Constructing a robust funding portfolio would not require complicated methods or dozens of holdings. An easy strategy utilizing three exchange-traded funds (ETFs) can ship outstanding outcomes by market cycles. This three-fund portfolio technique has gained reputation amongst buyers looking for simplicity with out sacrificing returns.

Vanguard pioneered index investing and maintains a singular possession construction that units it aside within the funding trade. Its funds collectively personal Vanguard itself, creating a robust alignment between the corporate’s success and investor returns. This distinctive construction has helped Vanguard preserve among the lowest expense ratios within the trade, a vital benefit for long-term funding success.

Begin Your Mornings Smarter! Get up with Breakfast information in your inbox each market day. Sign Up For Free »

Picture supply: Getty Photos.

These market-leading low prices, mixed with Vanguard’s deep experience in index investing, make it a perfect supplier for a three-fund portfolio technique. Let’s look at how three particular Vanguard ETFs work collectively to create a robust funding strategy that may function a basis for constructing lasting wealth.

The inspiration of U.S. market returns

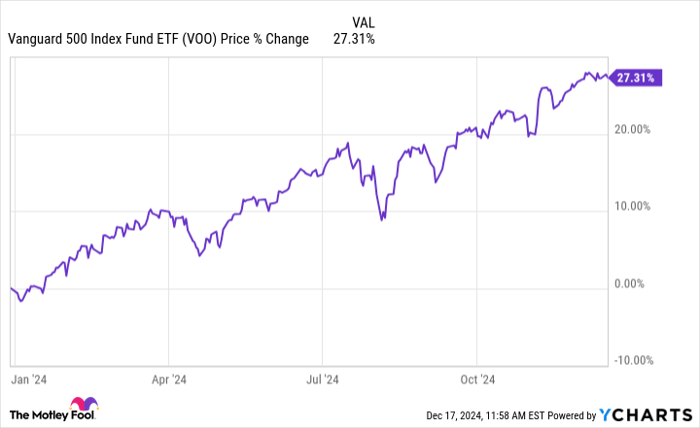

On the coronary heart of most profitable long-term investing methods lies the Vanguard S&P 500 ETF (NYSEMKT: VOO), a powerhouse funding car that opens the door to America’s company elite. This foundational fund would not simply observe 500 corporations — it supplies direct entry to the modern engines driving the world’s largest financial system. Business titans like Microsoft, Apple, and Berkshire Hathaway kind the spine of the fund’s portfolio.

What makes the Vanguard S&P 500 ETF significantly compelling for buyers is its outstanding price effectivity. With an expense ratio of simply 0.03%, it exemplifies the facility of low-cost investing. Think about paying solely $3 yearly to handle $10,000 of your wealth. This price benefit compounds considerably over time, permitting extra of your capital to give you the results you want.

The true magic of the Vanguard S&P 500 ETF lies in its elegant simplicity and highly effective attain. By a single funding, you achieve publicity to each main sector of the U.S. financial system, from cutting-edge know-how to established industrial giants. Many of those corporations have advanced into international powerhouses, producing substantial income streams from worldwide markets whereas sustaining the steadiness and transparency of U.S.-based operations.

This Vanguard fund has additionally constantly demonstrated its value towards lively administration methods. Even refined skilled buyers, armed with in depth analysis and assets, hardly ever outperform this listed ETF over prolonged durations, making it a cornerstone holding for long-term wealth constructing.

Capturing international development alternatives

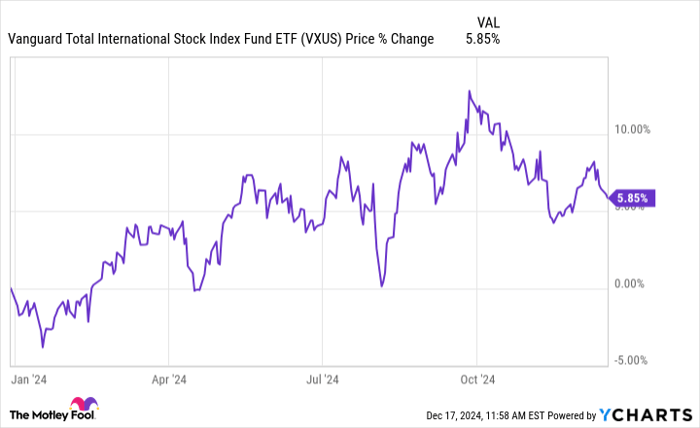

The Vanguard Complete Worldwide Inventory ETF (NASDAQ: VXUS) unlocks a world of alternative past American shores. This powerhouse fund opens doorways to 1000’s of modern corporations throughout developed and rising markets, from European stalwarts like Nestlé to Asia’s rising tech giants. With a minimal 0.08% expense ratio, it gives an environment friendly gateway to international wealth creation.

The strategic fantastic thing about worldwide publicity lies in its pure hedging energy. When U.S. markets face headwinds, development engines in Europe, Asia, or Latin America typically proceed to thrive, offering essential portfolio resilience. This makes the Vanguard Complete Worldwide Inventory ETF not only a diversification software, but in addition an important part of forward-thinking wealth constructing.

Stability by fixed-income

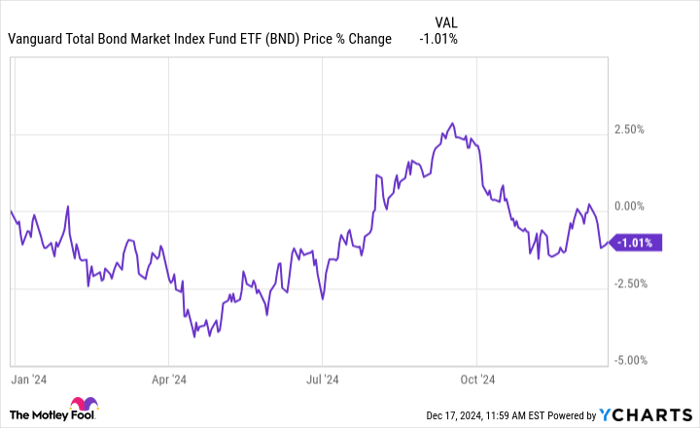

The Vanguard Complete Bond Market ETF (NASDAQ: BND) serves because the portfolio’s stabilizing power by investing in U.S. authorities and high-quality company bonds. This fund helps scale back portfolio volatility whereas producing regular revenue by curiosity funds. The rock-bottom 0.03% expense ratio ensures buyers preserve extra of their bond returns.

Fixed-income investments usually transfer otherwise from shares, offering essential portfolio stability throughout market turbulence. This relationship helps buyers preserve their long-term methods throughout the inevitable drawdown in inventory markets.

The zen of long-term wealth-building

A profitable funding strategy combines the most effective of established market knowledge with disciplined execution. By a robust mixture of the Vanguard S&P 500 ETF for U.S. market publicity, the Vanguard Complete Worldwide Inventory ETF for international alternatives, and the Vanguard Complete Bond Market ETF for stability, buyers can achieve entry to a complete wealth-building framework. Furthermore, this technique removes emotional decision-making from the funding course of, which might considerably enhance returns over the lengthy haul.

Do you have to make investments $1,000 in Vanguard S&P 500 ETF proper now?

Before you purchase inventory in Vanguard S&P 500 ETF, contemplate this:

The Motley Idiot Inventory Advisor analyst group simply recognized what they consider are the 10 best stocks for buyers to purchase now… and Vanguard S&P 500 ETF wasn’t one in every of them. The ten shares that made the minimize may produce monster returns within the coming years.

Take into account when Nvidia made this listing on April 15, 2005… for those who invested $1,000 on the time of our advice, you’d have $808,966!*

Inventory Advisor supplies buyers with an easy-to-follow blueprint for fulfillment, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of December 16, 2024

George Budwell has positions in Apple, Berkshire Hathaway, Microsoft, Vanguard S&P 500 ETF, and Vanguard Complete Bond Market ETF. The Motley Idiot has positions in and recommends Apple, Berkshire Hathaway, Microsoft, Vanguard S&P 500 ETF, Vanguard Complete Bond Market ETF, and Vanguard Complete Worldwide Inventory ETF. The Motley Idiot recommends Nestlé and recommends the next choices: lengthy January 2026 $395 calls on Microsoft and quick January 2026 $405 calls on Microsoft. The Motley Idiot has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.