A number of the heading names have actually currently reported this profits period however there are still some significant supplies that financiers will certainly intend to see following week.

Below are 3 supplies that deserve factor to consider in advance of their quarterly records as well as might end up being much more eye-catching as we proceed via 2023.

Ciena ( CIEN)

Ciena Company stands apart prior to its financial second-quarter profits on June 6 with a Zacks Ranking # 2 Buy. Ciena’s Optical fiber Sector is additionally in the leading 3% of over 250 Zacks sectors.

Ciena is well placed within its solid organization market as a leading optical networking tools, software application as well as providers. While Ciena’s development hasn’t been frustrating in recent times, its appraisal has actually ended up being much more eye-catching.

Ciena supply professions at $48 a share as well as 16.7 X onward profits, which is approximately on the same level with the market standard as well as perfectly underneath the S&P 500’s 19.6 X. And also, Ciena is a leader in its room as well as professions 71% listed below its five-year high of 58.3 X profits as well as at a 28% discount rate to the mean of 23.2 X.

Picture Resource: Zacks Financial Investment Research Study

Ciena’s Q2 profits can additionally begin to reconfirm that much better days are in advance in regards to development. Second-quarter profits are anticipated at $0.60 per share which would certainly be up 20% from Q2 2022. Also much better, yearly profits are anticipated to climb up 48% this year as well as dive an additional 28% in FY24 at $3.61 per share.

Casey’s General Shops ( CASY)

Ready to report its financial fourth-quarter profits on June 6, Casey’s General Shops is certainly a business worth viewing following week as well as presently lands a Zacks Ranking # 3 (Hold).

Casey’s supply has actually gotten on an amazing run over the last couple of years as the firm has actually proceeded its development as a retail corner store leader throughout the Midwest. Trading at $229 a share, there can be much better acquiring chances in advance however the firm’s development in recent times has actually been huge.

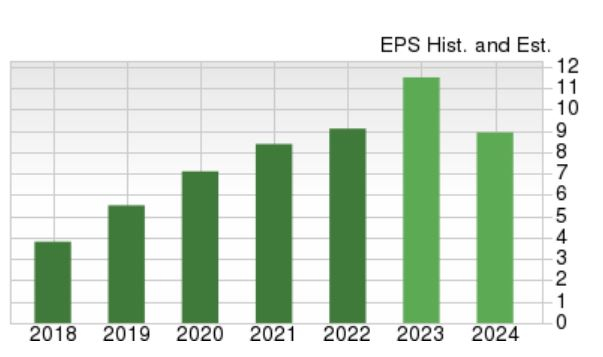

Fourth-quarter profits are forecasted to dip -1% from the previous year quarter at $1.58 per share. Still, Casey’s would certainly complete its financial 2023 with profits climbing up 28% YoY at $11.70 per share contrasted to EPS of $9.10 in 2022. Monetary 2024 EPS is anticipated to dip -12% at $10.30 per share after what would certainly be a difficult year to adhere to however Casey’s profits continues to be durable.

Picture Resource: Zacks Financial Investment Research Study

Dave & & Buster’s ( PLAY)

Finally, readied to report its financial first-quarter profits on June 6, Dave & & Buster’s outcomes will certainly provide a wider check out exactly how enjoyment as well as friendliness firms are getting on.

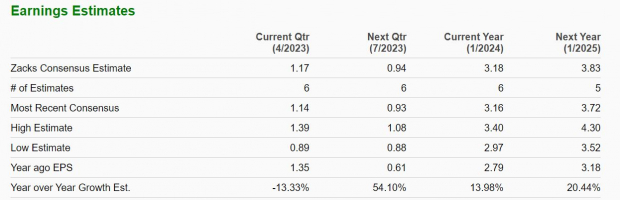

Dave & & Buster’s presently lands a Zacks Ranking # 3 (Hold) with its Retail-Restaurants Sector in Zacks leading 18%. The firm’s development continues to be eye-catching regardless of Q1 profits anticipated to dip -13% YoY at $1.17 per share. With that said being claimed, Dave & & Buster’s existing financial 2024 profits are still anticipated to increase 14% as well as dive an additional 20% in FY25 at $3.83 per share.

With shares of PLAY trading at $33 as well as still 26% from 52-week highs, Dave & & Buster’s expected development is beginning to make its supply far more eye-catching.

Picture Resource: Zacks Financial Investment Research Study

Profits

These supplies are really fascinating in advance of their quarterly records next week as well as getting to or surpassing profits assumptions can result in much more upside. This will certainly be most likely if they can supply favorable assistance as Ciena, Casey’s, as well as Dave & & Buster’s supply ought to remain to be feasible financial investments moving forward.

Zacks Discloses ChatGPT “Sleeper” Supply

One obscure firm goes to the heart of a specifically fantastic Expert system industry. By 2030, the AI market is forecasted to have a net as well as iPhone-scale financial effect of $15.7 Trillion.

As a solution to viewers, Zacks is supplying a reward record that names as well as discusses this eruptive development supply as well as 4 various other “need to gets.” Plus much more.

Download Free ChatGPT Stock Report Right Now >>

Ciena Corporation (CIEN) : Free Stock Analysis Report

Casey’s General Stores, Inc. (CASY) : Free Stock Analysis Report

Dave & Buster’s Entertainment, Inc. (PLAY) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The sights as well as point of views revealed here are the sights as well as point of views of the writer as well as do not always show those of Nasdaq, Inc.