Supplies that have direct exposure or prominence in markets that can be increased by more comprehensive financial development are extremely interesting.

Numerous premier Zacks supplies show up to fit the costs. Allow’s have a look at 3 of these supplies that deserve financiers’ factor to consider presently.

ePlus ( AND ALSO)

Flaunting a Zacks Ranking # 1 (Solid Buy) ePlus supply is extremely interesting as a leading service provider of modern technology options.

The solid efficiency of the Nasdaq this year has financiers looking for technology supplies that can proceed increasing. This can be the situation for ePlus supply which is up 25% YTD to somewhat track the Nasdaq’s +31% however quickly leading the S&P 500’s +16%.

Picture Resource: Zacks Financial Investment Study

The marketplace atmosphere is looking solid for ePlus as its Business-Software Provider Market remains in the leading 19% of over 250 Zacks sectors. ePlus looks positioned to proceed profiting with the business making it possible for companies to maximize their IT facilities and also supply chain procedures.

ePlus supply looks underestimated as revenues are anticipated to dip -8% in its present monetary 2024 at $4.61 per share adhering to a document year that saw EPS at $5.02 in the business’s FY23. Still, FY25 revenues are anticipated to rebound and also increase 7% to $4.92 per share.

Piggybacking off of ePlus’ worth, its price-to-earnings evaluation is extremely appealing taking into consideration the costs technology supplies can regulate. Trading at $55 a share and also 12.1 X onward revenues, ePlus professions at a significant discount rate to the sector standard of 22.3 X and also well below the S&P 500’s 20.6 X.

Picture Resource: Zacks Financial Investment Study

Thrill Enterprises ( RUSHA)

Retail car supplier Thrill Enterprises is beginning to stand apart with a Zacks Ranking # 2 (Buy). Thrill runs the biggest network of Peterbilt sturdy vehicle car dealerships in The United States and Canada and also John Deere building tools car dealerships in Texas and also Michigan.

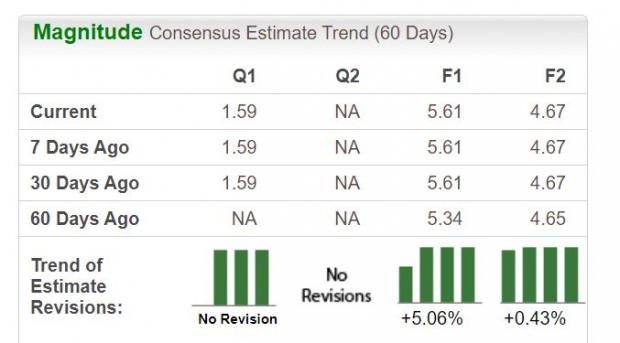

Adhering to a document year for profits and also productivity, Thrill supply is up 14% in 2023 and also its P/E evaluation is attracting with revenues quotes greater over the last 60 days. Monetary 2023 revenues are currently anticipated at $5.61 per show Thrill supply trading around $60 and also simply 10.7 X onward revenues.

Picture Resource: Zacks Financial Investment Study

While Thrill is trading decently over its sector standard of 7.2 X onward revenues the business is a leader in its area and also professions well listed below the standard’s 20.6 X. Additionally, Rush supply professions 75% listed below its decade-long high of 41X and also at a 25% discount rate to the mean of 14.2 X.

Picture Resource: Zacks Financial Investment Study

Sterling Facilities ( STRL)

Additionally showing off a Zacks Ranking # 2 (Buy) Sterling Facilities supply has actually been extremely interesting considering that the business introduced in February that it was granted a spots website growth task for the Hyundai Design America New EV Battery Center in Georgia.

As a matter of fact, the E-infrastructure, structure and also transport options business has actually currently seen its supply rise 59% this year to greatly exceed the more comprehensive indexes. Much more amazing, Sterling supply is currently up +447% over the last years to greatly exceed the S&P 500’s +180% and also also the Nasdaq’s +309%.

Picture Resource: Zacks Financial Investment Study

Capitalists have actually been holding on to participate Sterling’s current development with monetary 2023 revenues forecasted to increase 11% to $3.52 per share after what was a previous document year that saw EPS at $3.16 in 2022. And also, monetary 2024 revenues are anticipated to leap one more 16% at $4.11 per share.

Also much better, Sterling’s supply still trades fairly at $52 a share and also 15X onward revenues. This is well below its sector standard of 17.4 X and also the standard.

Picture Resource: Zacks Financial Investment Study

Takeaway

These firms are wonderfully positioned in their sectors as leaders that can take advantage of financial development. Presently, ePlus, Thrill Enterprises, and also Sterling Facilities supply all have a total “A” VGM Zacks Design Ratings quality for the mix of Worth, Development, and also Energy.

As rising cost of living remains to relieve their solid efficiencies can proceed making them practical financial investments for 2023 and also past.

Free Record Exposes Exactly How You Can Benefit from the Expanding Electric Car Market

Around the world, electrical vehicle sales proceed their amazing development also after exceeding in 2021. High gas rates have actually sustained his need, however so has progressing EV convenience, functions and also modern technology. So, the eagerness for EVs will certainly be about long after gas rates stabilize. Not just are suppliers seeing record-high revenues, however manufacturers of EV-related modern technology are bring in the dough too. Do you understand exactly how to money in? Otherwise, we have the ideal record for you– and also it’s FREE! Today, do not miss your possibility to download and install Zacks’ leading 5 supplies for the electrical automobile change at no charge and also without responsibility.

>>Send me my free report on the top 5 EV stocks

Rush Enterprises, Inc. (RUSHA) : Free Stock Analysis Report

Sterling Infrastructure, Inc. (STRL) : Free Stock Analysis Report

ePlus inc. (PLUS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The sights and also point of views shared here are the sights and also point of views of the writer and also do not always mirror those of Nasdaq, Inc.