As financiers remain to absorb quarterly outcomes, a number of remarkable firms are reporting profits on Thursday, May 18.

Below are 3 supplies financiers will certainly intend to enjoy as they contribute to their corresponding sectors and also might increase on solid quarterly records.

Applied Products ( AMAT)

We’ll begin with Applied Products, out of the technology industry and also a noteworthy name amongst semiconductor supplies.

Lots of eyes will certainly get on Applied Product as one of the globe’s biggest vendors of devices for the construction of semiconductors, level panel fluid crystal display screens (LCDs), and also solar photovoltaic or pv (PV) cells and also components.

Right now Applied Products supply lands a Zacks Ranking # 3 (Hold) with its Semiconductor Equipment-Water Construction Sector in the leading 49% of over 250 Zacks sectors.

Applied Products’ financial second-quarter outcomes and also assistance will certainly offer a wider context on the expectation for lots of semiconductor firms. Profits are anticipated to be about on the same level with the prior-year quarter at $1.84 per show to Q2 sales anticipated to increase 2% to $6.40 billion.

Yearly profits are forecasted to decrease -9% this year and also dip an additional -5% in FY24 at $6.67 per share adhering to outstanding years for EPS development in 2021 and also 2022. With that said being claimed, profits quote modifications have actually risen over the last quarter and also solid Q2 outcomes might catapult Applied Products supply which is still up +129% over the last 3 years to greatly outshine the more comprehensive indexes.

Picture Resource: Zacks Financial Investment Research Study

Ross Shops ( ROST)

Quarterly arise from large stores have actually highlighted today’s profits schedule and also one firm financiers will certainly not intend to forget is Ross Shops.

Ross Shops has actually sculpted a distinct specific niche as an off-price store of garments and also house devices and also presently has a Zacks Ranking # 3 (Hold) with its Retail-Discount Shops Sector additionally in the leading 49% of all Zacks sectors.

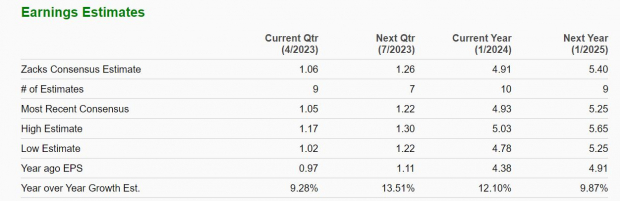

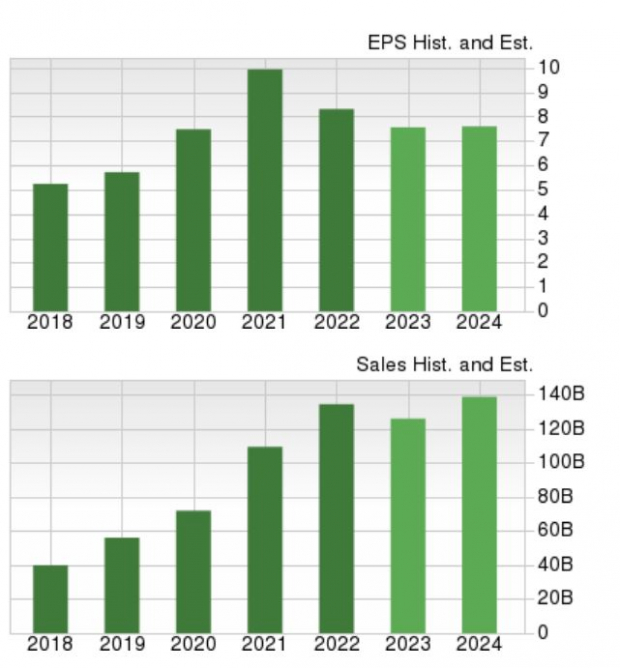

Ross Shops’ first-quarter profits are anticipated to increase 9% YoY at $1.06 per show to sales forecasted to be up 4% from the prior-year quarter to $4.49 billion. Also much better, Ross Shop’ yearly EPS development is really eye-catching presently.

Profits are prepared for to leap 12% in Ross Shop’ present financial 2024 and also increase an additional 10% in FY25 at $5.40 per share. If Ross Shop’ first-quarter record assists reconfirm this development trajectory shares of ROST might obtain some great energy.

Picture Resource: Zacks Financial Investment Research Study

Alibaba ( BABA)

Chinese shopping titan Alibaba is an additional firm financiers will certainly intend to enjoy on Thursday. There might be some great benefit capacity for Alibaba supply as logistic and also supply chain concerns start to decrease with China’s economic situation back completely change.

Alibaba additionally lands a Zacks Ranking # 3 (Hold) presently and also its Internet-Commerce Sector remains in the leading 36% of all Zacks sectors. Business empire’s financial fourth-quarter profits are anticipated to increase 4% from Q4 2022 at $1.30 per share. This is regardless of Q4 sales anticipated to dip -6% to $30.35 billion.

The profits capacity for Alibaba has actually constantly been interesting with EPS currently anticipated to be down -5% this year yet rebound and also surge 6% in FY24 at $8.31 per share. After a solid begin to 2023 upon China resuming its boundaries Alibaba supply has actually considering that cooled down yet a solid quarter and also affirmation of a secure operating setting might obtain the rally going once more.

Picture Resource: Zacks Financial Investment Research Study

Takeaway

Alibaba (BABA), Applied Products (AMAT), and also Ross Shop (ROST) are 3 firms financiers will absolutely intend to enjoy today. As special leaders in their area, solid quarterly outcomes on Thursday might provide a great increase to these supplies and also they are sensible long-lasting financial investments worth keeping presently.

Zacks Names “Solitary Best Select to Dual”

From hundreds of supplies, 5 Zacks professionals each have actually selected their favored to increase +100% or even more in months to find. From those 5, Supervisor of Study Sheraz Mian hand-picks one to have one of the most eruptive benefit of all.

It’s an obscure chemical firm that’s up 65% over in 2014, yet still economical. With unrelenting need, rising 2022 profits price quotes, and also $1.5 billion for buying shares, retail financiers might enter at any moment.

This firm might measure up to or go beyond various other current Zacks’ Supplies Ready To Dual like Boston Beer Firm which soared +143.0% in bit greater than 9 months and also NVIDIA which expanded +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Ross Stores, Inc. (ROST) : Free Stock Analysis Report

Applied Materials, Inc. (AMAT) : Free Stock Analysis Report

Alibaba Group Holding Limited (BABA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The sights and also viewpoints revealed here are the sights and also viewpoints of the writer and also do not always mirror those of Nasdaq, Inc.