When dividend-paying corporations go on sale, their yields enhance, which may make them juicy passive earnings alternatives. However a dividend is just nearly as good as the corporate paying it; that means if you are going to put money into a beaten-down dividend-paying firm, it has to have the ability to overcome no matter challenges it’s going by means of.

United Parcel Service (NYSE: UPS) and Devon Power (NYSE: DVN) are removed from firing on all cylinders, however each corporations have what it takes to seek out their footing. In the meantime, the inventory of Kinder Morgan (NYSE: KMI) simply hit an eight-year excessive and will nonetheless be an amazing worth.

Here is what makes all three dividend stocks nice buys now, based on these Motley Idiot contributors.

Picture supply: Getty Pictures.

Not off course

Daniel Foelber (United Parcel Service): UPS has a 22.2 price-to-earnings ratio (P/E) and a dividend yield of 4.8%. So proper off the bat, it stands out as an intriguing high-yield worth inventory. However when a widely known trade chief has a depressed valuation or inflated yield, it’s usually for good reasons.

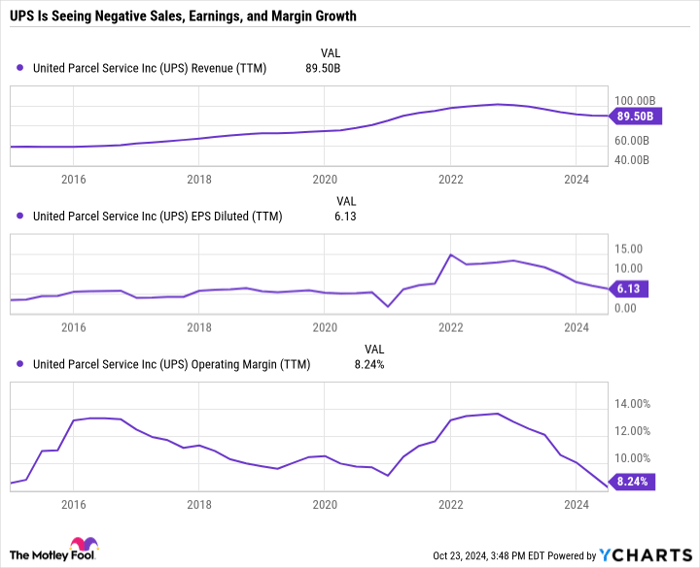

UPS has seen a major discount in its gross sales development and profitability prior to now couple of years. As you possibly can see within the following chart, it loved a surge in gross sales and margins throughout the pandemic, however now the enterprise is arguably worse off than it was pre-pandemic. Previous success means little to traders, who are inclined to care more about where a company is headed than where it has been.

Information by YCharts.

In March, UPS outlined a three-year plan to get again on the right track, with an emphasis on growing supply volumes in 2024 and working margins in 2025 and 2026. It has made some progress on that plan, with larger supply volumes within the second quarter, however it must maintain that momentum to impress traders.

The excellent news is that UPS stays extremely dedicated to its dividend, though raises could also be small for the foreseeable future till the corporate can present significant earnings development, and thus justify a better payout. However at a 4.8% yield, it’s already providing earnings traders one thing to love, making it a worthwhile dividend inventory to contemplate shopping for now.

Buyers will not pay an arm and a leg to energy their portfolios with this vitality inventory

Scott Levine (Devon Power): For these trying to procure regular passive earnings, it may be extremely thrilling to discover a compelling dividend inventory.

However to seek out one sitting within the cut price bin? That is the icing on the cake — and it is a chance that’s accessible with Devon Power, which gives a juicy ahead dividend yield of 4.9%. At present, shares of this main oil stock commerce at 3.8 instances working money movement, representing a reduction to the five-year common money movement a number of of 4.

With shares of this upstream vitality powerhouse down about 10% yr up to now, traders could suspect that there is one thing awry with the corporate — particularly with the S&P 500 rising about 23% throughout the identical interval.

However the larger catalyst for the inventory’s decline might be the downward motion (albeit minor) in vitality costs. West Texas Intermediate (WTI) crude, the U.S. oil benchmark, has dipped about 20% over the previous yr, and traders could speculate {that a} additional decline is within the quick future.

Though it is vital to acknowledge the lower cost of oil, it is also essential to understand that vitality costs each rise and fall. Devon Power is a number one exploration and manufacturing firm that has withstood vitality worth downturns earlier than, and it’ll probably stand up to future downturns as effectively.

Even with the value of WTI at $70 per barrel, as an illustration, Devon tasks a free cash flow yield of 9% — an auspicious signal contemplating administration targets returning 70% of free money movement to traders.

For additional reassurance that this firm is working from a powerful monetary place — and to listen to up to date steering, which incorporates the current Grayson Mill Energy acquisition — traders ought to take note of its third-quarter earnings presentation on Nov. 5.

Pure fuel will probably be a part of the vitality combine for many years to come back

Lee Samaha (Kinder Morgan): It was straightforward to jot down off fossil fuels a number of years in the past, however the actuality of unstable vitality costs, geopolitical battle, and the growing value and complexity of renewable vitality imply the transition goes to happen at a slower tempo than beforehand thought.

That is excellent news for the nuclear industry and for the pure fuel trade. The new reality has despatched shares like fuel turbine and companies (and wind energy) firm GE Vernova hovering, alongside utilities with nuclear energy functionality, like Vistra.

It has additionally helped traders to understand the charms of Kinder Morgan, a specialist in pure fuel pipelines and storage, liquefied pure fuel (LNG) liquefaction, and LNG terminals.

Furthermore, suppose the betting markets are proper concerning the presidential election? If they’re, there will probably be a brand new administration within the White Home that may very well be rather more favorable to increasing U.S. vitality manufacturing, notably fuel, much more than it already has over the previous 4 years.

It speaks to a de-risking of the difficulty that Kinder Morgan traders could be most involved about, specifically the long-term way forward for pure fuel/LNG as an vitality supply or export product. Whereas the clear vitality transition is going down, it is clear that there is a vital position to play for fuel as an vitality supply to help the intermittent nature of renewable vitality.

And the transition will happen over a number of a long time. As such, Kinder Morgan will probably generate earnings and dividends (at the moment yielding 4.7%) for traders for a few years.

Must you make investments $1,000 in United Parcel Service proper now?

Before you purchase inventory in United Parcel Service, think about this:

The Motley Idiot Inventory Advisor analyst staff simply recognized what they consider are the 10 best stocks for traders to purchase now… and United Parcel Service wasn’t one among them. The ten shares that made the lower may produce monster returns within the coming years.

Think about when Nvidia made this listing on April 15, 2005… when you invested $1,000 on the time of our suggestion, you’d have $879,935!*

Inventory Advisor supplies traders with an easy-to-follow blueprint for achievement, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of October 21, 2024

Daniel Foelber has no place in any of the shares talked about. Lee Samaha has no place in any of the shares talked about. Scott Levine has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Kinder Morgan. The Motley Idiot recommends United Parcel Service. The Motley Idiot has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.