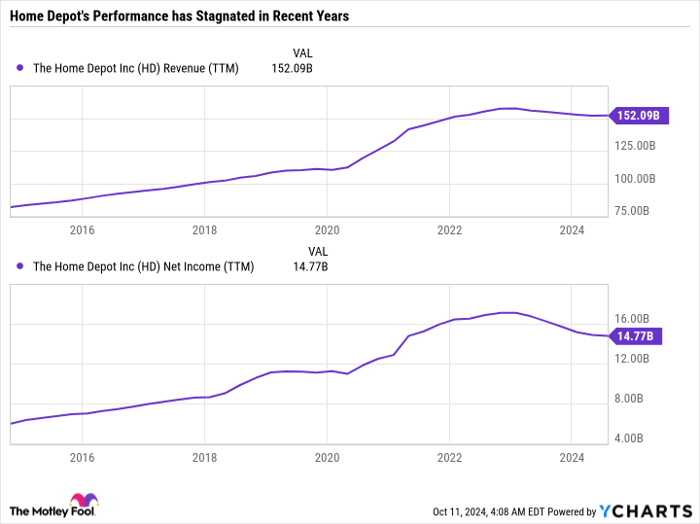

Residence Depot is the sort of cyclical firm that may thrive throughout a consumer-led financial growth — which we have not actually seen since 2020 and 2021. In truth, Residence Depot’s outcomes over the previous few years have been pretty poor — with flatlining or barely declining gross sales and internet revenue.

HD Revenue (TTM) knowledge by YCharts

Glass-half-full traders might take into account Residence Depot a long-overdue coiled spring for outsized progress. Although Residence Depot is not displaying indicators of enchancment but, affected person traders could also be OK with merely holding the inventory and letting it develop into its valuation. Residence Depot has a price-to-earnings ratio of 27.6 — which is above its historic common. However remember the fact that valuation is predicated on trailing earnings. If Residence Depot can kick into a brand new progress gear and maintain double-digit earnings progress, it might make immediately’s considerably expensive valuation cheap in hindsight.

What’s extra, Residence Depot has a superb dividend. The inventory yields 2.2% and Residence Depot’s payout ratio is just 58.4% — which is wholesome for a dependable blue chip dividend inventory.

With Home Depot’s best days likely ahead, it would not be shocking if the inventory has loads of room to run from right here.

Do you have to make investments $1,000 in ExxonMobil proper now?

Before you purchase inventory in ExxonMobil, take into account this:

The Motley Idiot Inventory Advisor analyst workforce simply recognized what they imagine are the 10 best stocks for traders to purchase now… and ExxonMobil wasn’t one in every of them. The ten shares that made the reduce might produce monster returns within the coming years.

Take into account when Nvidia made this checklist on April 15, 2005… for those who invested $1,000 on the time of our advice, you’d have $846,108!*

Inventory Advisor offers traders with an easy-to-follow blueprint for achievement, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of October 14, 2024

Daniel Foelber has no place in any of the shares talked about. Lee Samaha has no place in any of the shares talked about. Scott Levine has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Constellation Vitality, Residence Depot, and Microsoft. The Motley Idiot recommends the next choices: lengthy January 2026 $395 calls on Microsoft and quick January 2026 $405 calls on Microsoft. The Motley Idiot has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.